CHAPTER 1

Getting Started in Mergers and Acquisitions

A little learning is a dangerous thing;

Drink deep, or taste not the Pierian spring;

There shallow draughts intoxicate the brain,

And drinking largely sobers us again.

Alexander Pope

An Essay on Criticism

INTRODUCTION

Perhaps nowhere else does Popes maxim prove truer than in the area of mergers, acquisitions, and buyouts. The purchase or sale of a business enterprise is one of the most challenging transactionsindeed, journeysone can undertake. And the wise traveler should set off on this journey for the right reasonsfor the most common catalysts to doing a deal can also be the most ill-fated. Consider the business owners who want to revolutionize their technology without realizing that they are in the wrong business to begin withor are going about it the wrong way.

And beyond the boardroom debate about whether to do an acquisition of some type is the issue of how the potential transaction is actually structured. Not only does an M&A deal cut across countless securities and tax laws, accounting rules, and regulatory requirements, but it also has the potential to either reinforce, or disrupt, the cultural underpinnings of the buyer or seller. Key intangiblessuch as the cultural alignment and logistical integration of two previously disparate organizationswin or lose deals. They can be the determining factor in whether an otherwise well-structured merger or acquisition ultimately harvests its intended benefits and builds long-term value. As such, M&A can be a make-or-break decision for many executives of major corporations; likewise, the sale of a business can be a once-in-a-lifetime realization event for many small business owners. In both cases, the players must know what they are doing.

More than 50 years ago, in the fall of 1965, Stanley Foster Reed, the original author of this book, launched the first issue of Mergers & Acquisitions magazine. He prefaced the magazine, which continues to this day via the SourceMedia platform, as follows:

Dedicated to the Ever-Renewing Corporate Society

As we take part in this third great wave of merger and acquisition activity in America, we are struck by the rate of economic growth, and by the speed with which corporations are merging and being formed. Research indicates that at present rates, one out of every three corporations will either merge or be acquired during the next ten years. This makes change the condition by which we grow and develop.

Each day here in the United States one thousand new businesses are born. Some drive for the heights like a great Fourth of July rocket and end in a burst of colora hasty life, beautiful but short.... A few, carried on a quick tide of youthful energy and special knowledge, will grow great and strong and eventually wise and will become a shelter for the less strong and the less wise.

This is the ever-renewing corporate society.

As Reeds prologue shows, Mergers & Acquisitions magazine was founded with one clear goal in mind: to show buyers and sellers of companies how to create strategiesand shelterfor continual growth in a world of constant change.

Reed had this same purpose in mind when he teamed up with the law firm of Lane & Edson, PC, to produce the first edition of this guidebook in 1988, the height of the LBO movement, as romanticized by the character Gordon Gekko in Oliver Stones unforgettable movie Wall Street. The L&E attorneys shaping the first edition of this book were really there on the front lines of M&A change, advising buyout kings like former Treasury secretary William E. Simon and Ray Chambers, founders of Wesray. The first edition of the big book featured Reed as coauthor and Alexandra Reed Lajoux, his daughter, initially as project manager.

The 1988 text was an instant classic, but as deal structures shifted under the weight of hundreds of legal precedents, temperamental financing markets, and constantly changing accounting and tax rules, a major revision in the original text proved necessary. Subsequent editions by Reed and Lajoux followed in 1995 and 1999, as did a series of spin-off titles, exploring each of the major topics in greater depth. H. Peter Nesvold joined the series in 2001, serving as coauthor of not only three special titles in the series but also most notably as coauthor of the fourth edition with Reed and Lajoux. That edition was published in 2007shortly before Reed passed away at age 90, his mission accomplished. As detailed in the front matter to this book, the current edition contains the wisdom of countless professionals dedicated to M&Aincluding experts associated with Capital Expert Services, LLC, coproducer of this edition.

To state the obvious, much has changed over the past decade. This fifth edition continues the legacy of the original book and the broader Art of M&A series, capturing key trends and technical changes that have occurred over the 10-plus years as the M&A arena suffered through a global financial crisis and emerged with new, sometimes painful, lessons learned. Yet Reeds vision from 50 years ago of M&A as central to an ever-renewing corporate society remains as true today as it did in 1965.

