Table of Contents

Preface

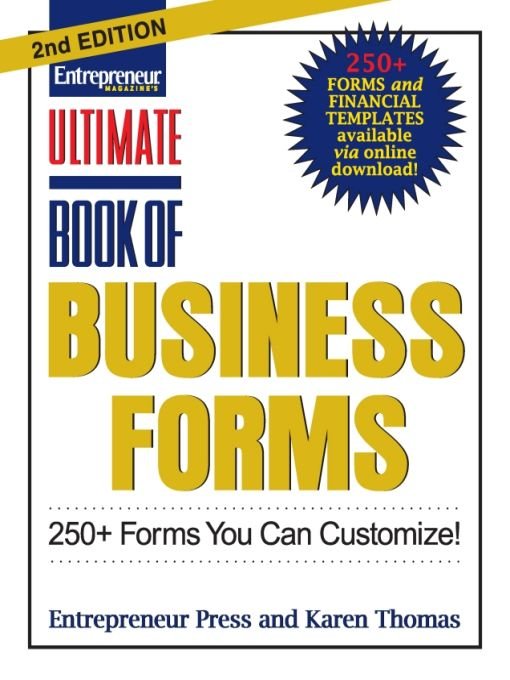

The Ultimate Book of Business Forms, Second Edition delivers the must-have formsand then somethat small business owners need to operate whether in the office, offsite, at home, or online. Since the original title was published, the small business owner has evolved in conjunction with technology, the working environment, and economy. The new edition is structured to support a business owners progression and is organized in a in a logical fashion that is consistent with the natural evolution of a small business.

The second edition is the forms book for the modern entrepreneur whos just started his or her business or is adapting existing operations to succeed in a highly digital and regulated world. Each chapter serves a distinct purpose in terms of providing the essential forms business owners can use to operate more efficiently and resourcefully, ultimately saving time and money.

Supporting Web Site

Every small business is unique. Therefore its essential to have business forms that are customizable depending on your businesss needs. The forms included in this book can be found online at www.entrepreneur.com/formnet. Forms will be available in the following formats: Word, Excel, and PDF and can be completely customized to match your business brand, processes, and culture.

This book can be used as your reference guide as you work with each customizable form. Refer to the book to understand when and how to use the forms. Balance your budgets, file for tax rebates, and even determine if your Twitter and Facebook accounts are impacting your bottom line. There are hundreds of forms at your disposal, and each one serves a specific purpose that will help streamline business processes and maximize time.

Finding the forms online is easy. Simply visit the site, www.entrepreneur.com/formnet, select the appropriate forms category, and download as many forms as you need from each. Theres no cost or special code required to access and customize these forms for your business.

About the Author

Karen Thomas is an accomplished writer who has much experience in business and technical writing. Thomas reported for the Orange County Register, published business and startup books with Entrepreneur Press, and continues to produce technical and consumer-friendly articles for several online properties. In addition to authoring business books, Thomas is the creative director at Affnet, Inc., an Orange County-based marketing and technological firm.

Acknowledgments

I would like to thank Jere Calmes and the team at Entrepreneur Press for allowing me this opportunity to revise the Ultimate Book of Business Forms. Their innate understanding of a small business owners needs is proven in each Entrepreneur Press publication including the Ultimate Book of Business Forms, Second Edition, which provides a whole new slew of business forms for the modernday businessman or woman.

CHAPTER 1

Name Your Business

HOW IMPORTANT IS ESTABLISHING A name for your business? Before the marketing team can qualify the importance of a businesss nomenclature, the legal department (or person in charge of the business compliance) should understand why its first necessary to establish a DBA.

The United States governments official online business resource (

www.business.gov) outlines the DBA need and processes as follows:

The legal name of a business is the name of the person or entity that owns a business. If you are the sole owner of your business, its legal name is your full name. If your business is a partnership, the legal name is the name given in your partnership agreement or the last names of the partners. For limited liability corporations (LLCs) and corporations, the business legal name is the one that was registered with the state government.

Your business legal name is required on all government forms and applications, including your application for employer tax IDs, licenses, and permits. However, if you want to open a shop or sell your products under a different name, then you may have to file a fictitious name registration form with your government agency.

A fictitious name (or assumed name, trade name, or DBA name is a business name that is different than your personal name, the names of your partners, or the officially registered name of your LLC or corporation.

This chapter includes several state-specific forms that business owners can use to file their DBA. The following state-specific DBA forms are included in this chapter: Alaska, Arkansas, Delaware, Louisiana, Iowa, Ohio, and Washington.

While its essential to file a DBA to maintain legal compliance, a DBA is also a central component of your business brand. When selecting your DBA consider where it will appear, how it will sound, and so on. A DBA can differentiate your business from competitors. Also, once you select a DBA, make sure to check registered and unregistered trademarks to ensure youre not infringing on businesses of the same moniker.

Its best to check with your state or local agencies within your county to determine what DBA forms are required. Doing so before any business is transacted is recommended, as well.

While its up to each individual state to decide how a business has to file its DBA, a majority either require businesses to file by mail or online. The information required online and each form differs, as well. This chapter includes several samples of forms required by states that mandate businesses mail hard copies. Many states allow business owners to file a DBA completely online.

1. Alaska Doing Business As Form

2. Arkansas Fictitious Name Form

3. Delaware Procedure for Filing Fictitious Name Certificate

PROCEDURE FOR FILING FICTITIOUS NAME CERTIFICATE

1. This certificate is being filed in accordance with Title 6 Del. C. Chapter 31. The applicant must bear primary responsibility for determining whether there is in existence any other business or organization utilizing the same fictitious name. The acceptance and recording of a fictitious name certificate in the Prothonotarys Office shall in no way be deemed a warranty of the applicants right to operate under the name registered.

2. Make sure the form is complete and the information is accurate.

3. After the form is completed, please return it to the cashier for processing. If you are returning it by mail, be sure that it is notarized. Please enclose a stamped, selfaddressed envelope so that we may send you a certified copy as proof of filing for your records. To register in New Castle County, mail the completed form to:

New Castle County Prothonotary

500 N. King Street

Suite 500, Lower Level 1

Wilmington, DE 19801-3746

4. The filing fee is $25.00. Your check or money order should be made payable to the Prothonotary.

5. If you sell, change the name, or in any other way change the status of the business, you should notify this office.