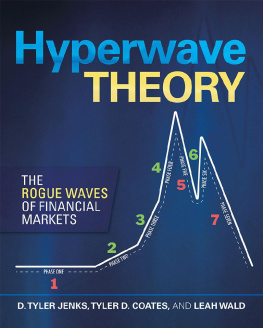

HYPERWAVE THEORY

THE ROGUE WAVES OF FINANCIAL MARKETS

D. TYLER JENKS, TYLER D. COATES, AND LEAH WALD

Copyright 2020 D. Tyler Jenks, Tyler D. Coates, And Leah Wald.

All rights reserved. No part of this book may be used or reproduced by any means, graphic, electronic, or mechanical, including photocopying, recording, taping or by any information storage retrieval system without the written permission of the author except in the case of brief quotations embodied in critical articles and reviews.

This book is a work of non-fiction. Unless otherwise noted, the author and the publisher make no explicit guarantees as to the accuracy of the information contained in this book and in some cases, names of people and places have been altered to protect their privacy.

Archway Publishing

1663 Liberty Drive

Bloomington, IN 47403

www.archwaypublishing.com

1 (888) 242-5904

Because of the dynamic nature of the Internet, any web addresses or links contained in this book may have changed since publication and may no longer be valid. The views expressed in this work are solely those of the author and do not necessarily reflect the views of the publisher, and the publisher hereby disclaims any responsibility for them.

Any people depicted in stock imagery provided by Getty Images are models,

and such images are being used for illustrative purposes only.

Certain stock imagery Getty Images.

ISBN: 978-1-4808-8876-0 (sc)

ISBN: 978-1-4808-8877-7 (e)

Library of Congress Control Number: 2020903606

Archway Publishing rev. date: 2/29/2020

CONTENTS

ACKNOWLEDGEMENTS

Dearest Hyperwavers, thank you for creating a beautiful community of support, collaboration, and education. This book would not be possible without you.

Tone, thank you for believing in us and helping us navigate the Wild West of Bitcoin.

Gabriel Harber, thank you for helping to edit the final draft of the manuscript.

And to the talented photographer and friend Daisy Komen, thank you for taking our author photos. You encapsulated Tylers spirit with your photograph where he can forever be a Bitcoin Standard Bearer.

This book is dedicated to Tyler Jenks, our co-

author, who passed away on July 23, 2019.

Tyler spent his entire professional career studying financial markets and investments. He loved to share his extensive experience and investment acumen through classes, seminars, and the financial media. He will always be loved, remembered, and missed.

Tyler invented and developed hyperwave theory during the massive run-up in commodities that occurred in the 1970s. He implemented this newfound approach to sell silver in the low to mid $30s in 1980, less than a month before Silver Thursday.

One year later, he noticed a very similar pattern forming in the US long-term interest rates, which had skyrocketed from 5 percent to over 15 percent in fifteen years. In 1982, Tyler published a twenty-five-page article entitled The Case for Bonds, and he called for rates to return to 6 percent when they were still above 12 percent.

That call was entirely due to hyperwave theory, and it allowed him to predict what few others could believe at that time. It also allowed him to make a very valuable inference: a long phase 7 in interest rates should result in a long bull market in equities. Dwindling interest rates are generally very bullish for equities, and this induction allowed him to build heavy, long exposure in the S&P 500 in 1983 when the price was in the $150 neighborhood.

He proceeded to use his new theory to sell the S&P 500 and Dow Jones Industrial Average in October 1987, one week before Black Monday. At that time, the S&P was $311.12, and D. Tyler made more than a 100 percent ROI in less than five years by narrowly avoiding the record-breaking crash that followed.

His most lucrative investment was right around the corner, as was the best call of his career. The Japanese equity market was forming the largest hyperwave that the world has ever known, returning over 4,000 percent in less than twenty years. The peak was at 39,270, and Tyler sold at slightly under 35,000. He proceeded to call for a return to the mid four digits, which was almost inconceivable at the time. The Lost Decade followed, and prices fell below five figures right as Tyler was in the process of selling the top of his fourth bubble.

The dot-com bubble that formed in the 1990s sent the Nasdaq into a beautiful hyperwave. The last five years of the millennium were the biggest returns that the US stock market had ever experienced; however, most were unable to capitalize on the run-up. Some stayed out entirely; others became overexposed at or near the top and were confronted with huge losses after the market reversed.

Tyler focused on buying growth stocks during the mid-1990s when the Nasdaq was still below $500. The hyperwave became apparent shortly thereafter, and by this point, he had tremendous confidence in his ability to trade the pattern. Around this time, he was promoted to chief investment officer at Amivest Capital Management, but he was severely restricted in how he could manage money. The maximum cash allocation allowed was 5 percent. When the Nasdaq broke down phase 4, he was handcuffed but was still able to rotate out of growth stocks and into value. His performance led PS Ephron to rank him in the 99 th percentile of money managers from 1998 to 2003.

Hyperwaves became much less common over the following decade; however, his best trade was still on the horizon. His son called at the beginning of 2017 and said that he thought Bitcoin was starting a hyperwave. Tyler looked at the charts and agreed with his sons analysis. He entered his entire retirement account in GBTC (the Bitcoin Investment Trust) that summer at an average cost basis of $3,200. He sold in December 2017 at $12,500 for nearly a 400 percent ROI in less than six months. He went on to project that Bitcoin would return to phase 1, which is waiting at $1,000.

Many people will make calls and predictions while very few are willing to put their entire retirement account at risk. Tyler made bold calls, and he made even bolder trades. His best calls and trades had all been a direct result of hyperwave theory.

This book will dive deep into the theory that took Tyler a lifetime to develop. We will show exactly how Tyler was able to sell the top of the most prominent bubbles that have occurred over the past forty years, and we will provide a complete strategy that will allow readers to repeat this process. There are currently more active hyperwaves than there have ever been in recorded history; therefore, hyperwave theory has never been more important. We will explore how to profit from these patterns, and we will delve into the macroeconomic repercussions of these financial rogue waves that are currently swelling in unprecedented proportions.

We are eternally grateful to Tyler for his love and support as a partner, mentor, and friend. He will never be forgotten as he will remain in our hearts forever.

PHASE 1

TECHNICAL THEORY

CHAPTER 1

TECHNICAL THEORY &

HYPERWAVE ARCHETYPE

All through time, people have basically acted and reacted the same way

in the market as a result of greed, fear, ignorance, and hope. That is why

the numerical formations and patterns recur on a constant basis.

Jesse Livermore

People familiar with financial markets are likely very familiar with the different types of chart patterns that are prevalent, including head and shoulders, double tops, triangles, wedges, etc. Even if one does not understand or believe in the implications of these patterns, one is likely aware that they recur constantly.

Next page