The projections of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results.

Information was obtained from third party sources, which we believe to be reliable but not guaranteed for accuracy or completeness.

The information provided should not be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice.

The information provided does not take into account the specific objectives, financial situation or particular needs of any specific person.

Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income.

Investing entails risk including the possible loss of principal and there is no assurance that the investment will provide positive performance over any period of time.

All rights reserved.

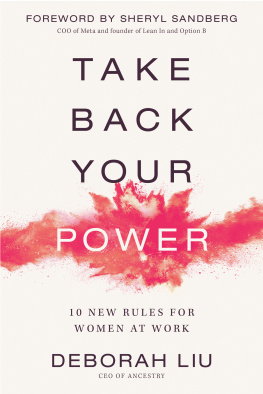

Published in the United States by Crown Business, an imprint of the Crown Publishing Group, a division of Penguin Random House LLC, New York.

CROWN BUSINESS is a trademark and CROWN and the Rising Sun colophon are registered trademarks of Penguin Random House LLC.

Library of Congress Cataloging-in-Publication Data is available upon request.

In memory of my grandmother, who tore down a lot of walls. With thanks to my family, and particularly my amazing kids, supportive husband, and best friend brother.

Well, here we are.

But the view looks a little different than we expected, right? After all, werent we supposed to have arrived? Perhaps with our first female president, gender pay parity was in sight and workplace parity would come soon thereafter? Or, if that was asking too much, at least the end of locker room talk? And, if youre an optimist, werent we going to be able to do this while also achieving the elusive work-life balance?

Well, not yet. Not so much.

The tough truth is that progress on gender diversity in corporate America (and elsewhere) has been slower than many expected, even with all of the research on how it helps business performance, and all of the advice telling professional women how to get ahead. Has feminism hit a plateau? Only if we continue to do the same thingsand expect different results.

Luckily, there is another way. And thats why I am facing the future with real optimism. Because we can change this; we can own this.

As youll read in the coming pages, my optimism is due, in large part, to the fact that the business world is changingfastand its changing in ways that play to our strengths. This places us on the brink of a seismic shift in the traditional power structure: one with significant implications for women in business. And its a shift that begins with recognizing the power that we already haveand using that power to accelerate these changes.

So Im not here to tell you how to win yesterdays version of the game, in which we women are instructed to develop some set of not-too-hot-and-not-too-cold skills for yesterdays world. And Im not here to teach you yesterdays rules for achieving yesterdays version of success.

Nor am I here to empower you. Yes, you read that right. Because to be honest, Im pretty over the whole notion of women being empowered. Look it up in the dictionary and youll see why:

Empower (verb): to give power or authority to.

Thats right, to empower women, power must be given to them. Well, this book isnt going to be about the slight sense of passivity that the definition implies. We shouldnt count on anyone else doing this for us.

Instead this book is going to be about how to take an active role in your future by owning the power you already have. Im here to tell you that you already have the qualities and skills it takes to get ahead in the modern workplace, and, that in owning those qualities, you have more power and potential than you realize.

So rather than looking to be empowered, this book is going to be about how to leverage our existing power to thrive and advance in our careers in ways that play to our strengths, how to turn our companies into places at which we want to work (or leave to start our own), and how to invest our economic muscle in making our lives and the world better.

Who am I to tell this story? Well, Ive been around. I spent my career on Wall Street, starting out as a data-driven research analyst: Ive run Smith Barney, at the time part of Citigroup, where I also served as chief financial officer. Ive run Merrill Lynch Wealth Management, the thundering herd. Ive run U.S. Trust and the Citi Private Bank. Ive led teams of more than thirty thousand financial advisors and bankers, and reported directly to CEOs of multibillion-dollar organizations. Ive sat on a number of corporate boards. Today I chair Ellevate Network, the global professional womens network. And, most recently, I launched Ellevest, a digital investment platform for women, funded with venture capital money.

Two things have set me apart in all these settings. First: Ive invariably been the only woman, or one of the only women, in the room.

Second: Ive often been the only person to question the status quo. Ive often been the lone voice saying, Hold on a second. Slow down. Maybe we should talk this out before jumping in.

And Im going to drop a bomblet here: I believe that those two thingsmy being a female and my approaching business differently from the others in the roomare related.

To understand this better, lets go back to Wall Street, circa 2008. Because it was there that capitalism brokenearly taking the global economy down with itand I had a front-row seat. It was also then that I was fired (on the front page of the Wall Street Journal, no less); because, when the economy imploded, I alone at the big Wall Street firms fought to do the unthinkable: reimburse some of our clients investment losses.

I know. Crazy, right?

At Smith Barney, we had sold a set of investment products by the name of Falcon that were supposed to be low-risk. In a good market, the thinking went, their value would increase; in a down market, their value would drop, but not much. The downside was, we told our clients, maybe 8 cents on the dollar.

Well, as we all know too well, in 2007 and 2008 the market did go downa lot. Falcon? It went down, too, but not 8 cents. Not 15 cents or even 35 cents. It lost most of its cents on the dollar. Our team had misread the risk of the investment, and it had cost our clients dearly.