Published in 2013 by The Rosen Publishing Group, Inc.

29 East 21st Street, New York, NY 10010

Copyright 2013 by The Rosen Publishing Group, Inc.

First Edition

All rights reserved. No part of this book may be reproduced in any form without permission in writing from the publisher, except by a reviewer.

Library of Congress Cataloging-in-Publication Data

Meyer, Terry Teague.

How inflation affects you/Terry Teague Meyer. 1st ed.

p. cm.(Your economic future)

Includes bibliographical references and index.

ISBN 978-1-4488-8341-7 (library binding)

1. Inflation (Finance) I. Title.

HG229.M54 2013 332.024dc23

2012018537

Manufactured in the United States of America

CPSIA Compliance Information: Batch #W13YA: For further information, contact Rosen Publishing, New York, New York, at 1-800-237-9932.

How Pricing Works

Monetary Policy

Inflation and Globalization

Inflation and the Local Scene

Inflation and Your Finances

S ophias parents worry a lot about money these days. They both have jobs, but they havent gotten a raise in over a year and they feel like they are falling behind. When the rent increased, the family stopped eating out at restaurants. Sophias mother says that the cost of eating at home is going up all the time, too. When Sophia had to have a cavity filled at the dentists office, her parents were shocked that the cost of a filling was so much more than they remembered. Sophia had been saving up for a special pair of shoes, but she had to buy a cheaper pair to wear for the start of school. The ones she wanted had gotten too expensive. Her friend Caitlins older sister had planned to start college this year but will have to begin part-time instead, due to the rising cost of tuition. Sophias parents say they wont dip into her college savings no matter how tough their finances get. Sophia wonders if the amount saved, even if it goes untouched, will be enough to pay for college by the time she graduates from high school.

These family problems are caused by inflation, a gradual rise in prices over time that robs people of purchasing power (the ability to pay for what they need and want). In order to understand the impact of inflation, we need to answer a number of questions. What causes inflation? What are considered healthy or unhealthy rates of inflation and why? Why do costs in certain sectors (education, health care) rise faster than others (wages)? Does inflation always have a negative effect, or is there a way to benefit from it? What mechanisms drive inflation, and how does it affect government policy, national employment, and consumer behavior?

Understanding inflation and the issues surrounding it are part of gaining financial literacy so that you can effectively manage your money, even in dire periods of inflation (or deflation or recession or tight credit). Armed with this knowledge, you can come out on top, economically stable, secure, and confident.

I n terms of money, inflation means a rise in prices over time. Just as you inflate a balloon with air to make it bigger or add more helium to make it rise, inflation means the prices people pay for goods and services are inflating and rising ever higher. The annual rate of inflation rises and falls over time, but the trend is always upward.

Although consumers might not see rising prices as something good, the rate of inflation reflects the general health of the economy. Economists argue about the optimal rate of inflation for a healthy and growing economy, but an increase of between 2 to 3 percent each year is generally accepted to be ideal. Many factors affect the rate of inflation: consumer demand, government monetary policy, and international trade.

Supply and Demand

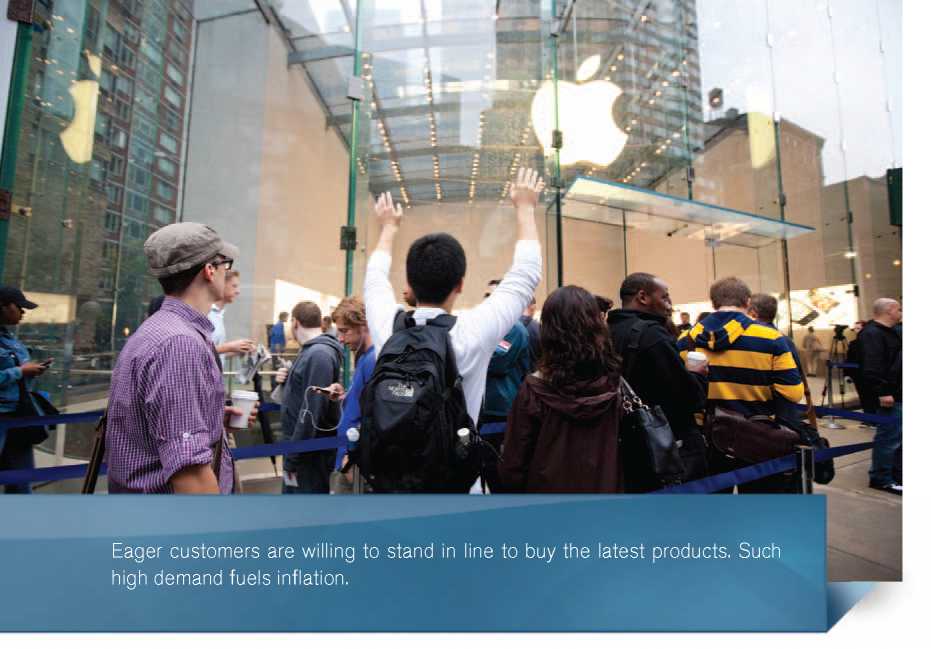

Underlying all pricing, especially price increases, is the economic law of supply and demand. There is a limited amount of goods (things you buy) and services (things you pay others to do for you) available. Think about people camping out in line for tickets to a popular concert or the newest smartphone or game console. Here, the number of people wanting a limited number of tickets or new products is greater than the supply available. Consequently, people may be willing to stand in line for hours or pay much more for a concert ticket or above list price for the latest consumer electronic gadget. In times of natural disaster, people have been charged unreasonable prices for necessities like ice and water, which tend to be in very short supply.

Hard Choices

Inflation affects all of us as prices rise for necessities like food, water, electricity, housing, fuel to heat and cool our homes, gas to transport us, and the various household and personal products we need. If salaries rise at the same rate of inflation, people can keep pace with rising prices for the goods and services they desire. However, salaries tend to lag behind price increases, forcing families and individuals to make hard budget choices. For example, if the rent increases, a family might have to give up entertainment or eating out. When the cost of electricity or fuel oil goes up, consumers may have to adjust the thermostat to save on heat and electricity or put off buying nonessential goods like new clothes. They may have to make do by keeping the old family car on the road for another year or two; buying secondhand clothes, books, or furniture; or buying generic instead of name-brand foods at the supermarket.

These are extreme examples, but they illustrate the force of supply and demand. When people really need and want certain goods and services, they are willing to pay more for them than in the past. When a lot of people want the same product or service, demand outstrips supply and prices rise. This is because producers and sellers, seeking higher profits, raise prices as soon as they realize their products are now worth more.

Lets use a fictional scenario to illustrate how inflation is related to supply and demand. Matt is a computer whiz who helps family members solve their computer problems and create personal Web sites. In order to earn money, he goes into business using his computer and Web expertise. At first, he is happy to charge a very small amount ($5 an hour), since he is earning money for what he used to do for free. However, as word gets around among his parents friends, he soon has more customers than he has time for and realizes that his services are more valuable than he realized. He begins charging $10 an hour and finds that he still has all the customers he can handle.