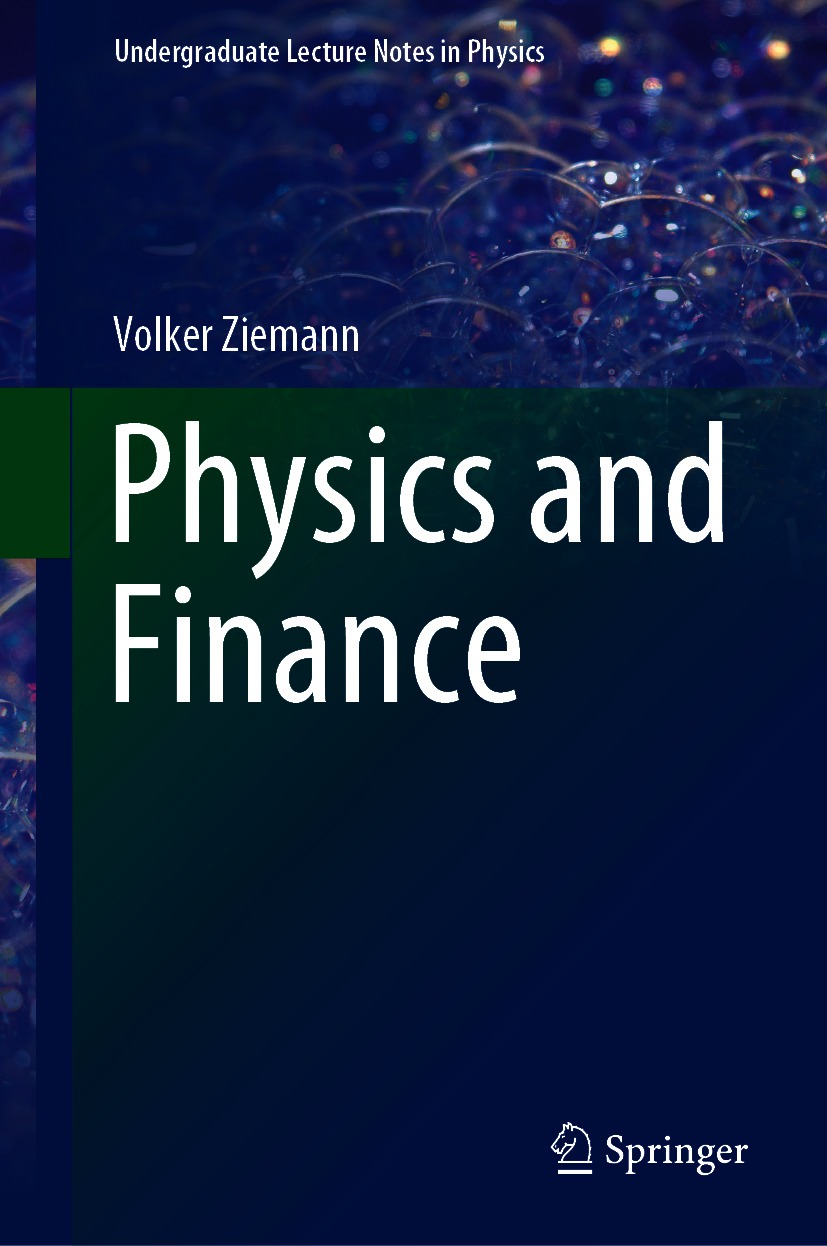

Volker Ziemann - Physics and Finance

Here you can read online Volker Ziemann - Physics and Finance full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2021, publisher: Springer International Publishing, genre: Romance novel. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Physics and Finance

- Author:

- Publisher:Springer International Publishing

- Genre:

- Year:2021

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

- 80

- 1

- 2

- 3

- 4

- 5

Physics and Finance: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Physics and Finance" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Physics and Finance — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Physics and Finance" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Undergraduate Lecture Notes in Physics (ULNP) publishes authoritative texts covering topics throughout pure and applied physics. Each title in the series is suitable as a basis for undergraduate instruction, typically containing practice problems, worked examples, chapter summaries, and suggestions for further reading.

ULNP titles must provide at least one of the following:

An exceptionally clear and concise treatment of a standard undergraduate subject.

A solid undergraduate-level introduction to a graduate, advanced, or non-standard subject.

A novel perspective or an unusual approach to teaching a subject.

ULNP especially encourages new, original, and idiosyncratic approaches to physics teaching at the undergraduate level.

The purpose of ULNP is to provide intriguing, absorbing books that will continue to be the reader's preferred reference throughout their academic career.

More information about this series at http://www.springer.com/series/8917

This Springer imprint is published by the registered company Springer Nature Switzerland AG

The registered company address is: Gewerbestrasse 11, 6330 Cham, Switzerland

One fine day, my son, who was studying economics at the time, brought along books on the use of stochastic differential equations in finance. Following a dialog along the lines of Oh, I know that, its a Fokker-Planck equation---No dad, thats Black-Scholes, I got curious. After all, there might be some fun in economics and finance, besides the money. So, I borrowed Hulls book about the basics of financial economics, because I wanted to understand the basic concepts and the lingo. Just looking through the book, I recognized those differential equations that look so similar to a diffusion equation with a drift term. So, I set out to understand what finance has to do with diffusion.

I later presented some lectures about my explorations to a few interested students and colleagues, which was very stimulating and caused me to explore the subject further. That was how the later chapters came about. They all deal with some aspect of random processes and have some overlap between physics, finance, and other neighboring disciplines.

At that point, I prepared a 5 ECTS (European transfer credits) lecture series for masters students at Uppsala University and expanded the manuscript to serve as lecture notes for this course, which ran for the first time in the spring of 2019, with about 15 interested students. The feedback after the course was rather positive such that I gave the course again in the spring of 2020. This time with 24 students, who provided much more feedback and criticism, which caused me to revise parts of the manuscript to bring it to its present form.

Obviously, many people helped to improve the manuscript. First, I have to thank my son Ingvar. He stimulated my interest in finance and also critically read parts of the manuscript. Likewise, I am indebted to my colleagues and the students who participated in the early lectures and in the course later. Many of them gave valuable criticism and feedback on the growing manuscript. I want to single out a few students, who were particularly diligent: Joe and Martin from the course in 2019; Friedrich, Sebastian, and Elias from 2020. They helped me weed out many ambiguities and errors. They are, however, not to blame for any remaining bugs, those are my responsibility alone. I also need to thank our director of studies, Lisa Freyhult, for her support at the faculty to include this course in the curriculum. Finally, I want to thank my family for their patience with me when I was a bit overfocused on the manuscript.

This chapter sets the stage for the book when it establishes a common theme in many physical and financial systems; both deal with dynamical systems subject to external random forces. A brief discussion of the books target audience follows, before an overview over its contents is given.

What do physics and finance have in common? The short answer is: they both deal with dynamical systems that are subject to external random forces.

In physics, an example is the random walk of pollen floating on a liquid, the Brownian motion first interpreted and theoretically analyzed by Einstein []. A modern example is the startup of conventional lasers and free-electron laser from noise. In general, most of the sub-domain of statistical physics treats systems that are subject to random forces and are described by distributions of the state variables. Many diffusion processes fall into this group.

Font size:

Interval:

Bookmark:

Similar books «Physics and Finance»

Look at similar books to Physics and Finance. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Physics and Finance and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.