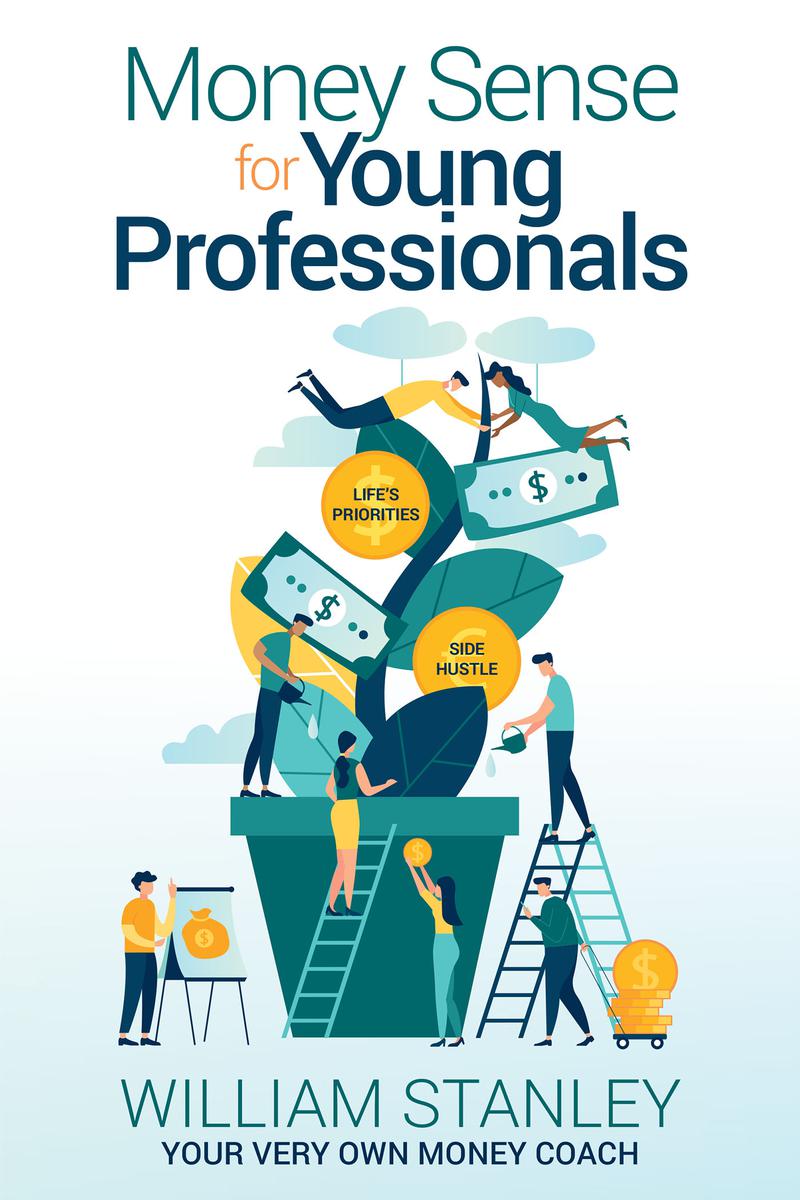

Prologue 2

Me, Your Money Coach

I am not your generation; I prefer to call myself Generation S (seniors) or Generation E (experience). My generation has many perennials we keep blooming year after year.

How do I know your generation? Ive raised three kids, now in their thirties and early forties. I have four grandkids; I know the importance of early education when it comes to money. I work closely with elementary and high school kids as well as young adults. I have interviewed scores of Young Professionals for this book. I want you to learn from them what they have done right and what mistakes they have made. Many of their comments are included in this book. Learn from your peers. If they can be successful, so can you.

Financial Literacy is my goal. You dont often find it in school. You may have grown up in a family where money was a continuing problem. It is time to learn from your Money Coach.

In this book I also use my own experience. I grew up with frugal parents and learned to carefully manage what little money I had. When something broke, my family would fix it, not buy something new. My mother encouraged my sister and me to save money whenever we could. My father cautioned us never to buy anything unless we first had saved the money. I have always handled my own money and, in the 1980s, I wrote a newsletter, Money Sense, for family and friends. I have learned from my many money mistakes. Mistakes are OK, but you must say to yourself, I wont do that again.

I have acquired many ideas from my clients over the years how to do things right and how money mistakes can ruin an otherwise good life.

Life is full of choices. It is up to you to decide when to move in a better direction with your finances. You can begin now, you can begin later, or you can never begin. I want you to choose the right path to financial success. Thats why I wrote this book.

