Table of Contents

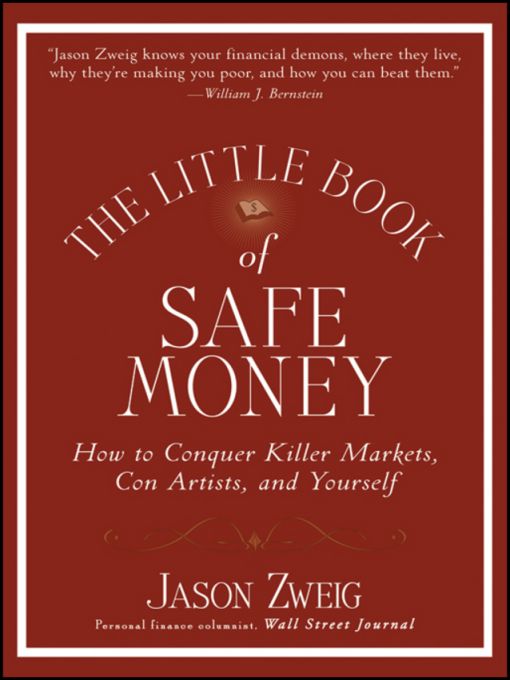

Additional Praise forThe Little Book of Safe Money

There are two parts to investing. One part seeks gains. The other parttoo often overlookedprotects your standard of living when markets go bad. Jason Zweig brilliantly focuses on protection, not only in bond investing but in stocks, as well. He names, and knocks, the products designed to part you from your money, while steering you toward the kinds of low-cost, low-risk investments that, historically, have come out ahead.

Jane Bryant Quinn, financial columnist and author of Smart and Simple Financial Strategies for Busy People

Ive been a financial planner for over 30 years and there is not one client Ive worked with who would not profit from reading and heeding the advice in The Little Book of Safe Money.

Harold Evensky, President, Evensky & Katz

Little Book Big Profits Series

In the Little Book Big Profits series, the brightest icons in the financial world write on topics that range from tried-and-true investment strategies to tomorrows new trends. Each book offers a unique perspective on investing, allowing the reader to pick and choose from the very best in investment advice today.

Books in the Little Book Big Profits series include:

The Little Book That Beats the Market, in which Joel Greenblatt, founder and managing partner at Gotham Capital, reveals a magic formula that is easy to use and makes buying good companies at bargain prices automatic, enabling you to successfully beat the market and professional managers by a wide margin.

The Little Book of Value Investing, in which Christopher Browne, managing director of Tweedy, Browne Company, LLC, the oldest value investing firm on Wall Street, simply and succinctly explains how value investing, one of the most effective investment strategies ever created, works, and shows you how it can be applied globally.

The Little Book of Common Sense Investing, in which Vanguard Group founder John C. Bogle shares his own time-tested philosophies, lessons, and personal anecdotes to explain why outperforming the market is an investor illusion, and how the simplest of investment strategiesindexingcan deliver the greatest return to the greatest number of investors.

The Little Book That Makes You Rich, in which Louis Navellier, financial analyst and editor of investment newsletters since 1980, offers readers a fundamental understanding of how to get rich using the best in growth-investing strategies. Filled with in-depth insights and practical advice, The Little Book That Makes You Rich outlines an effective approach to building true wealth in todays markets.

The Little Book That Builds Wealth, in which Pat Dorsey, director of stock analysis for leading independent investment research provider Morningstar, Inc., guides the reader in understanding economic moats, learning how to measure them against one another, and selecting the best companies for the very best returns.

The Little Book That Saves Your Assets, in which David M. Darst, a managing director of Morgan Stanley, who chairs the firms Global Wealth Management Asset Allocation and Investment Policy Committee, explains the role of asset allocation in maximizing investment returns to meet life objectives. Brimming with the wisdom gained from years of practical experience, this book is a vital road map to a secure financial future.

