All rights reserved. No part of this book may be reproduced in any form by any electronic or mechanical means (including photocopying, recording, or information storage and retrieval) without permission in writing from the publisher.

This book was set in Stone Serif and Stone Sans by Westchester Publishing Services. Printed and bound in the United States of America.

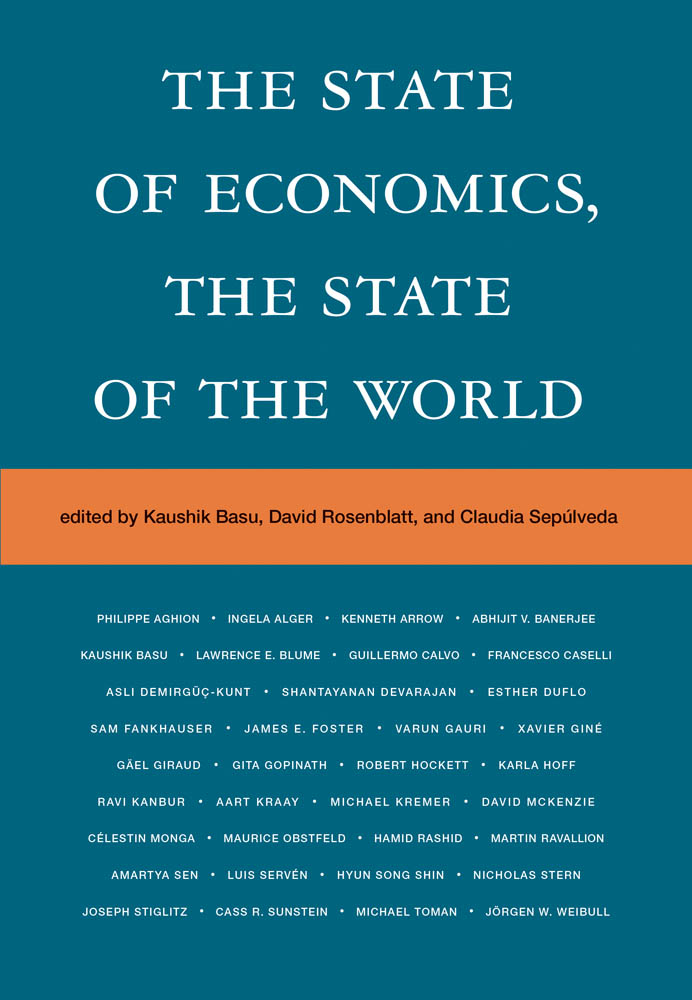

Names: Basu, Kaushik, editor. | Seplveda, Claudia Paz, 1969 editor. | Rosenblatt, David, editor.

Title: The state of economics, the state of the world / edited by Kaushik Basu, Claudia Sepulveda, and David Rosenblatt.

Description: Cambridge, MA : MIT Press, [2019] | Includes bibliographical references and index.

Identifiers: LCCN 2018046336 | ISBN 9780262039994 (hardcover : alk. paper)

Subjects: LCSH: Economic development. | Information technology--Economic aspects. | Monetary policy. | Social change.

Contents

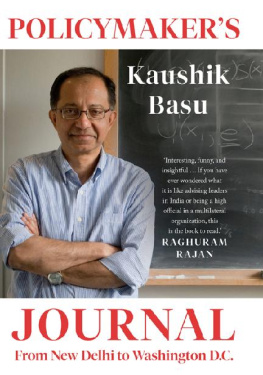

- Kaushik Basu

- Kenneth Arrow

- Amartya Sen

- Joseph Stiglitz

- Guillermo Calvo

- Hyun Song Shin

- Philippe Aghion

- Sam Fankhauser and Nicholas Stern

- Cass R. Sunstein

- Ingela Alger and Jrgen W. Weibull

- Abhijit Vinayak Banerjee, Esther Duflo, and Michael Kremer

List of Figures

Role model effects on parents decision to educate a daughter

Notes: (A) Parents framed utility U from an educated daughter. The utility depends on the salience of a stereotype A, in which an educated girl is a source of pride to her parents, and a stereotype P, in which an educated girl is perceived to be a threat to the patriarchal social order. The salience of the stereotype A depends on the fraction of educated daughters in the village. W is the market-determined lifetime expected earnings of an educated girl.

(B) Cumulative distribution function of parents utility from a daughter who is not educated.

(C) Multiple equilibria of the proportion of parents who choose to educate their daughters.

