Richard Mansfield - Clean Up Your Credit!: A Black Ops Guide to Credit Repair and Restoration

Here you can read online Richard Mansfield - Clean Up Your Credit!: A Black Ops Guide to Credit Repair and Restoration full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2022, publisher: Lyons Press, genre: Romance novel. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Clean Up Your Credit!: A Black Ops Guide to Credit Repair and Restoration

- Author:

- Publisher:Lyons Press

- Genre:

- Year:2022

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

Clean Up Your Credit!: A Black Ops Guide to Credit Repair and Restoration: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Clean Up Your Credit!: A Black Ops Guide to Credit Repair and Restoration" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

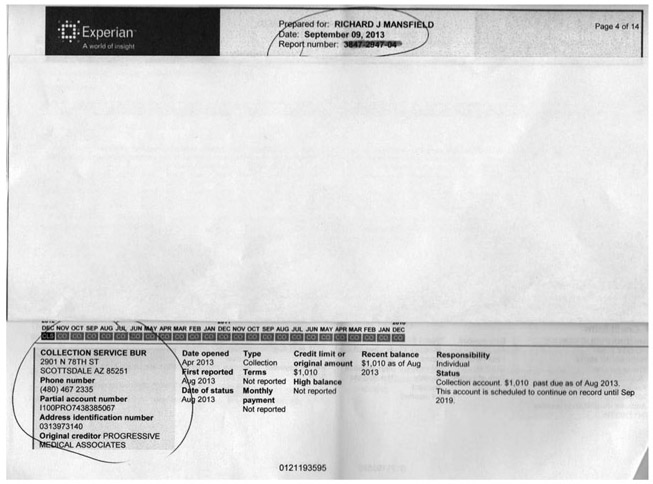

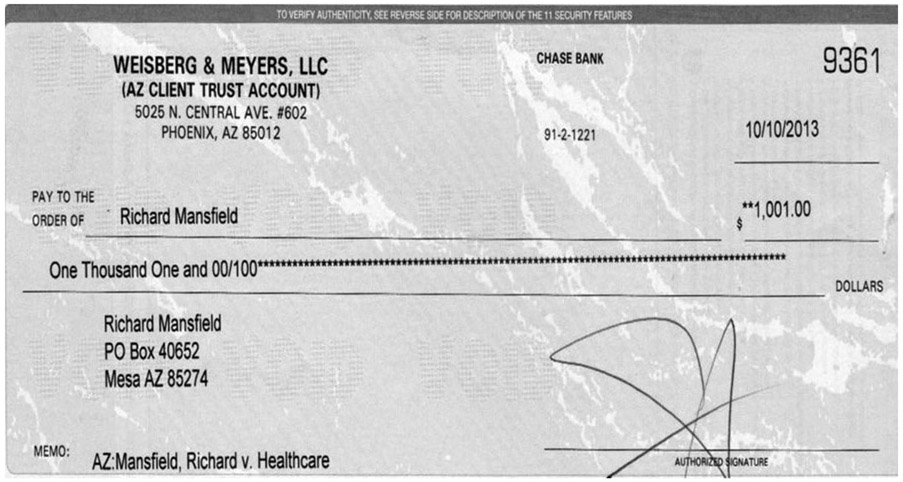

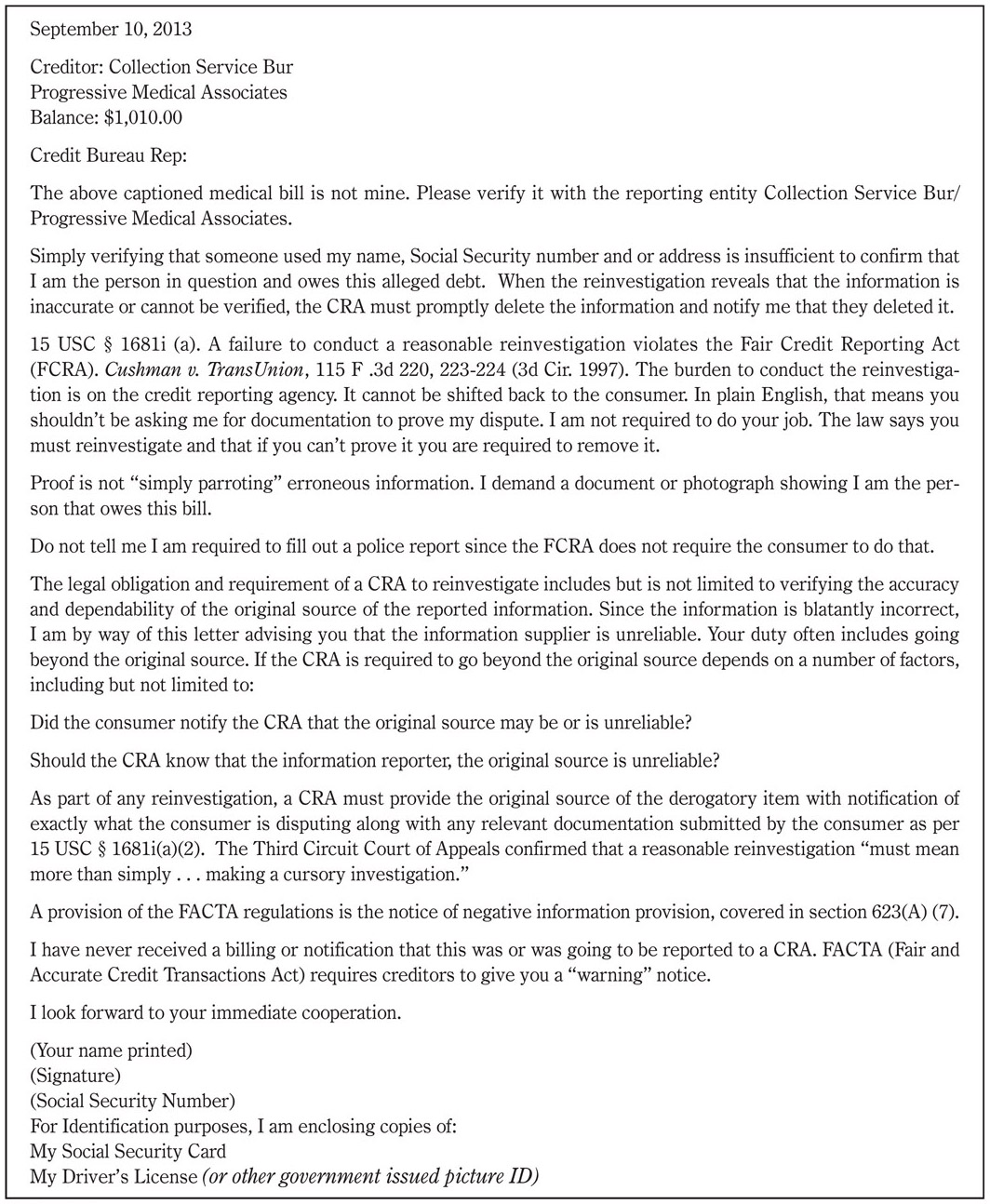

