THE BASICS

OF UNDERSTANDING

FINANCIAL STATEMENTS

Learn how to read financial statements by understanding the balance sheets, the income statements, and cash flow statement

By

MARIUSZ SKONIECZNY

CLASSIC VALUE INVESTORS LLC

Copyright 2012 by Mariusz Skonieczny

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, or otherwise, without the written permission of the author. For permission requests, write to the author, addressed to Mariusz Skonieczny; P.O. Box 59313; Schaumburg, IL 60159-0313, USA.

Website: www.classicvalueinvestors.com

First printing 2012

Printed in the United States of America

15 14 13 12

Cover design by Lucie Allam

Website: www.graphi-co.com

Table of Contents

Financial Statements

Jelirozwiniesz swoje umiejtnoci inwestycyjne i jeli inwestujesz mdrze, to pozwoli Ci to w przyszoci y lepiej i zapewnisz sobie w ten sposb godn emerytur na przyszo. Niestety wikszo ludzi nie ma ochoty uczy si jak inwestowa swoje pienidze, wic dlatego ufaj na lepo tak zwanym profesionalistom, ktrzy s ubrani w drogie i eleganckie garnitury, s dobrze uczesani i piknie mwi. Drog, ktr wybierzesz, zaley wycznie od Ciebie.

It is unlikely that anyone would disagree that in order to understand the text above, one has to know the language in which it is written. Unfortunately, many investors do not transfer this logic to the field of investing. Many people choose to invest their entire life savings into stocks, yet they do not take the time to learn basic accounting, which is the language of business.

Managers of publicly traded companies communicate with shareholders about the successes and failures of their business endeavors through financial statements which include the balance sheet, the income statement, and the cash flow statement. The preparation of financial statements is guided by various accounting guidelines. When buyers and sellers of stocks are truly involved in buying and selling businesses, it is critical that they know how to read and understand financial statements so that they know what it is that they are buying or selling. The purpose of my other book, Why Are We So Clueless about the Stock Market, is to help investors build a basic investment foundation. It is targeted toward beginning and intermediate investors who might not have had much investment experience. This book, on the other hand, requires readers to know information covered in Why Are We So Clueless about the Stock Market . This book is intended to take investors to the next level by equipping them with the knowledge necessary to read financial statements.

This book is not intended to cover all the possible topics in accounting and financial statement preparation. Coverage of such a complex subject would require a work much broader in scope and much more voluminous than this primer. However, investors do not need to become professional accountants in order to have the skills necessary to make competent investment decisions what is necessary is a basic understanding of accounting. The ability to understand basic accounting in order to read financial statements is just another tool in the toolbox for wise investors. It does not guarantee investment success; however, its lack almost certainly guarantees failure.

