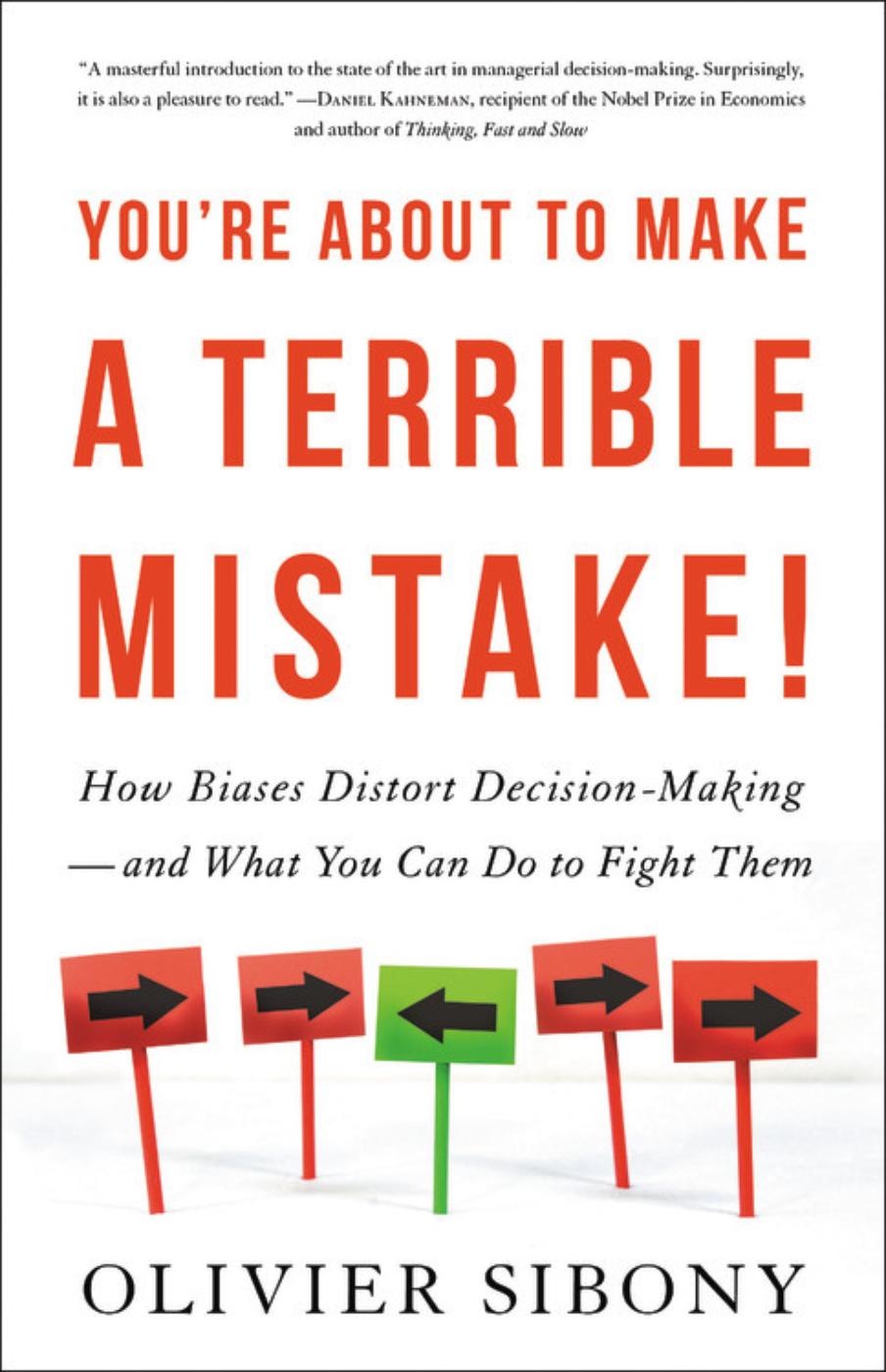

Olivier Sibony - Youre about to make a terrible mistake : how biases distort decision-making -- and what you can do to fight them

Here you can read online Olivier Sibony - Youre about to make a terrible mistake : how biases distort decision-making -- and what you can do to fight them full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2020, genre: Romance novel. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Youre about to make a terrible mistake : how biases distort decision-making -- and what you can do to fight them

- Author:

- Genre:

- Year:2020

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

- 80

- 1

- 2

- 3

- 4

- 5

Youre about to make a terrible mistake : how biases distort decision-making -- and what you can do to fight them: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Youre about to make a terrible mistake : how biases distort decision-making -- and what you can do to fight them" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Olivier Sibony: author's other books

Who wrote Youre about to make a terrible mistake : how biases distort decision-making -- and what you can do to fight them? Find out the surname, the name of the author of the book and a list of all author's works by series.

Youre about to make a terrible mistake : how biases distort decision-making -- and what you can do to fight them — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Youre about to make a terrible mistake : how biases distort decision-making -- and what you can do to fight them" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Copyright 2019 by Olivier Sibony

Translation copyright 2020 by Little, Brown Spark

Cover design by Julianna Lee

Cover art by Getty Images

Author photograph by ALRS

Cover 2020 Hachette Book Group, Inc.

Hachette Book Group supports the right to free expression and the value of copyright. The purpose of copyright is to encourage writers and artists to produce the creative works that enrich our culture.

The scanning, uploading, and distribution of this book without permission is a theft of the authors intellectual property. If you would like permission to use material from the book (other than for review purposes), please contact permissions@hbgusa.com. Thank you for your support of the authors rights.

