A&A Book Publishing

www.shortstoppress.com

www.aampersanda.com

First published in Australia 2011

New edition published 2012

Text 2011, 2012 Charles Badenach

ISBN 978-0-9872367-1-5

This book is copyright. Apart from any use permitted under the Copyright Act 1968 and subsequent amendments, no part may be reproduced, stored in a retrieval system or transmitted by any means or process whatsoever without the prior written permission of the publishers.

ePUB edition by

David Andor / Wave Source Design

www.wavesourcedesign.com

A record for this publication may be found in the National Library of Australia.

CHAPTER SEVEN:

Superannuatio n

"You cannot have the success without the failures."

H.G Hassler

Superannuation is an attractive structure in which to build for your eventual retirement despite the goal posts constantly changing. Having decided to use superannuation as an investment structure, you can use any of the following types of superannuation funds.

An industry Fund

An industry fund is a broad term that is used to describe a superannuation fund that is established with the primary purpose for providing for a particular type of worker. Approximately 30% of workers use an industry fund and, for more information, it is worthwhile looking at their website www.industrysuper.com. The main industry super funds are Australian Super, Host Plus, C Bus, and Care Super.

Industry super funds are characterised by:

A low fee structure

Limited and/or very basic financial advice

Limited number of investment options which keep the fee structure low

Competitive insurance offerings

As a general rule, industry super funds are suitable for those investors who have a small superannuation balance or have no interest in how their monies are invested. If you have no contact with an industry fund, your money will be invested in accordance with what is known as the default investment option. This default option usually provides a balanced asset allocation, by giving an investor exposure to all of the asset classes.

Retail Super Fund

A retail superannuation fund can be broadly described as a superannuation fund, whose aim is not only to provide an investment and insurance solution for investors, but also to make a profit for the owners of the fund. There are more than four-thousand retail funds in Australia, and these are generally run by the major banks, insurance companies and fund managers. The standard retail fund does not offer a choice of investment managers, but simply has one investment manager.

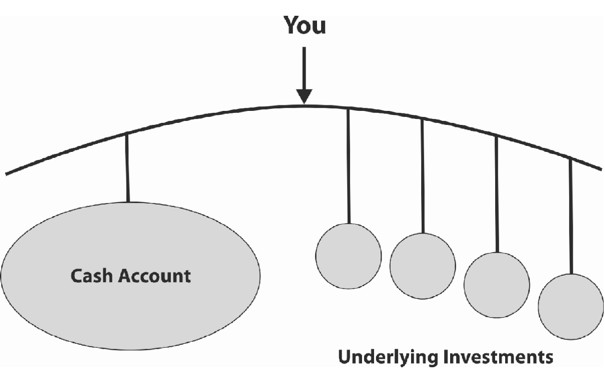

The following diagram explains how they operate:

These structures were very popular in the 1990s but, as the superannuation industry has developed, these structures have lost their appeal. They generally have a very high fees and limited investment choice when compared to the alternatives.

For example, retail superannuation often charges entry fees which can be as high as 4% of the capital sum invested and ongoing fees of up to 3%. This means that in the first year an investor, in some cases, needs to generate a return of over 7% to get a positive return. The good news is that competitive forces have now substantially reduced these costs so entry fees are now the exception rather than the norm and the ongoing fees have fallen to around 22.5%.

In the 1990s, many advisers built substantial businesses on the back of retail funds, and there was one well known adviser who set up the majority of the workers in a remote mining town on a regular savings plan of $1,000 per month into superannuation. At one stage, he had three-hundred workers each paying in $1,000 per month to super, charged 4% as an upfront fee and a 1% ongoing fee. Let us consider these numbers for a moment:

300 workers x $1,000 per month = $300,000 being contributed each month into superannuation

4% contribution fee on $300,000 = $12,000 per month or $144,000 per year

1% ongoing fee on the $300,000 per annum = $3,000 per year

The compounding nature of the fees, excluding any growth in these funds due to market movements, means that in year one, the fees will be approximately $147,000; year two, $294,000; year three, $441,000; and so on. From this, you can see that it would not take very long to build up a very successful business using this strategy. With the recent changes to how financial advisers are paid this model will be outlawed from the 1st July 2012 onwards which to be frank is a positive move for the consumers.

In summary, these structures should be avoided at all costs, as there are better places to put your superannuation funds.

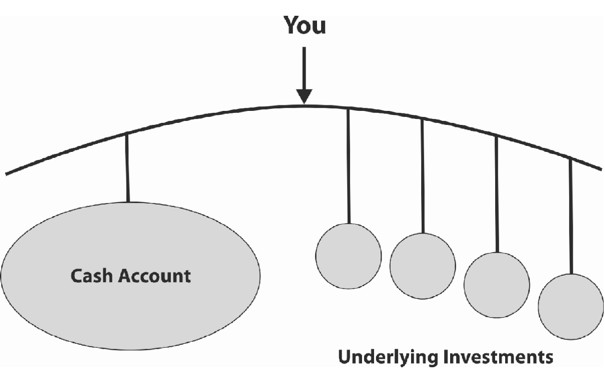

Wrap Accounts

A wrap account is essentially a structure that offers a transaction and portfolio administration umbrella. This structure provides access to a wide range of wholesale, institutional and direct investments, such as listed shares, from a single point of reporting. Within a wrap structure there is usually a cash accountwhich is the account through which all of the investment transactions are processed, income received, contributions and payments made, and is the account from which fees are deducted. As a consequence of this, many investors like the transparency of this structure.

The financial adviser usually receives a fee for this structure of between 0.5% and 1.5% for providing ongoing financial advice to you. This amount is usually deducted on a monthly basis from the cash account. These fees can be worked out by getting a copy of the cash account transactions. With the introduction of the FOFA legislation from the 1st July 2012 these arrangements will need to be reviewed every 2 years.

This structure works as follows,

A wrap account has the following features:

Consolidated investment and tax reporting of all of your investments

Provides a wide range of investment options from managed funds to direct shares

The structure is fairly simple to understand

The fee structure is generally very competitive when compared with the alternatives

For investors who take an active interest in their superannuati on, a wrap or master trust structure can be an attractive alternative to a self managed superannuation fund.

Self Managed Superannuation Funds

With the recent focus on fees and investment performance, many people have elected to set up their own self managed superannuation fund, commonly known as SMSFs. These are small private funds, which have between one and four members. The trustee of the fund is either a company, known as a corporate trustee, or all of the members of the fund. The main disadvantage of these funds is that they involve a high degree of personal involvement and the ultimate responsibility for the fund lies with the trustee of the fund. You may engage other professionals such as accountants and financial advisers, but you are responsible for ensuring the fund complies with the appropriate tax and superannuation regulations.

An SMSF offers a number of advantages over the other structures:

Given the fixed nature of many of the costs in running a fund the costs can be cheaper where you have large amounts invested within this structure

Your investment choices are generally unlimited, provided you comply with the legislative requirements and the investment strategy of the fund permits this. For example, clients have had samurai swords, art, wine, and coin collections as an investment in their SMSF

Next page