Balance Sheet

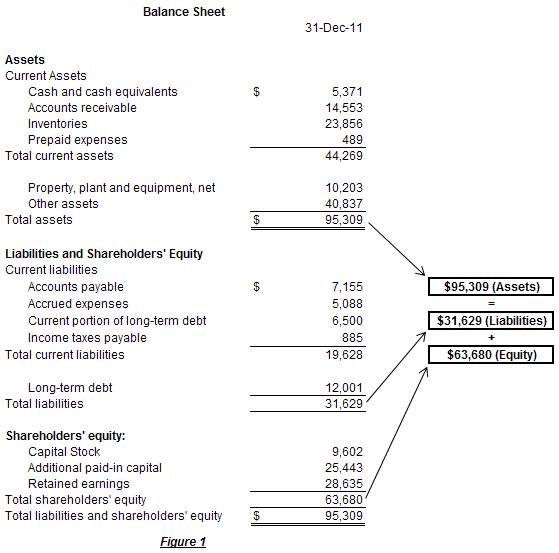

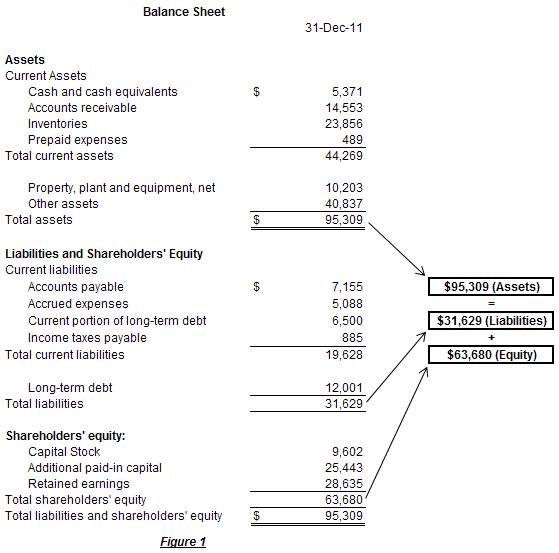

The balance sheet is a financial statement that shows what a company owns, how much it owes, and what is left for the shareholders in the form of equity. This same approach can be taken by homeowners who own an asset called a home. In this case, they might owe 90 percent of the value to the bank, while the remaining 10 percent represents equity. The balance sheet shows the companys financial position on a particular day, such as March 31 for the end of first quarter or December 31 for the end of the year. The balance sheet can be thought of as a photograph of the companys financial situation at a particular point of time. Its preparation is based on the most important accounting equation:

ASSETS = LIABILITIES + EQUITY

The reason this financial statement is called a balance sheet is due to the fact that the accounting equation has to balance all the time. It means that assets must always be equal to liabilities plus equity. This makes sense even at an individuals level because all possessions (assets) are either owned free and clear (equity) or purchased by acquiring debt (liabilities). A home buyers down payment is an example of equity, while the mortgage is an example of debt.

Figure 1 shows an example of a balance sheet and the concept of how assets ($95,309) equal liabilities ($31,629) plus equity ($63,680).

ASSETS

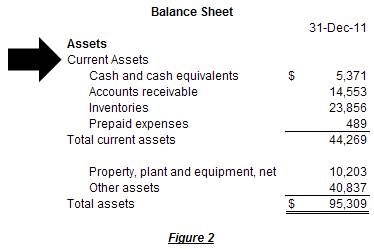

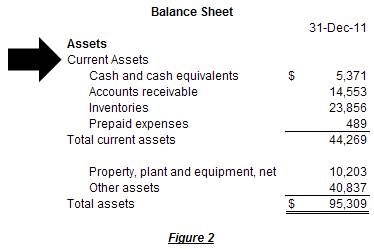

Assets represent tangible items that the company owns such as cash, inventory, machinery, and intangible items such patents, copyrights, franchises, trademarks, and goodwill. Assets are classified into current assets; property, plant and equipment (PP&E); and other assets.

CURRENT ASSETS

Current assets, which consist of cash and cash equivalents, accounts receivable, inventory, and prepaid expenses, are called current because they are expected to be either converted into cash or their benefit received (in the case of prepaid expenses) within 12 months. These items are listed according to their liquidity, meaning that the most liquid assets, such as cash, are listed first.

Current assets are part of the current asset cycle, and are also called working assets because a certain amount of cash is constantly being spent on inventory and is turned back into cash after customers pay for a companys products or services.

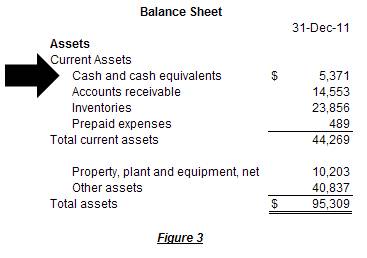

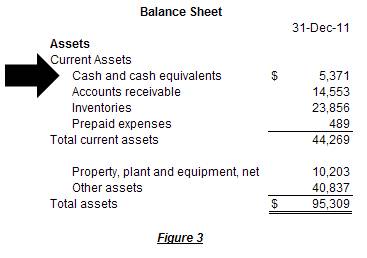

CASH AND CASH EQUIVALENTS

Cash represents coins, paper bills, and on-demand bank deposits. Cash equivalents represent highly liquid, very safe, and short-term investments such as certificates of deposits, Treasury bills, and money market funds.

A good way to analyze cash and cash equivalents is to compare them to total assets from quarter to quarter and year to year. For example, if every year for the past 10 years, cash and cash equivalents constituted 5 to 7 percent of total assets and this percentage jumps to 20 percent, this incident should be investigated more closely. Such a jump may be positive or negative, depending on where the cash came from. If the cash came from the companys operations, indicated by a sudden increase in retained earnings, which will be discussed later, this could mean that the company became more profitable. If the cash increase was a result of the company selling one of its properties, taking on more debt, or issuing more shares, it may not be good for shareholders because fewer properties may translate into a reduced ability to generate revenue in the future, more debt will increase interest payments, and more outstanding shares will dilute the interests of current shareholders.

Next page