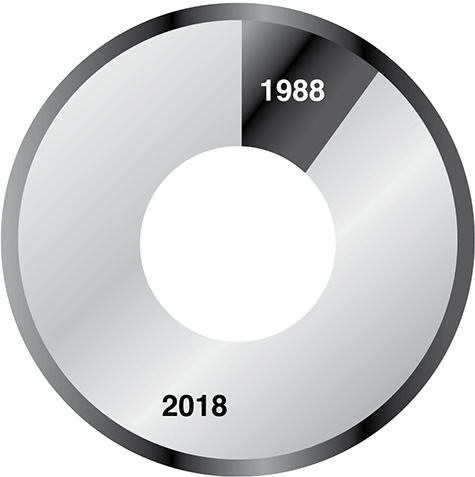

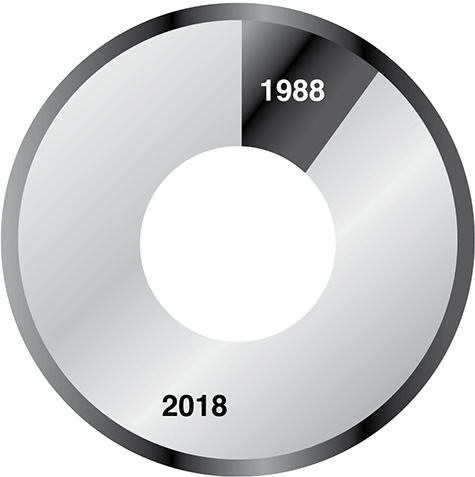

Every year trillions of M&A dollars change hands globallynot only in the purchase of huge companies or of major interests in them, but in the tens of thousands of smaller companies that are bought and sold from Peoria to Paris. As we go to press, M&A remains very much a part of the global economy. As illustrated in Exhibit A-1 in the Preface to this book, dealmakers closed M&A transactions worth more than $4 trillion globally in 2018. Aggregate global M&A transaction values have recently more than doubled off their Crisis lows of 2009; whats more, recent annual values have increased nearly fourfold from 2002s cyclical lull and have soared more than 13 times over since 1985. Even considering the multiplier effect of inflation,.)

Exhibit 1-1 Global M&A Transaction Value (1988 vs. 2018)

Source: Institute of Mergers, Acquisitions & Alliances (IMAA), 2019.

Often divestiture is the cure.

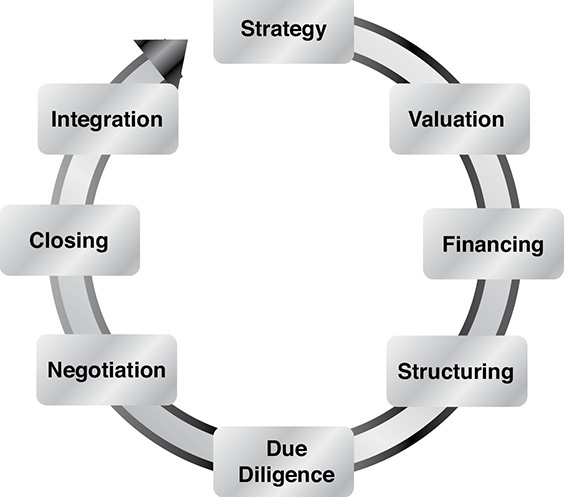

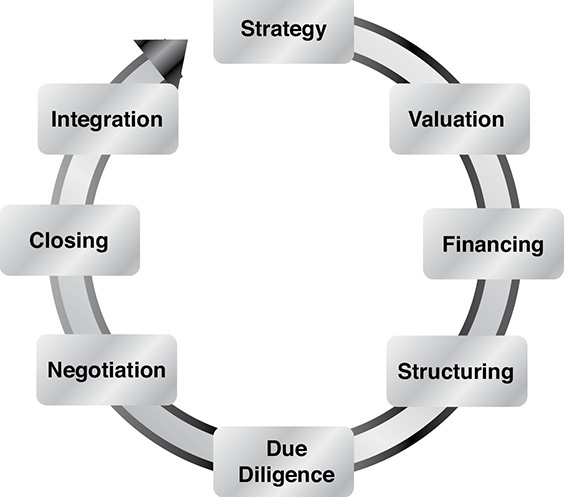

To strike lasting deals, acquirers and sellersboth large and smallmust drink from the ever-renewing spring of M&A knowledge. To drink deep, they must recognize first that there is something called an acquisition process, with many crucial stages and many key players. To carry out any one stage well requires solid grounding in the entire process, which typically unfolds in the following phases (see ):

Exhibit 1-2 The M&A Process

Strategy PhaseDeciding whether, and if so how, to buy or sell whether as a strategic buyer or a financial buyer

Strategy PhaseDeciding whether, and if so how, to buy or sell whether as a strategic buyer or a financial buyer

Valuation PhaseDetermining the value of the company to be bought or sold

Valuation PhaseDetermining the value of the company to be bought or sold

Financing PhaseObtaining the funds, internal or external, to make the deal happen

Financing PhaseObtaining the funds, internal or external, to make the deal happen

Structuring PhaseMaking the proper accounting, financial, legal, and tax designations for the transaction

Structuring PhaseMaking the proper accounting, financial, legal, and tax designations for the transaction

Due Diligence PhaseVerifying that the company is what it claims to be and discovering risk exposures material to the transaction

Due Diligence PhaseVerifying that the company is what it claims to be and discovering risk exposures material to the transaction

Strategy PhaseDeciding whether, and if so how, to buy or sell whether as a strategic buyer or a financial buyer

Strategy PhaseDeciding whether, and if so how, to buy or sell whether as a strategic buyer or a financial buyer