SpringerBriefs in Applied Sciences and Technology SpringerBriefs in Computational Intelligence

Series Editor

Janusz Kacprzyk

Systems Research Institute, Polish Academy of Sciences, Warsaw, Poland

SpringerBriefs present concise summaries of cutting-edge research and practical applications across a wide spectrum of fields. Featuring compact volumes of 50 to 125 pages, the series covers a range of content from professional to academic.

More information about this subseries at http://www.springer.com/series/10618 Typical publications can be:

A timely report of state-of-the art methods

An introduction to or a manual for the application of mathematical or computer techniques

A bridge between new research results, as published in journal articles

A snapshot of a hot or emerging topic

An in-depth case study

A presentation of core concepts that students must understand in order to make independent contributions

SpringerBriefs are characterized by fast, global electronic dissemination, standard publishing contracts, standardized manuscript preparation and formatting guidelines, and expedited production schedules.

On the one hand,SpringerBriefs in Applied Sciences and Technology are devoted to the publication of fundamentals and applications within the different classical engineering disciplines as well as in interdisciplinary fields that recently emerged between these areas. On the other hand, as the boundary separating fundamental research and applied technology is more and more dissolving, this series is particularly open to trans-disciplinary topics between fundamental science and engineering.

Indexed by EI-Compendex, SCOPUS and Springerlink.

Simo Moraes Sarmento

Instituto de Telecomunicaes, IST, University of Lisbon, Lisbon, Portugal

Nuno Horta

Instituto de Telecomunicaes, IST, University of Lisbon, Lisbon, Portugal

ISSN 2191-530X e-ISSN 2191-5318

SpringerBriefs in Applied Sciences and Technology

ISSN 2625-3704 e-ISSN 2625-3712

SpringerBriefs in Computational Intelligence

ISBN 978-3-030-47250-4 e-ISBN 978-3-030-47251-1

https://doi.org/10.1007/978-3-030-47251-1

The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG 2021

This work is subject to copyright. All rights are solely and exclusively licensed by the Publisher, whether the whole or part of the material is concerned, specifically the rights of translation, reprinting, reuse of illustrations, recitation, broadcasting, reproduction on microfilms or in any other physical way, and transmission or information storage and retrieval, electronic adaptation, computer software, or by similar or dissimilar methodology now known or hereafter developed.

The use of general descriptive names, registered names, trademarks, service marks, etc. in this publication does not imply, even in the absence of a specific statement, that such names are exempt from the relevant protective laws and regulations and therefore free for general use.

The publisher, the authors and the editors are safe to assume that the advice and information in this book are believed to be true and accurate at the date of publication. Neither the publisher nor the authors or the editors give a warranty, expressed or implied, with respect to the material contained herein or for any errors or omissions that may have been made. The publisher remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This Springer imprint is published by the registered company Springer Nature Switzerland AG

The registered company address is: Gewerbestrasse 11, 6330 Cham, Switzerland

Acronyms

ADF

Augmented Dickey-Fuller

ANN

Artificial neural network

ARMA

Autoregressivemoving-average

DBSCAN

Density-based spatial clustering of applications with noise

ETF

Exchange-traded fund

FNN

Feedforward neural network

GARCH

Generalized autoregressive conditional heteroskedasticity

LSTM

Long short-term memory

MAE

Mean absolute error

MDD

Maximum drawdowm

MLP

Multilayer perceptron

MSE

Mean squared error

OPTICS

Ordering points to identify the clustering structure

PCA

Principal component analysis

RNN

Recurrent neural network

ROI

Return on investment

SR

Sharpe ratio

SSD

Sum of Euclidean squared distance

t-SNE

T-distributed Stochastic Neighbor Embedding

Contents

The Author(s), under exclusive license to Springer Nature Switzerland AG 2021

S. Moraes Sarmento, N. Horta A Machine Learning based Pairs Trading Investment Strategy SpringerBriefs in Applied Sciences and Technology https://doi.org/10.1007/978-3-030-47251-1_1

1. Introduction

Simo Moraes Sarmento

(1)

Instituto de Telecomunicaes, IST, University of Lisbon, Lisbon, Portugal

Simo Moraes Sarmento (Corresponding author)

Email:

Keywords

Pairs Trading Unsupervised Learning Time-series forecasting

1.1 Topic Overview

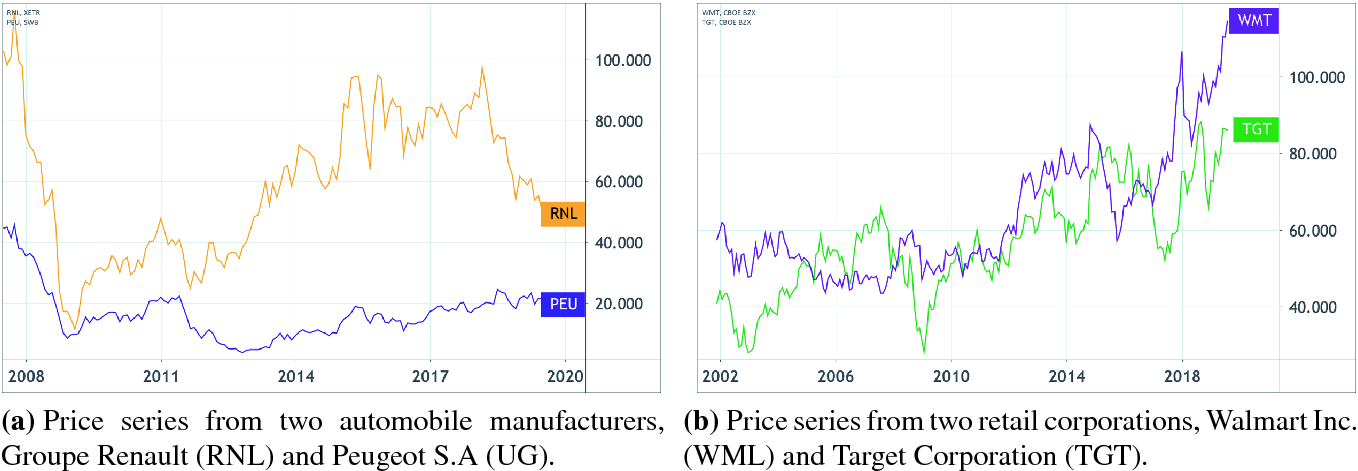

Pairs Trading is a well-known investment strategy developed in the 1980s. It has been employed as one important long/short equity investment tool by hedge funds and institutional investors Cavalcante et al. [

Once the pairs have been identified, the investor may proceed with the strategys second step. The underlying premise is that if two securities price series have been moving close in the past, then this should persist in the future. Therefore, if an irregularity occurs, it should provide an interesting trade opportunity to profit from its correction. To find such opportunities, the spread between the two constituents of the pairs must be continuously monitored. When a statistical anomaly is detected, a market position is entered. The position is exited upon an eventual spread correction. It is interesting to observe that this strategy relies on the relative value of two securities, regardless of their absolute value.

We proceed to introduce how the strategy may be applied using an example from this work. A more formal description concerning the trading setup is presented in Sect.. The investor may calculate the mean value of the spread formed by the two constituents of the pair, as well as its standard deviation. These values describe the statistical behaviour known for that pair and which the investor expects to remain approximately constant in the future.

Fig. 1.1

Price series which could potentially form profitable pairs