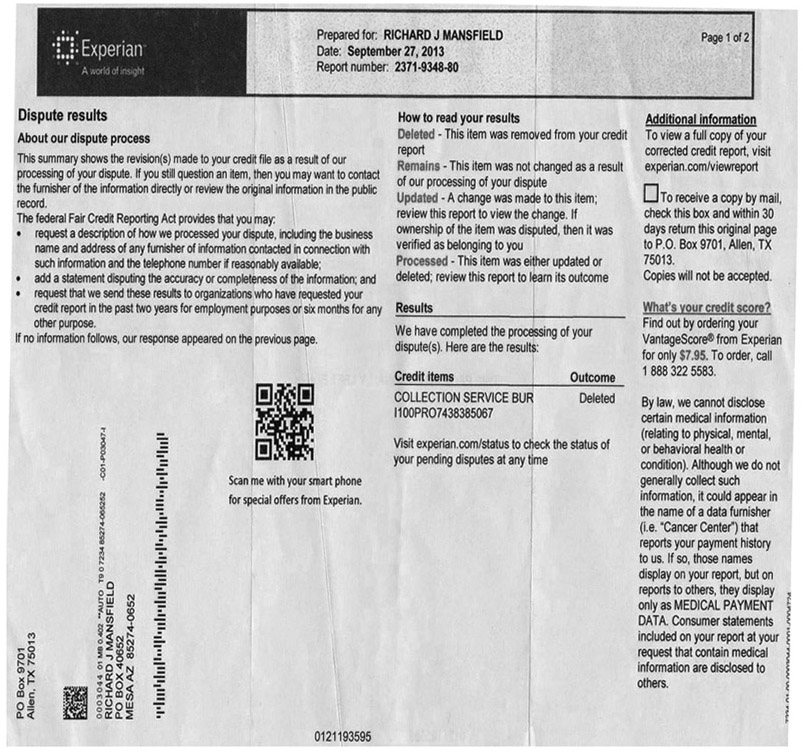

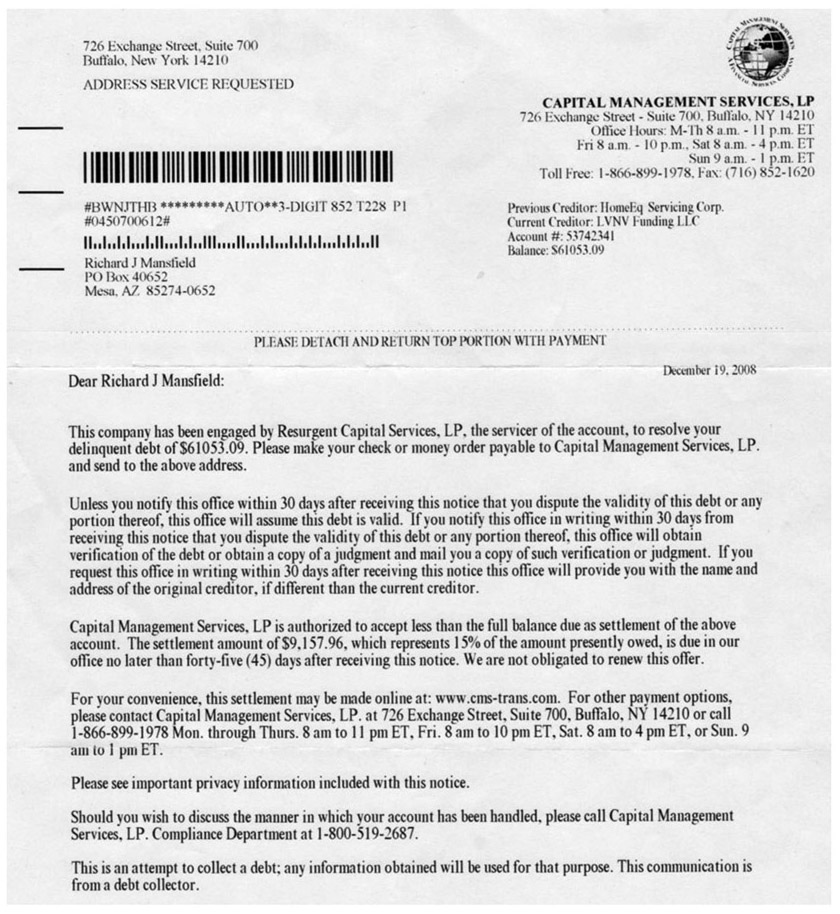

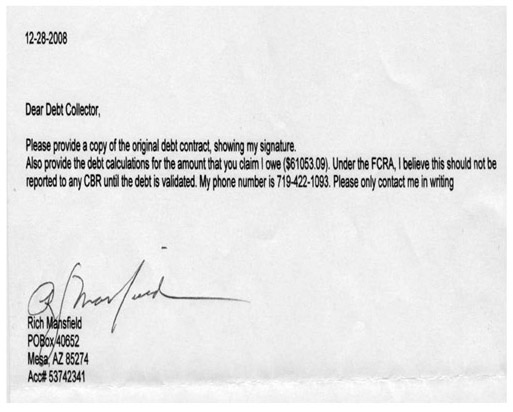

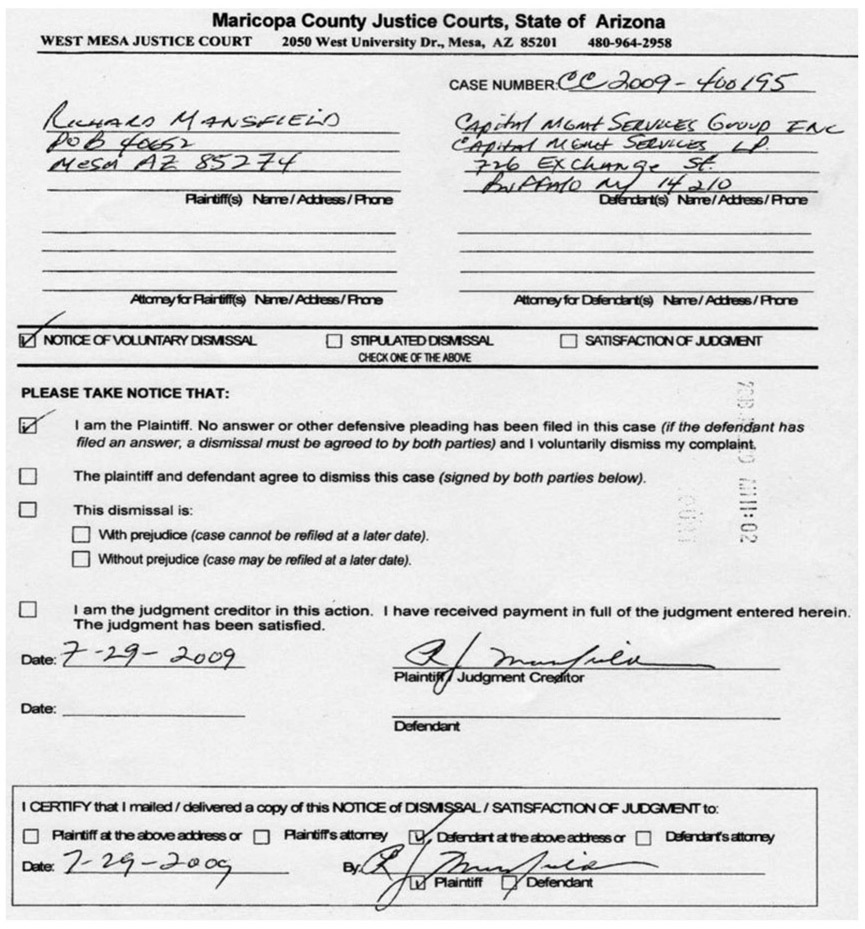

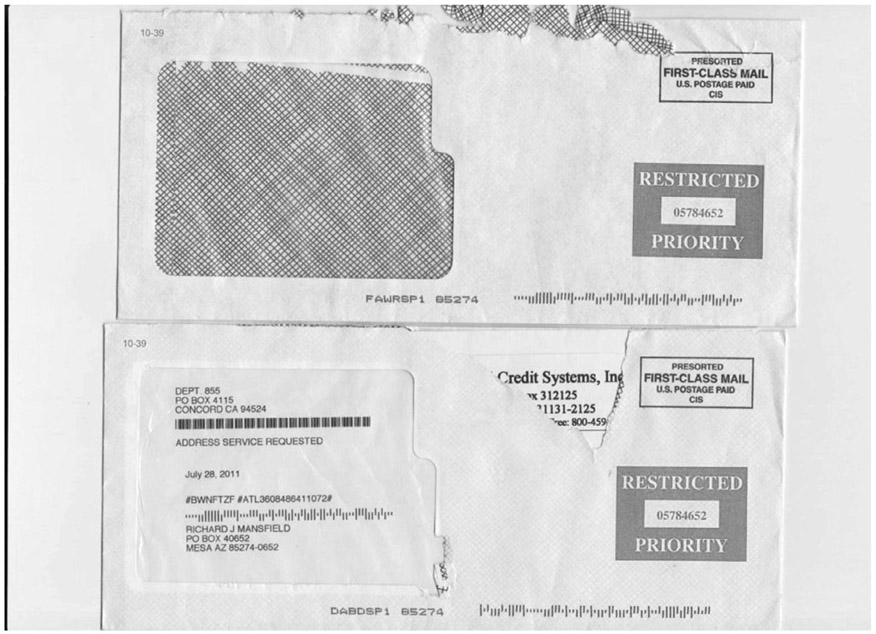

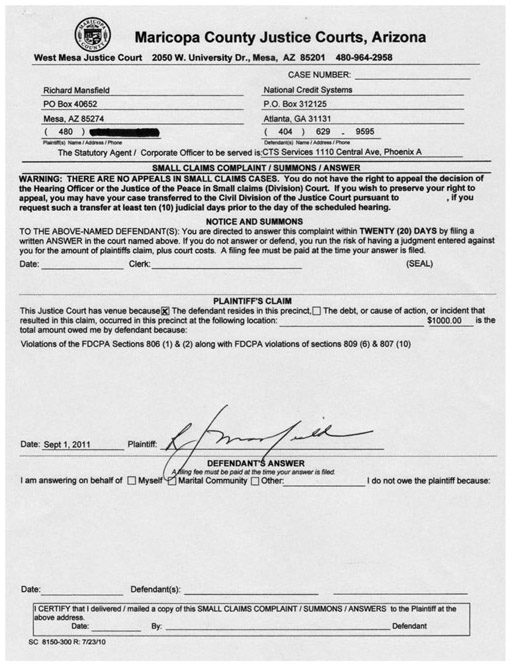

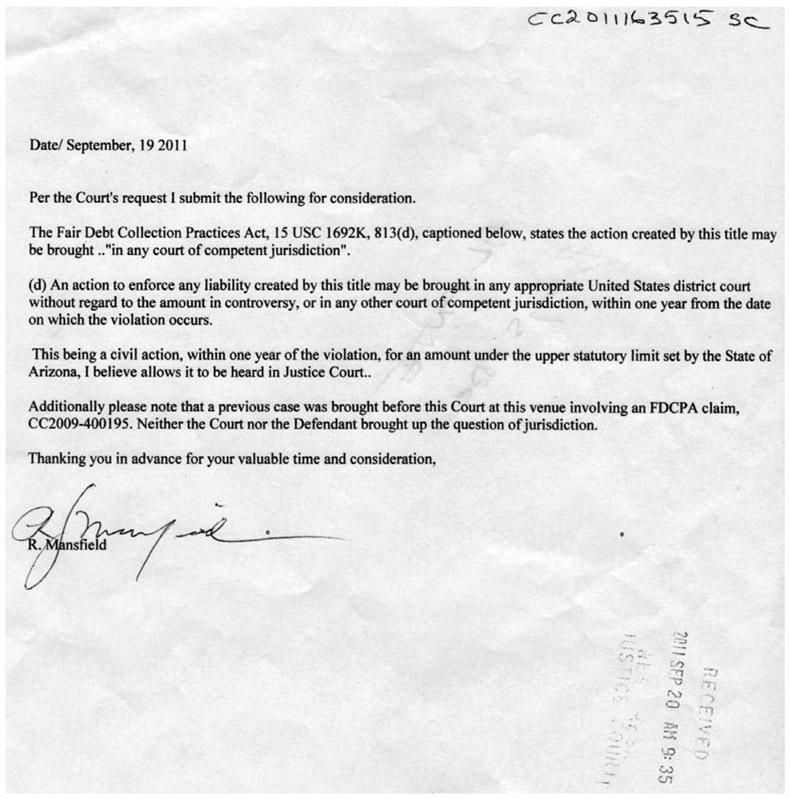

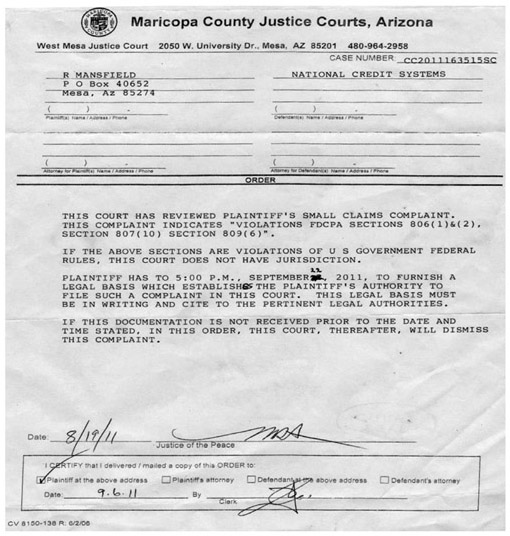

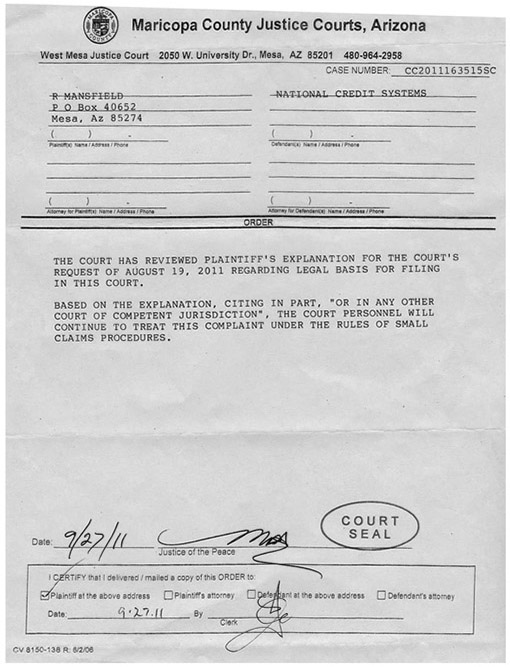

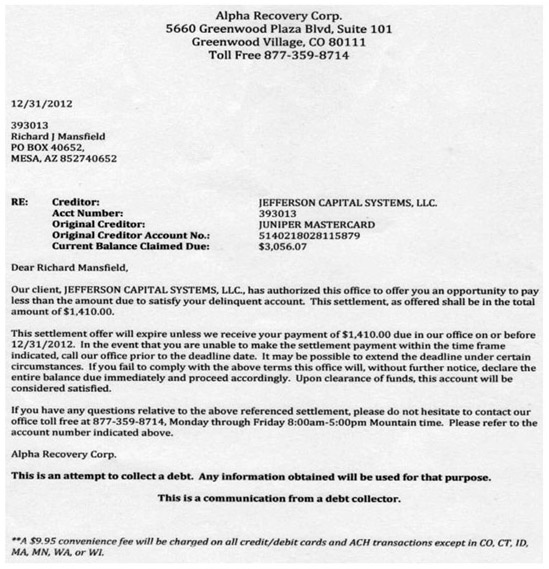

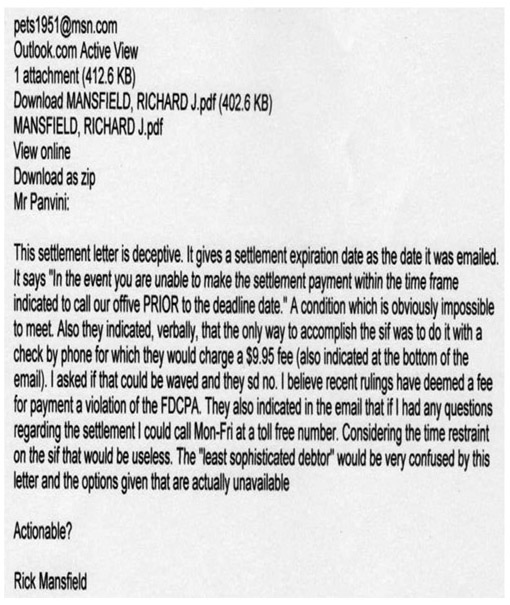

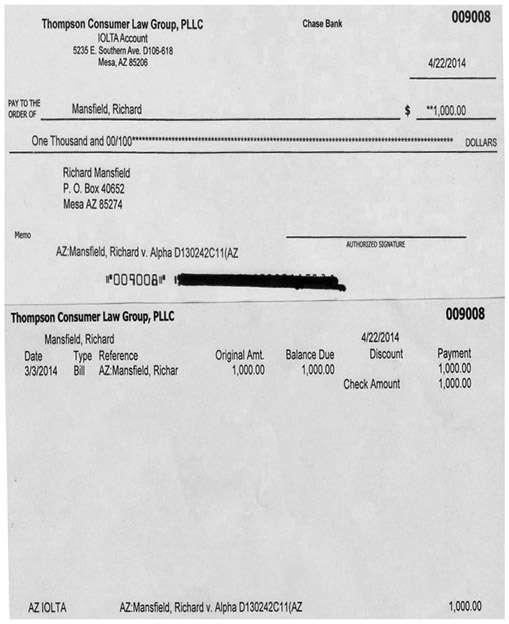

