First published 1999 by Ashgate Publishing

Reissued 2018 by Routledge

2 Park Square, Milton Park, Abingdon, Oxon, OX14 4RN

711 Third Avenue, New York, NY 10017, USA

Routledge is an imprint of the Taylor & Francis Group, an informa business

Copyright Simon S. Gao 1999

All rights reserved. No part of this book may be reprinted or reproduced or utilised in any form or by any electronic, mechanical, or other means, now known or hereafter invented, including photocopying and recording, or in any information storage or retrieval system, without permission in writing from the publishers.

Notice:

Product or corporate names may be trademarks or registered trademarks, and are used only for identification and explanation without intent to infringe.

Publisher's Note

The publisher has gone to great lengths to ensure the quality of this reprint but points out that some imperfections in the original copies may be apparent.

Disclaimer

The publisher has made every effort to trace copyright holders and welcomes correspondence from those they have been unable to contact.

A Library of Congress record exists under LC control number: 99073322

ISBN 13: 978-1-138-31898-4 (hbk)

ISBN 13: 978-1-138-31905-9 (pbk)

ISBN 13: 978-0-429-45185-0 (ebk)

This book could not have been finished without the help of many people. I would like to thank Professor Dr. A.C.C. Herst and Professor Dr. M.A. van Hoepen RA for getting me started on this complex topic 'International Leasing' and for their encouragement through the years when I was their doctoral student at Erasmus University from 1987 to 1992. I would also like to thank Prof. Drs. W. Siddr, Prof. Dr. J. Spronk, Dr. W.M.L. van Bueren, Prof. H. Lunt, Prof. J. Blake, Prof. Dr. H. Peer, Dr. A.W.A. Joosen, and Drs. Frans den Adel for their comments and contribution to my PhD thesis, which forms some parts of this book.

Acknowledgements are also due to the Department of Risk and Financial Services of Glasgow Caledonian University, where I spent four years when this book was written, for providing me with various supports in terms of facilities and attending conferences and seminars.

Last but not least, special thanks to ray wife Jane who has helped me persevere in the challenges of scholarly research.

The fancy of leasing is as old as mankind. The applications of this fancy have naturally varied remarkably, based on social, legal, economic, fiscal, financial and technical circumstances prevailing in the respective civilisation and period of time. Leasing has its origins in ancient civilisations that used leasing arrangements for agricultural tools, shipping and real estate. The earliest record of leasing occurred in about 2010 B.C. Those leases involved rentals of agricultural tools to farmers by the priests who were, in effect, the government officials. Land leasing has then been more common, but equipment leasing can be traced to the 1800s.

The dynamic nature of the modern leasing industry began in the 1950s in the USA when tax incentives for investment were created. In May 1952, Henry Schoenfield set up a separate corporation in the USA to handle one particular type of leasing transactions. He soon gained the confidence that leasing could be overlooked as a useful financing tool for business and decided to develop and market this technique. The company he founded with a capital of US$20,000, called the United States Leasing Corporation (now United States Leasing International, Inc.), was the first independent corporation to engage in the business of equipment leasing in the USA and still is one of the largest American leasing companies.

Globally, the development of leasing accelerated in the 1960s and the 1970s in west Europe, in the 1980s in Asian and Latin American countries, varying based on the circumstance of an individual country. Expansion was primarily marked by the emergence of leasing companies to offer financing to companies within their own countries. The modern leasing industry has developed progressively since the 1960s.

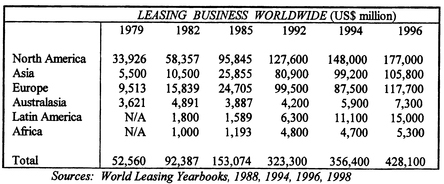

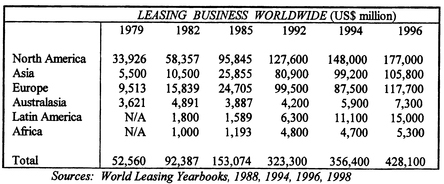

Internationalisation is by now a well established fact in the world of business and finance. One of the most attractive new fields in modern finance and business is leasing. Leasing has grown enormously over the past decade: the volume level of world leasing has increased from US$63.6 billion in 1980 to US$428.08 billion in 1996 (World-Leasing-Yearbook 1998, p.2).

Leasing business worldwide

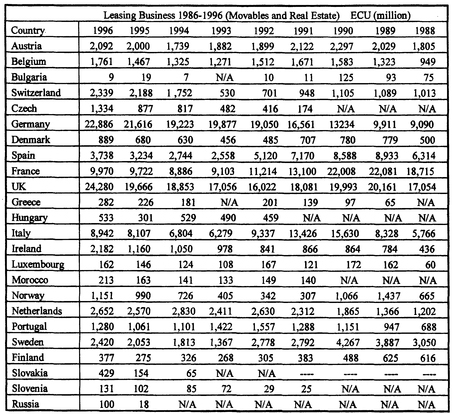

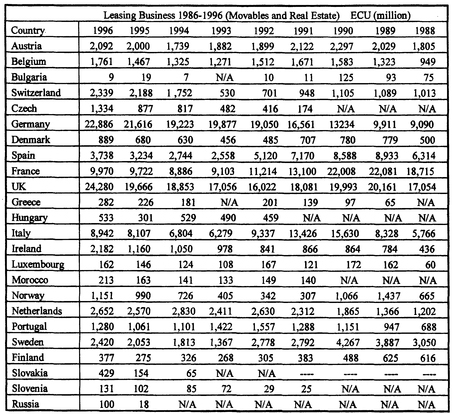

During the past 35 years leasing in Western Europe has grown at a faster rate than any other form of finance. New business of leased movable equipment recorded by the members of the European Federation of Leasing

Leasing business of movables and real estate in the Leaseurope

markets, particularly equipment and aircraft markets. Over 50 per cent of the commercial aircraft coming into services today in Europe are leased, and smaller airlines lease an even higher percentage of their planes. In the United States, the figure is over 75 per cent.

In the UK, according to the Finance & Leasing Association (which represented about 90 per cent of the UK leasing industry), assets to the value of 19,757 million at cost were acquired for leases by its members in 1996, an increase of 21.16% from 1995, which represents over 30% of all UK fixed investment in plant and equipment. In the Netherlands, the Dutch leasing market is characterised by the strong development of operating leasing in the vehicle and computer sectors. In 1996, businesses in equipment leasing reached 2,641 million ECU. In the USA, equipment lease financing reached US$168.9 billion in 1996. In Japan, despite the difficult trading conditions for many of the financial sectors resulted from the Asian financial crisis, the volume of lease contracts increased 8.7% from 1995 to US$71.4 billion in 1996. For the development of leasing in other countries, see World Leasing Yearbook 1998.

The popularity of leasing is increasing rapidly not only in developed countries, but also in developing economies such as Brazil, China, Greece, Indonesia, Mexico, Pakistan, the Philippines, Thailand, Turkey and some African countries. Over 55 developing countries have their own leasing industries (Porter 1997). In these countries, many leasing companies have been established to modernise their credit systems and promote capital investments. Leasing activity in Asia, Latin America and Africa has remained high with enormous growth. The leasing market size of emerging countries grew by 22.2% per year from 1988 to 1995 and reached US$61 billion in 1995 (World Leasing Yearbook 1998). The share of private investment through leasing more than doubled between 1988 and 1995 with leasing accounting for 4% of asset financing in Asia and Latin America in 1988 to an average of 11% in 1995 (World leasing Yearbook 1998).