Chapter 1

Money Basics

Smart Finances for Young Professionals

Listen to Your Mother

Live within Your Means: What Does That Mean?

Financial Goals: The How-To

When You Might Need a Money Coach

Take the Money Coach Test: The Financial Checkup

The Big Money Picture

A Money Exercise for All

Learn from Kids

Smart Finances for Young Professionals

Financial Planning Is Simply Taking Charge of Your Money

You can start now.

You can start later.

You can never start.

The start time is up to youand only you.

Want to Be a Millionaire?

Start by learning how to spot a millionaire. A millionaire shuts the light off when he/she leaves the room. Be frugal and wise if you want to be a millionaire. Saving a little over a long period will help you tremendously. Start early and keep adding to the account. Start today!

Take Control

Take control of your money no matter how much or how little you have.

Learn as much as you can. Apply that learning.

Youve heard of street smarts. Develop money smarts.

Set goals. Achievable goals for yourself. Short, medium, long termwrite them down. Do it now!

Its Not How Much You Make; Its How Much You Spend

You do the best you know how to earn as much as you can based upon your education and your attitude.

You dont have full control over how much you earn.

You do have control over how much you spend.

When you budget, you keep track of where your money goes. That way, you know how much you spend.

What You Want Is Not Always What You Need

This advice is from my stepdaughter, who, in her teens and twenties, was always buying things she later decided she did not need.

Learn from Your Mistakes

This is a lesson in life. Mistakes are okay, but we must reflect upon them and learn not to make the same mistake again. Avoid paying a service charge on your bank account or buying something over the phone from an unsolicited phone call, a telemarketer. Just say, Sorry, I do not accept telephone solicitations. Then hang up.

Write down some money mistakes you have made. Write down mistakes you have made and are not going to make again.

Investing Is Not Gambling

Educate yourself about investing. It is not that hard. You can do it!

Protect Your Health, and Amass a lot of Wealth

Avoid tobacco and alcohol and sugary stuff.

If you now spend $50 per month on beer and cigarettes and instead invest the money at 8% gain compounded annually, you could have nearly $175,000 after forty years.

Despite perceptions that it is healthier, there is little difference between bottled water and tap water per the World Wildlife Fund. Often the only difference between bottled water and tap water is that it is distributed in bottles rather than pipes. Bottled water can cost up to a thousand times more than tap water.

Listen to Your Mother

We honor Mom on her special day each year in May, but we should forever follow Moms advice on money matters.

Look both ways before crossing the street. Streets are dangerous; you must be careful. The world of finances is also a dangerous place; people are often trying to take advantage of you. Enter this world with caution, and keep your eyes open. Learn the basics. Question everything.

Save for a rainy day. This is a very important piece of advice from Mom. It translates to having an emergency fund to pay for unexpected things that might happen. If you have an emergency fund, you dont have to put emergency expenses on a credit card.

Dont put all your eggs in one basket. This means diversify your investments. Dont buy too much of any one investment option; dont have too much in the stock market. Spread your money across the savings and investment board.

Dont play with sharp objects. You can hurt yourself. In the world of finance, people who make a commission on things they recommend are sharp objects. Dont play with them. Learn how to do it yourself or get help from a fee-only adviser who is a fiduciary (someone who must put the client first).

Finish your homework. Mom wants you to do well in school. The financial reason is, a good education brings a good job and a good job brings benefits. Your financial life will be much better if you have a steady job, a good health care program, and good retirement benefits. Pick a career you enjoy. Enthusiasm is the key to success!

Walk. Dont run. If you are going into something new in finances, walk; dont run. Take your time. Learn about it. Think about it. Do not make a hasty decision because some financial salesman bought you lunch. Apply the twenty-four-hour rule: when pressed to buy, tell the seller you need twenty-four hours to think it over.

Eat your vegetables. Mom knows health is more important than wealth. Live a healthy life. Eat good stuff, exercise, and have many close relationships.

Thanks, Mom, for all your wisdom. Now, if we could only follow your advice.

A footnote about Dad: Kaitlyn, twenty-one, says, I can relate to the advice of listening to your mom because my mother would always tell me to save when I was younger, and I did. Unfortunately, I listened to her so much that I would never spend any money. My dad had to sit me down and tell me that it was okay to spend sometimes, though I should never spend excessive amounts. I think thats an important lesson.

Live within Your Means: What Does That Mean?

I tell everybody, Live within your means! Im often asked to further explain just what that entails. At the very basic level, this entails the following: