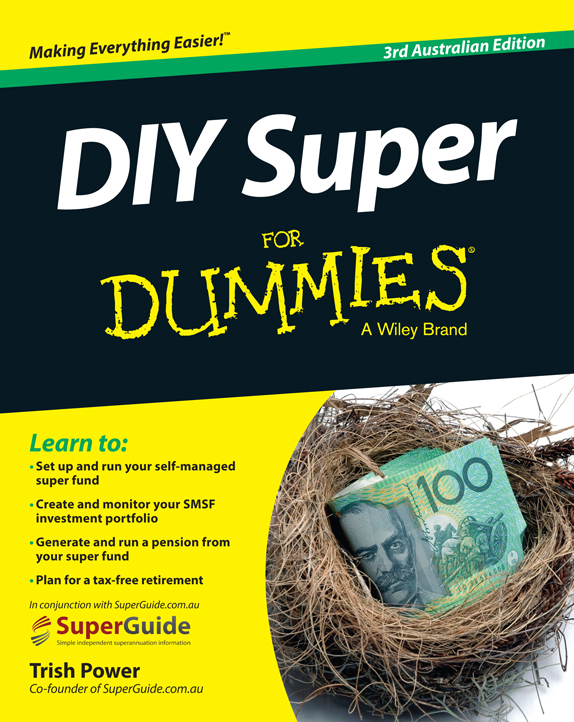

DIY Super For Dummies

3rd Australian Edition Published by

Wiley Publishing Australia Pty Ltd

42 McDougall Street

Milton, Qld 4064

www.dummies.com

Copyright 2015 Wiley Publishing Australia Pty Ltd

The moral rights of the author have been asserted.

National Library of Australia

Cataloguing-in-Publication data:

| Author: | Power, Trish, author. |

| Title: | DIY Super For Dummies / Trish Power. |

| Edition: | 3rd Australian edition. |

| ISBN: | 9780730315346 (pbk.) |

| 9780730315353 (ebook) |

| Series: | For Dummies. |

| Notes: | Includes index. |

| Subjects: | Pensions Australia. |

| Retirement income Australia. |

| Retirement Planning. |

| Finance, Personal Australia. |

| Investments Australia. |

| Dewey Number: | 331.2520994 |

All rights reserved. No part of this book, including interior design, cover design and icons, may be reproduced or transmitted in any form, by any means (electronic, photocopying, recording or otherwise) without the prior written permission of the Publisher. Requests to the Publisher for permission should be addressed to the Legal Services section of John Wiley & Sons Australia, Ltd, Level 2, 155 Cremorne Street, Richmond, Vic 3151, or email .

Cover image: iStock.com/pamspix

Typeset by diacriTech, Chennai, India

Printed in Singapore by

C.O.S. Printers Pte Ltd

10 9 8 7 6 5 4 3 2 1

Limit of Liability/Disclaimer of Warranty: THE PUBLISHER AND THE AUTHOR MAKE NO REPRESENTATIONS OR WARRANTIES WITH RESPECT TO THE ACCURACY OR COMPLETENESS OF THE CONTENTS OF THIS WORK AND SPECIFICALLY DISCLAIM ALL WARRANTIES, INCLUDING WITHOUT LIMITATION, WARRANTIES OF FITNESS FOR A PARTICULAR PURPOSE. NO WARRANTY MAY BE CREATED OR EXTENDED BY SALES OR PROMOTIONAL MATERIALS. THE ADVICE AND STRATEGIES CONTAINED HEREIN MAY NOT BE SUITABLE FOR EVERY SITUATION. THIS WORK IS SOLD WITH THE UNDERSTANDING THAT THE PUBLISHER IS NOT ENGAGED IN RENDERING LEGAL, ACCOUNTING, OR OTHER PROFESSIONAL SERVICES. IF PROFESSIONAL ASSISTANCE IS REQUIRED, THE SERVICES OF A COMPETENT PROFESSIONAL PERSON SHOULD BE SOUGHT. NEITHER THE PUBLISHER NOR THE AUTHOR SHALL BE LIABLE FOR DAMAGES ARISING HEREFROM. THE FACT THAT AN ORGANISATION OR WEBSITE IS REFERRED TO IN THIS WORK AS A CITATION AND/OR A POTENTIAL SOURCE OF FURTHER INFORMATION DOES NOT MEAN THAT THE AUTHOR OR THE PUBLISHER ENDORSES THE INFORMATION THE ORGANISATION OR WEBSITE MAY PROVIDE OR RECOMMENDATIONS IT MAY MAKE. FURTHER, READERS SHOULD BE AWARE THAT INTERNET WEBSITES LISTED IN THIS WORK MAY HAVE CHANGED OR DISAPPEARED BETWEEN WHEN THIS WORK WAS WRITTEN AND WHEN IT IS READ.

Trademarks: Wiley, the Wiley logo, For Dummies, the Dummies Man logo, A Reference for the Rest of Us!, The Dummies Way, Making Everything Easier, dummies.com and related trade dress are trademarks or registered trademarks of John Wiley & Sons, Inc. and/or its affiliates in the United States and other countries, and may not be used without written permission. All other trademarks are the property of their respective owners. Wiley Publishing Australia Pty Ltd is not associated with any product or vendor mentioned in this book.

Contents at a Glance

Introduction

T he past few years have been extraordinary in terms of economic downturns, volatile investment markets, and the ensuing bumpy ride endured by investors, including DIY super fund trustees.

Throughout this time, hundreds of thousands of DIY super fund trustees have been investing super money in these volatile markets, and continuing to look after the needs of fund members.

In June 2014, when I began work on DIY Super For Dummies, 3rd Australian Edition, the investment markets were rebounding from a torrid few years, although by the time I finished writing this book several months later, the investment markets were again a little bumpy.

More seriously, in mid-2007, when I first met my publisher to discuss writing the first edition of DIY Super For Dummies, the worlds investment markets were booming and Australia was enjoying an extended wave of economic growth. The super laws had just been changed to deliver tax-free super for over-60s and, as a result, the future was looking very bright indeed for Australias retirees.

In October 2008, less than 18 months later, when I actually started writing the first edition of DIY Super For Dummies, the worlds investment markets had imploded, and the international community was facing what has become known in Australia as the Global Financial Crisis GFC (I explain what happened during the GFC in ).

While in June 2011, when I began work on the second edition of DIY Super For Dummies, the worlds investment markets had still not fully recovered from the 2008 and 2009 GFC. Throughout 2010 and 2011, the international markets remained jittery about the precarious debt levels of Greece and other countries in Europe and the massive debt levels maintained by the United States.

Fortunately, the investment markets recovered during 2012 and 2013, and for most of 2014, although the investment ride became volatile again in late 2014.

Even when investment markets stagger and fall, or even stall for a couple of years, you still have to save for retirement and invest somewhere and in something. You can do this outside the superannuation system, if you wish; although due to the tax advantages available within super, the more likely scenario is that youre saving for your retirement via one of the large super funds or via a DIY super fund.

Despite the recent volatile markets (or, perhaps, because of these markets), Australians continue to embrace DIY super funds in significant numbers more than 32,000 DIY super funds were set up during the 201314 year. The number of DIY super funds in operation exceeds half a million, and the number of Australians running DIY super funds has already hit the 1 million mark.

About This Book

DIY Super For Dummies, 3rd Australian Edition, is a plain-English and practical resource for anyone running their own super fund, or considering running their own super fund.

Running your own fund can be an exhilarating ride but the twists and turns that you encounter along the way for example, the GFC, and the investment markets generally can sometimes be a challenge. Fortunately, youve come to the right place to find out how to face the challenge with confidence by getting the resources you need to be a successful DIY super fund trustee.

Written specifically for DIY super fund trustees, or prospective trustees, youll find that DIY Super For Dummies, 3rd Australian Edition, covers the most important super rules and tips you need to know about running your own fund.

DIY super is a specialist area within the super sector because it is a microcosm of the entire sector involving fund administration, compliance, investment management, tax management and retirement planning.

DIY Super for Dummies, 3rd Australian Edition, is a product of the most common questions and answers that I have been asked about DIY super, reinforced by a plain-English explanation of the super rules applying to DIY super funds.

You can delve into and read the sections that interest you. This book can help you run your DIY super fund, or help you decide whether a DIY super fund is suitable for you, including working out the costs of running a DIY super fund. And if a DIY super fund is right for you, this book then takes you through the steps you need to take to set up a DIY super fund, shows you how to run a DIY super fund, what you need to do to pay a super pension from your fund, and where to go for help. Investing your super monies and retirement planning are big deals, too.