Little, Brown Spark

Hachette Book Group

1290 Avenue of the Americas, New York, NY 10104

littlebrownspark.com

twitter.com/lbsparkbooks

facebook.com/littlebrownspark

First North American Edition: July 2020

Originally published in France as Rapprendre Dcider in 2014 by Dbats Publics. Translated from the 2019 edition, published by Flammarion.

Little Brown Spark is an imprint of Little, Brown and Company, a division of Hachette Book Group, Inc. The Little, Brown Spark name and logo are trademarks of Hachette Book Group, Inc.

The publisher is not responsible for websites (or their content) that are not owned by the publisher.

The Hachette Speakers Bureau provides a wide range of authors for speaking events. To find out more, go to hachettespeakersbureau.com or call (866) 376-6591.

ISBN 978-0-316-49497-7

E3-20200618-DA-NF-ORI

For Anne-Lise

Explore book giveaways, sneak peeks, deals, and more.

Tap here to learn more.

Youre About to Make a Terrible Mistake

(Unless You Read On)

Unless youve been living in a cave for at least a decade, you have heard about cognitive biases. Particularly since the publication of Daniel Kahnemans Thinking, Fast and Slow, terms like overconfidence, confirmation bias, status quo bias, and anchoring have become part of daily conversations at the water cooler. Thanks to decades of research by cognitive psychologists and the behavioral economists they inspired, we are now familiar with a simple but crucially important idea: when we make judgments and choicesabout what to buy, how to save, and so onwe are not always rational. Or at least not rational in the narrow sense of economic theory, in which our decisions are supposed to optimize for some preexisting set of goals.

This is true, too, of business decisions. Just type biases in business decisions into your favorite search engine, and many millions of articles will confirm what experienced managers know: when executives make business decisions (even important strategic ones), their thought process does not remotely resemble the rational, thoughtful, analytical approach described in business textbooks.

My own discovery of this fact took place long before Id heard of behavioral science, when I was a young business analyst freshly hired by McKinsey & Company. The first client I was assigned to work with was a midsize European company contemplating a large acquisition in the United States. The deal, if it went through, would more than double the size of the company and transform it into a global group. Yet after we spent several months researching and analyzing the opportunity, the answer was clear: the acquisition did not make sense. The strategic and operational benefits expected from the merger were limited. The integration would be challenging. Most importantly, the numbers did not add up: the price our client would have to pay was far too high for the acquisition to have any chance of creating value for his shareholders.

We presented our findings to the CEO. He did not disagree with any of our assumptions. Yet he dismissed our conclusion with an argument we had not anticipated. By modeling the acquisition price in U.S. dollars, he explained, we had missed a key consideration. Unlike us, when he thought about the deal, he converted all the numbers into his home currency. Furthermore, he was certain that the U.S. dollar would soon appreciate against that currency. When converted, the dollar-based cash flows from the newly acquired American company would be higher, and easily justify the acquisition price. The CEO was so sure of this that he planned to finance the acquisition with debt denominated in his home currency.

I was incredulous. Like everyone else in the room (including the CEO himself), I knew that this was the financial equivalent of committing one crime to cover up another. Finance 101 had taught me that CEOs are not foreign exchange traders, and that shareholders do not expect companies to take bets on currencies on their behalf. And this was a gamble: no one could know for sure which way exchange rates would move in the future. If, instead of appreciating, the dollar kept falling, the deal would go from bad to horrible. That was why, as a matter of policy, a large dollar-based asset should be evaluated (and financed) in dollars.

To a starry-eyed twentysomething, this was a shock. I had expected thorough analysis, careful consideration of multiple options, thoughtful debate, quantification of various scenarios. And here I was, watching a CEO who basically trusted his gut instinct and not much else knowingly take an unjustifiable risk.

Of course, many of my colleagues were more jaded. Their interpretations divided them into two camps. Most just shrugged and explained (albeit in more tactful terms) that the CEO was a raving lunatic. Wait and see, they saidhe wont last. The others offered a diametrically opposite explanation: the man was a genius who could formulate strategic visions and perceive opportunities well beyond what we consultants were able to comprehend. His disregard for our myopic, bean-counting analytics was proof of his superior insight. Wait and see, they saidhell be proven right.

I did not find either explanation particularly satisfactory. If he was crazy, why was he the CEO? And if he was a genius, gifted with powers of strategic divination, why did he need to ask us to apply our inferior methods, only to ignore our conclusions?

Principle of Strategy

The passage of time brought some answers. This CEO was certainly not a madman: before this deal, and even more so after it, he was regarded in his home country as one of the most respected business leaders of his generation.

He was also astoundingly successful. The acquisition turned out to be a great success (yes, the dollar did rise). Several big bets later, many of them equally risky, he had turned a near-bankrupt provincial company into a global industry leader. See, some of my colleagues might have said, he was a genius after all!

If only it were that simple. During the following twenty-five years, as a consultant to CEOs and senior executives in multinational companies, I had a chance to observe many more strategic decisions like this one. I soon realized that the sharp contrast between the textbook decision-making process and the reality of how choices were made was not a quirk of my first client. It was the norm.

But another, equally important conclusion struck me too: although some of these unorthodox decisions had a happy ending, most did not. Errors in strategic decision-making are not exceptional at all. If you doubt it, just ask the people who observe them most closely: in a survey of some two thousand executives, only 28 percent said their company generally makes good strategic decisions. The majority (60 percent) felt bad decisions were just as frequent as good ones.

Font size:

Interval:

Bookmark:

Similar books «Youre about to make a terrible mistake : how biases distort decision-making -- and what you can do to fight them»

Look at similar books to Youre about to make a terrible mistake : how biases distort decision-making -- and what you can do to fight them. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Youre about to make a terrible mistake : how biases distort decision-making -- and what you can do to fight them and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.