Cover Design: Wiley

Cover image: turtleteeth/iStockphoto

Copyright 2016 by John Wiley & Sons, Inc. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, 978-750-8400, fax 978-750-4470, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, 201-748-6011, fax 201-748-6008, or online at http://www.wiley.com/go/permission.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable

for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services, or technical support, please contact our Customer Care Department within the United States at 800-762-2974, outside the United States at 317-572-3993 or fax 317-572-4002.

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may not be available in electronic books. For more information about Wiley products, visit our Web site at http://www.wiley.com.

ISBN: 978-1-119-12001-8 (paperback); 978-1-119-24089-1 (ebk); 978-1-119-24090-7 (ebk)

Preface

This publication is a comprehensive, yet simplified study program. It provides a review of all the basic skills and concepts tested on the CPA exam, and teaches important strategies to take

the exam faster and more accurately. This tool allows you to take control of the CPA exam.

This simplified and focused approach to studying for the CPA exam can be used:

- As a handy and convenient reference manual

- To solve exam questions

- To reinforce material being studied

Included is all of the information necessary to obtain a passing score on the CPA exam in a

concise and easy-to-use format. Due to the wide variety of information covered on the exam,

a number of techniques are included:

- Acronyms and mnemonics to help candidates learn and remember a variety of rules and checklists

- Formulas and equations that simplify complex calculations required on the exam

- Simplified outlines of key concepts without the details that encumber or distract from learning the essential elements

- Techniques that can be applied to problem solving or essay writing, such as preparing a multiple-step income statement, determining who will prevail in a legal conflict, or developing an audit program

- Pro forma statements, reports, and schedules that make it easy to prepare these items by simply filling in the blanks

- Proven techniques to help you become a smarter, sharper, and more accurate test taker

This publication may also be useful to university students enrolled in Intermediate, Advanced

and Cost Accounting; Auditing, Business Law, and Federal Income Tax classes; or Economics and Finance classes.

Good luck on the exam,

Ray Whittington, PhD, CPA

About the Author

Ray Whittington, PhD, CPA, CMA, CIA, is the dean of the Driehaus College of Business at DePaul University. Prior to joining the faculty at DePaul, Professor Whittington was the Director of Accountancy at San Diego State University. From 1989 through 1991, he was the Director of Auditing Research for the American Institute of Certified Public Accountants (AICPA), and he previously was on the audit staff of KPMG. He previously served as a member of the Auditing Standards Board of the AICPA and as a member of the Accounting and Review Services Committee and the Board of Regents of the Institute of Internal Auditors. Professor Whittington has published numerous textbooks, articles, monographs, and continuing education courses.

About the Contributor

Kurt Pany, PhD, CPA, is a Professor of Accounting at Arizona State University. His basic and advanced auditing courses provided the basis on which he received the Arizona Society of CP A s Excellence in Teaching Award and an Arizona CPA Foundation Award for Innovation in the Classroom for the integration of computer and professional ethics applications. His professional experience includes serving for four years on the AICPAs Auditing Standards Board, serving as an academic fellow in the Auditing Division of the AICPA, and prior to entering academe, working as a staff auditor for Deloitte and Touche.

PROFESSIONAL RESPONSIBILITIES

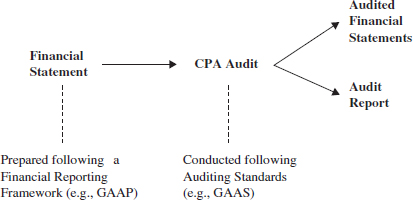

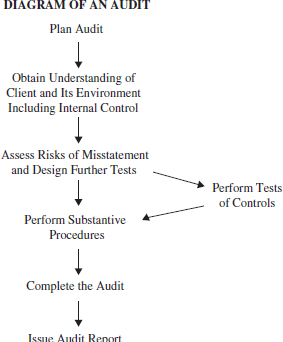

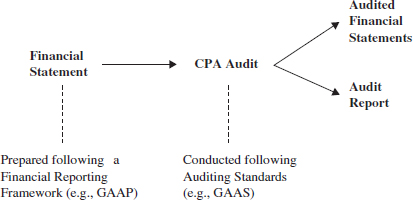

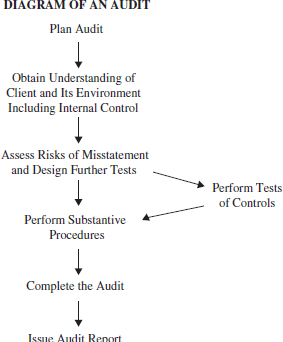

Financial Statements, an Audit and Audited Financial Statements

Principles Underlying an Audit

- Purpose of auditProvide an opinion.

- Premise of auditManagement has responsibility for preparing financial statements and providing auditor with all needed information.

- Personal responsibilities of auditorCompetence, follow ethical requirements, maintain professional skepticism.

- Auditor actions in auditProvide procedures to obtain reasonable assurance about whether financial statements are free from material misstatements.

- Reporting results of an auditWritten report with an opinion, or a statement that an opinion cannot be obtained.

Auditing Standard Requirement Categories

- Unconditional requirementThe auditor must comply with the requirement in all cases in which the circumstances exist. SAS use the words must or is required to indicate an unconditional requirement.

- Presumptively mandatory requirementSimilarly, the auditor must comply with the requirement, but, in rare circumstances, the auditor may depart from such a requirement. In such circumstances, the auditor documents the departure, the justification for the departure, and how the alternative procedures performed in the circumstances were sufficient. SAS use the word should to indicate a presumptively mandatory requirement.

Note: The PCAOB includes a third level, Responsibility to Consider, in which the auditor follows, depends upon the exercise of professional judgment in the circumstances. Terms such as may, might, or could, indicate a responsibility to consider.

Code of Professional Conduct

Next page