The Little Book of Bull Moves in Bear Markets, in which Peter D. Schiff, president of Euro Pacific Capital, Inc., looks at historical downturns in the financial markets to analyze what investment strategies succeeded and shows how to implement various bull moves so that readers can preserve, and even enhance, their wealth within a prosperous or an ailing economy.

The Little Book of Main Street Money, in which Jonathan Clements, award-winning columnist for the Wall Street Journal and a director of the new personal finance service myFi, offers 21 commonsense truths about investing to help readers take control of their financial futures.

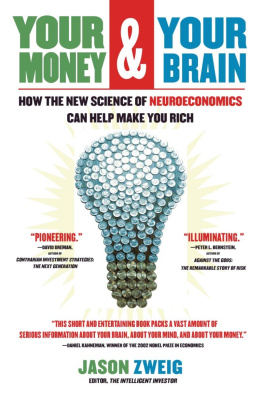

The Little Book of Safe Money, in which Jason Zweig, best-selling author and columnist for the Wall Street Journal, shows the potential pitfalls all investors face and reveals not only how to survive but how to prosper in a volatile and unpredictable economy.

For Mark Cornell and Eric Schmuckler

Shaped by the wise

Who gazed in breathing wonderment,

And left us their brave eyes

To light the ways they went.

Foreword

JASON ZWEIG, simply put, is the reigning gold medalist in the investing Olympics decathlon.

Allow me to explain. Investing success does not accrue to those with savant-like expertise in one field of intellectual endeavor, but rather rests on four pillars: a command of financial theory, a working knowledge of financial history, an awareness of financial psychology, and a solid understanding of how the financial industry operates. Like the decathlon winner, the successful investor is rarely the world champion in a single event, but rather someone who excels at all.

Few can match Jasons grasp of investment theory, and I am hard-pressed to name anyone who exceeds his knowledge of investment history or the cognitive neuropsychological aspects of finance. Extol the virtues of Ben Grahams magisterial Security Analysis, and Jason will ask which edition youre referring to. Mention to him the gambling proclivities of medicated Parkinsons disease sufferers, and then this neurologist soon finds himself humbled by an informed precis of the latest paper on the topic from Archives of Neurology.

Finally, over a professional lifetime as a beat reporter at Forbes, Money, and the Wall Street Journal, Jason has gotten to know the industry as well as anyone: whos been naughty, whos been nice, and who will soon be getting unwanted judicial attention in the Southern District of Manhattan. His output in this area has been so prodigious that he hasnt had the time to submit much of his best work for publication. Few investment professionals, for example, are unaware of his classification scheme that cleaves the mutual fund world into a tiny minority of investment companies, which focus exclusively on their fiduciary responsibility to their customers, and the overwhelming mass of marketing companies, concerned only with their bottom lines. Although Jason has of late made this piece available on his web site, you will not find it immortalized anywhere between hard or soft covers.

Jason thus has a great deal to offer all investors, from the rankest amateur to the most grizzled pro. Lets sample just a few of his pearls from each of the four events in the investing Olympics:

The theory of investing. Diversification and liquidity are dandy, but they both vanish when we need them the most. As 2008 began, millions of investors owned short-term bond funds holding securities ranging in safety from plain-vanilla high-grade corporate debt to more exotic asset-backed vehicles; a small but soon-to-be-highly-visible minority of funds actually juiced their returns by writing credit default swaps. In normal times, these securities were highly liquid, that is, easily exchangeable for cold, hard cash. When push came to shove in the fall of that year, however, shareholders in need of cash suddenly found that they were worth less than they ever thought possiblein some cases, a lot less. Similarly, during the great bull market of 2002-2007, investors piled into mutual funds specializing in emerging markets and real estate investment trusts (REITs)ostensibly because of their diversification value, but in reality because their recent performance had been red-hot. In the ensuing market collapse, the diversification value of these two asset classes disappeared faster than taco chips at a Super Bowl party, falling, in some cases, 60 to 70 percent. (In truth, REITs and emerging markets stocks do offer substantial diversification benefit, but only if held for the long term: during the 10-year period from 1999 to 2008, these two asset classes provided investors with salutary returns, while the S&P 500 lost money.)