Source: Hoff and Stiglitz (2016).

Neoclassical economics and the two strands of behavioral economics

Source: Based on Hoff and Stiglitz (2016).

Market share of large US banks: 20012014

Percentage of total assets of banks with more than $300 million in assets

Source: Authors compilation of data from https://www.federalreserve.gov/releases/lbr/.

Market value of US financial corporate equity ($ billion)

Source: US financial accounts, https://www.federalreserve.gov/releases/Z1/Current/data.htm.

Sovereign 10-year yields

US dollar interest rate implied by FX swaps

A., B. Three-month US dollar interest rate implied by FX swaps1

C., D. FX swap spread, 3-month2

Source: Bloomberg; Datastream; BIS calculations.

US dollar exchange rate and the cross-currency basis

1Simple average of bilateral exchange rate of the dollar against CAD, EUR, GBP, SEK, CHF, and JPY. Higher values indicate a stronger US dollar.

2Simple average of the five-year cross-currency basis swaps against CAD, EUR, GBP, SEK, CHF and JPY vis--vis the US dollar.

Source: Avdjiev et al. (2016); Bloomberg; BIS calculations.

Change in euro/US dollar exchange rate and change in cross-currency basis1

1 Changes in quarterly averages.

2 An increase represents an appreciation of the US dollar against the euro.

Source: Avdjiev, Du, Koch, and Shin (2016); Bloomberg; BIS calculations.

US dollar-denominated cross-border claims (billions of US dollars)

Source: BIS locational banking statistics.

Cross-border US dollar denominated credit, all sectors (trillion US dollars)

1 The break in the series between Q1 2012 and Q2 2012 is due to the Q2 2012 introduction of a more comprehensive reporting of cross-border positions (for more details, see http://www.bis.org/publ/qtrpdf/r_qt1212v.htm).

Source: BIS locational banking statistics, tables A5 (by residence) and A7 (by nationality).

1 For Germany, long-term debt securities of insurance companies. Transactions indicate acquisitions minus external financing.

2 For Japan, life insurance companies. Positive (negative) transactions indicate a net purchase (sale) of medium- and long-term bonds.

Outward bond investment of insurance companies

Source: Deutsche Bundesbank; Japanese Ministry of Finance; Statistics Sweden; Life Insurance Association of Japan; BIS calculations.

Over-the-counter foreign exchange derivativesNotional principal1

1 At half-year end (end June and end December). Amounts denominated in currencies other than the US dollar are converted to US dollars at the exchange rate prevailing on the reference date.

Source: BIS over-the-counter derivatives statistics.

US dollar cross-border bank lending and the dollar exchange rate

1 Plot of quarterly growth rate of cross-border bank lending in US dollars on quarterly changes in the US dollar nominal effective exchange rate for Q1 2003Q3 2015. Lending refers to loans by BIS reporting banks to all (bank and nonbank) borrowers outside the United States. The line is a fitted regression line. Positive changes indicate an appreciation of the dollar.

2 Rolling regression coefficient for 20-quarters window.

Sources: BIS locational banking statistics; BIS effective exchange rate indices; BIS calculations.

Euro-denominated cross-border bank lending

1 Plot of quarterly growth rate of cross-border bank lending in euros on quarterly changes in the euro nominal effective exchange rate for Q1 2003Q3 2015. Lending refers to loans by BIS reporting banks to all (bank and nonbank) borrowers outside the euro area. Positive changes indicate an appreciation of the euro.

2 Rolling regression coefficient for 20-quarter window.

Sources: BIS locational banking statistics; BIS effective exchange rate indices; BIS calculations.

The risk-taking channel for EMEs: Bilateral US dollar exchange rate and 5-year sovereign CDS, change from end2012

BR = Brazil; ID = Indonesia; MX = Mexico; MY = Malaysia; RU = Russia; TR = Turkey; ZA = South Africa. The size of the bubbles indicates the size of US dollar-denominated credit to nonbanks in the respective economies in Q4 2015.

Source: Avdjiev, McCauley, and Shin (2016); Datastream; Markit; national data; BIS; BIS calculations.

Net and gross capital flows

A. High-income countries

B. Upper-middle-income countries

C. Lower-middle-income countries

Maturity of domestic and international issuances, corporate-bond market

Notes: This figure reports the weighted average maturity of domestic and international corporate bonds issued by firms from developed and developing countries. The sample period is 19912014.

Source: Cortina, Didier, and Schmukler (2016).