It wasnt until I started researching the material for this book that I realized how many people have been or will be affected by poor credit. Over 1.7 million people will file for bankruptcy in this country alone, and there are millions more whose credit has been damaged to one degree or another. I myself am one of the millions who have been affected by damaged credit. Prior to writing this book, I spent three years as financial manager for a large automobile franchise looking at thousands of credit reports to determine if a customer qualified for a loan. I would say, without hesitation, over ninety percent of the credit reports I looked at were damaged to some degree by negative credit. The final determinant that drove me to create this resource was the people. Looking at a piece of paper is one thing; however, meeting face-to-face with the person(s) whose credit has been decimated is another. Time after time, customers would ask me to help them fix their credit, and all I could do was tell them to be responsible and pay their bills. Responding in that manner may sound callous; however, it was all I really knew. In time I realized it wasnt always due to irresponsibility that a persons credit was damaged. Sometimes life just takes an unfortunate turn, and among other areas in life, ones credit suffers. After having this paradigm shift, I knew there was a way I could help, and I knew people wanted to be helped. I have written this book to assist people in getting back on their feet as responsible credit consumers. I hope that the information in this book will point you in the direction of achieving stronger credit and a better way of living.

Chapter 1

Welcome

ITS YOUR CREDIT

One of the most important things to remember regarding credit problems is that youre not alone. Millions of good, hard-working people all around the country are currently having or have had problems with their credit. However, your awareness of the importance of having good credit has put you one step closer to actually achieving a good credit rating and improving your quality of living.

Even though your credit rating may seem like an intangible asset, it is one of the most valuable and important assets that you have. Without a good credit rating your financial, occupational, and personal goals are at risk of being severely limited. In order to obtain the privilege of using a credit card, your credit rating is checked. If a company determines your credit to be unsatisfactory, you will be denied. From the moment you are denied, your quality of living is impeded. If you cant get a credit card, you cant rent a car, order tickets, or even rent a video. Because your credit rating was determined to be unsatisfactory, most companies will not let you use their money.

Today more than ever, many businesses perform routine background checks during the hiring process. Once again, if your credit rating reveals something of concern to them, you can be turned away for employment. Since maintaining a good credit rating is important in todays society, a poor credit rating can have a negative snowball effect toward your personal goals. Good, strong credit allows you to live with financial security and enables you to purchase items without depleting your life savings.

Repairing your credit can seem like a monumental task; however, it can also be as easy as writing a letter or making a phone call. Your decision to repair your credit rating will benefit you for the rest of your life. The more time you invest now toward strengthening your credit rating, the better your quality of life will be.

WHAT INFORMATION DOES THIS BOOK CONTAIN?

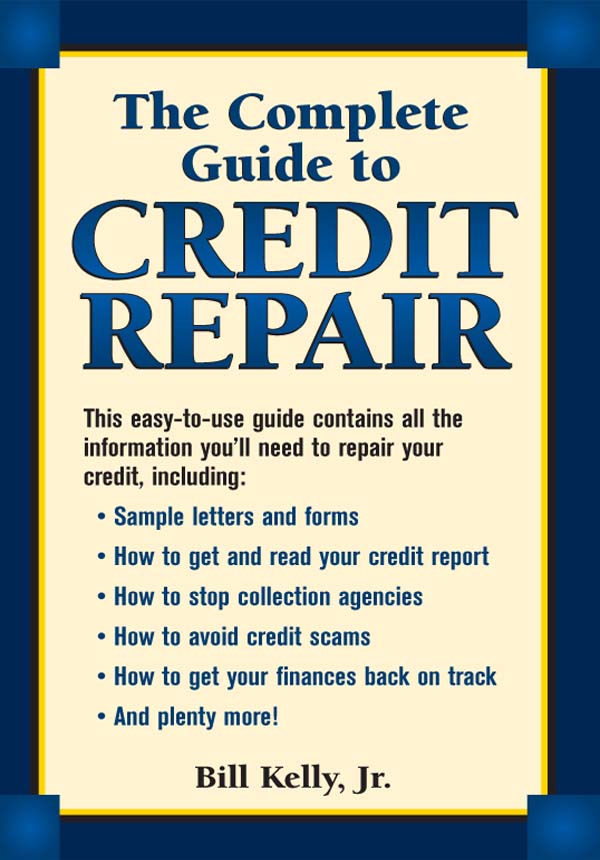

The Complete Guide to Credit Repair has been written to assist you in repairing and strengthening your credit rating. This guide provides you with step-by-step instructions, explanations, situations, details, testimony, inserts, and prewritten letters that will help you repair and strengthen your credit rating. After reading this guide, you will have a good understanding of the following items:

- How credit works and how it affects you

- How credit agencies operate

- How to establish your credit report

- What lenders are looking for

- How to read a credit report and how to get a copy of your report

- What credit problems can arise

- How to determine your credit problems

- How to strengthen your credit rating

- How to write letters, and where to send those letters

- How to follow through on what you start

HOW TO GET STARTED

Once you finish reading the material, you will begin the process of repairing and strengthening your credit. Before beginning the process, you must follow some important procedures in order to keep your information well organized. Following this set of procedures will help develop your organization skills, along with increasing your chances of strengthening your credit. The next section will detail these procedures.

HOW TO STAY ORGANIZED

- Write your goalswhat you plan to achieveon the insert provided. Creating goals will help you stay focused on an end result and expedite the strengthening process ().

- Retrieve all of your old financial records. The more records you can find, the better your chances of providing vital background information when necessary.

- Save all of your current financial records, especially the major records (e.g., billing statements, cancelled checks, and receipts). Use a typewriter or a computer when creating letters. (If you do not have access to a typewriter or a computer, you can print the letters in black ink.)

- If you have access to a computer, save all of the letters you create on a disk.

- Make photocopies of your financial records and any documents you send.

- Clearly state the terms and conditions on any agreements, whether oral or written. Anything that you and the creditor or credit agency agree upon must be put in writing and signed, with both parties receiving copies.

- Send all letters by certified mail. Certified mail enables you to obtain a receipt. Keeping records of your transactions is important.

- When sending any type of payment, always pay by check or money order. Using a check or money order allows you to have an instant receipt of your payment.

HOW TO USE THE SAMPLE LETTERS

The Complete Guide to Credit Repair provides you with 67 letters that have been prepared to get results and to save you time and money. Each letter has been carefully written to coincide with its corresponding section or topic (e.g., Letter #1 coincides with getting a free, yearly copy of your credit report).

After you have finished reading a section, a letter will be assigned for you to use, if applicable. Be sure you use the letter that corresponds with the section you are working on. Do not interchange letters unless otherwise instructed.

The letters are presented in three separate appendices, according to the order in which the letters will be sent. shows how the three categories are broken down and where each letter can be found, according to its number. Reproduce the letters using your computer. When reproducing the letter, you should quote word for word, only changing the personal information.