Contents

Copyright 2012 by David Voda. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com . Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions .

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor the author shall be liable for any damages arising herefrom.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may not be available in electronic books. For more information about Wiley products, visit our web site at www.wiley.com .

Library of Congress Cataloging-in-Publication Data :

Voda, David, 1953

Inflation-proof your portfolio : how to protect your money from the coming government hyperinflation / David Voda.

p. cm.

Includes bibliographical references and index.

ISBN 978-1-118-24927-7 (cloth); ISBN 978-1-118-28321-9 (ebk); ISBN 978-1-118-28437-7 (ebk); ISBN 978-1-118-28632-6 (ebk)

1. Investments. 2. Portfolio management. 3. Inflation (Finance) 4. Business cycles. I. Title.

HG4521.V63 2012

332.024dc23

2012009219

To Pat Allen

Preface

Like you, Im worried. In the midst of the worst economic crisis since the Great Depression, the politicos in Washington seem intent on driving the country toward bankruptcy. The current administrations 2011 budget is 50 percent higher than it was just three years agoand National Public Radio reports there will be at least $13 trillion in deficits in the next 10 years.

When President Obama was elected to office in January 2009, the national debt totaled $10.626 trillion. Now, in August of 2011, the debt has exploded by another $4 trillion according to CBS News.

On average, reports Zeke Miller of .).

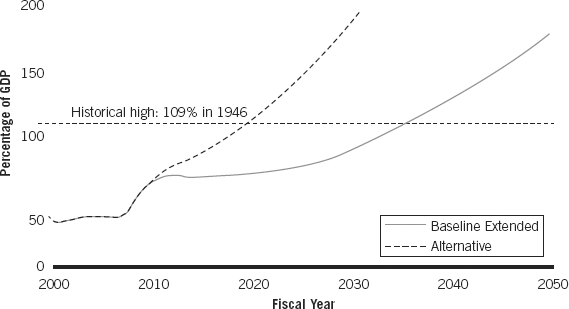

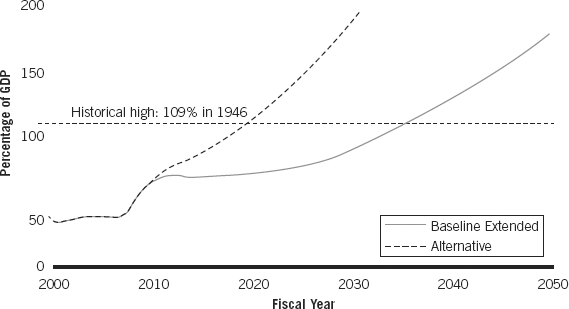

Debt Held by the Public under the Two Different Social Security, Medicare, and Medicaid Projections

Source : GAO.

As Ronald Reagan remarked, The nine most terrifying words in the English language are: Im from the government and Im here to help.

Just by the fact that youve invested in a book like this, I know you share my concern and I hope that you will do all you can to oppose the crazy government taxing, borrowing, and spending patterns that are leading to the ruin of the dollar and the coming dollar hyperinflation.

But enough about politics.

What This Book Is (and Isnt) About

This book is neither an economic treatise nor specific investment advice. It is intended as a resource to help empower you, the citizen, to take action and protect your money from the coming government-induced hyperinflation.

I contend hyperinflation is coming because creating and allowing inflation is the most likely strategy the politicians have for getting us out of the mess they have created. While there is broad agreement among economists that inflation pressures are growing, there is a wide variety of estimates as to what that inflation rate will be. Whether you are expecting a mild degree of inflation, like 5 to 10 percent, a return to 1970s-style inflation of 13 percent, or a total dollar meltdown with inflation running to hundreds or thousands of percent, there are strategies in this book for you to use.

- If you are mildly concerned about inflation, for instance, you might consider shifting some of your dollars out of bank accounts and CDs into stocks and mutual funds (described later) that may prosper during an inflationary period. You can reduce your exposure to changing interest rates by gradually cutting up your credit cards and refinancing your house to a fixed rate, rather than a variable rate, loan.

- If you are a little more wary about the future climate, you probably will also want to stock up on precious metals like gold and silver, and invest in timber, oil, or other resources that are likely to hold their value.

- If you are really worried about the direction of the economy, you can start to plan now to weather a depression-like period. Buying land in the country, moving assets overseas, and stocking up on food and medical supplies all are reasonable moves if things get really bad.

The book is organized around four major principles that will help you protect your money:

Principle 1 states exchange dollars for real things. Here youll learn about tangible investments that hold their value when paper currencies fail. Youve probably heard about gold, oil, and real estatebut what about timber? Diamonds? Stamps? Art?

Principle 2 tells us that future money is cheap money. In an inflationary environment, how should you handle your mortgage? Credit cards? Student debt?

Principle 3 suggests diversify out of dollars. The dollar used to be a house built of bricks; now its a house of straw. But is the euro any better? The yuan? And how can you protect government-regulated accounts like your IRA or 401(k)?

Finally, principle 4 encourages us to prepare for the worst, but expect the best. Taxes are almost certain to skyrocket in the coming decade, and in a world with a rapidly disintegrating dollar, it may be prudent to develop useful skills or stock up your country retreat.

Time to Take Action

Im afraid that the outlook for our country is very gloomy indeed, but that doesnt mean we need to throw in the towel. In this book, Ive tried to gather into one place all the different ways a person can begin to inflation-proof his or her life savings. No one needs to be a victim of misguided government policies; you can take action now to hold on to what you have and protect your assets from what is almost sure to be a prolonged bout of severe inflation.

Here are just a few of the things youll discover in this book:

- Why you are late to the gold party

- Why silver is undervalued

- What coins to have on hand