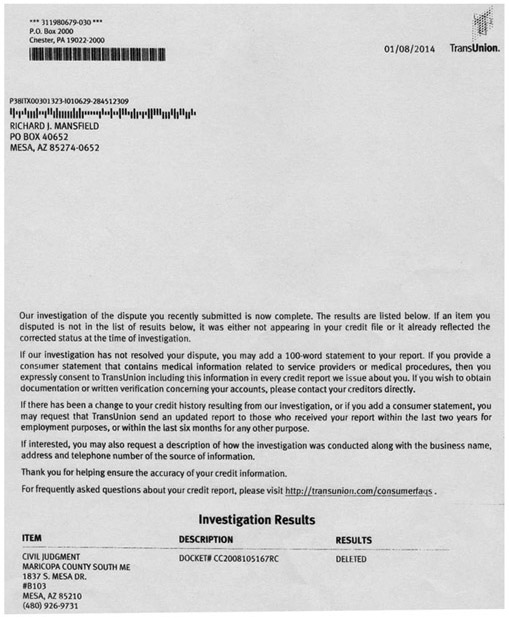

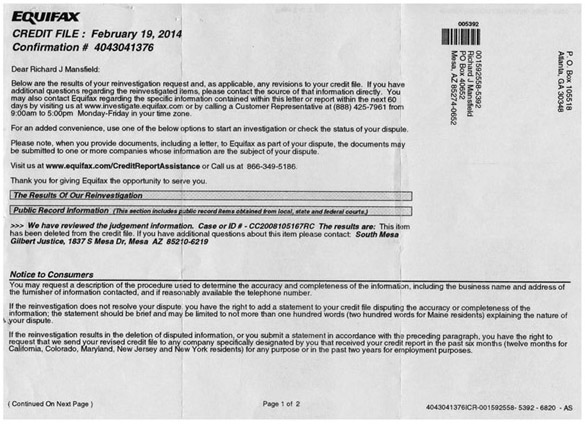

Bad things happen to good people. Events not always under our control can often result in our credit scores going down, and sometimes way, way down. There are consumer protection laws that you can use to remove negative items from your credit report,. Because of a quirk in the law you can, as the author did, remove items that really are yours. But if you try to go it alone, the credit repair journey can be a nightmare. This book introduces a step-by-step credit repair system, actulal documents the author used to settle suits, and legal cases filed in federal courts against major credit bureaus. These are the credit repair secrets they really dont want to you to know, from someone who successfully challenged the credit reporting industry. Contrary to what you may believe, there is a way to improve your credit score substantially, and this book will help you get there.The author was a vice president at Guardian Bank in charge of the collection department and went on to start a collection agency. After selling the agency he became a credit restoration coach. To prove what he knew in theory could in fact be done, he stopped paying everything: repossession, foreclosure, medical bills, student loans, and credit cards. He even filed for bankruptcy. His credit score went from over 800 down to 461. He had it back to 742 in five months. Mr. Mansfield walks you through every step of the credit restoration process. As a bonus, when you purchase the book theres information on how to contact Mr. Mansfield directly! There is no other credit restoration book like this.

Richard Mansfield: author's other books

Who wrote Clean Up Your Credit!: A Black Ops Guide to Credit Repair and Restoration? Find out the surname, the name of the author of the book and a list of all author's works by series.