Alan Bonham

Painless

Business

Finance

From bookkeeping to financial reports and ratios

Copyright Alan Bonham, 2012

The right of Alan Bonham to be identified as the author of this book has been asserted in accordance with the Copyright, Designs and Patents Act 1988.

First published in 2012 by

Infinite Ideas Limited

36 St Giles

Oxford

OX1 3LD

United Kingdom

www.infideas.com

All rights reserved. Except for the quotation of small passages for the purposes of criticism or review, no part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning or otherwise, except under the terms of the Copyright, Designs and Patents Act 1988 or under the terms of a licence issued by the Copyright Licensing Agency Ltd, 90 Tottenham Court Road, London W1T 4LP, UK, without the permission in writing of the publisher. Requests to the publisher should be addressed to the Permissions Department, Infinite Ideas Limited, 36 St Giles, Oxford, OX1 3LD, UK, or faxed to +44 (0) 1865 514777.

A CIP catalogue record for this book is available from the British Library

ISBN 978-1-908474-35-3

Brand and product names are trademarks or registered trademarks of their respective owners.

Although the author and publisher have used their best efforts in preparing this book, they make no representation or warranties with respect to the accuracy or completeness of this book. (Author, are you sure we need this? Everyone says that youre the most accurate in the biz. Editor) Therefore the author and publisher do not assume and hereby disclaim any liability to any party for any loss, damage, or disruption caused by errors or omissions, whether such errors or omissions result from negligence, accident, or any other cause. (Author, this is, to say the least, a bit outside our house style in terms of its formality, could you rephrase it and make it a bit moreer folksy? Ed) The author or the publisher can accept no responsibility for loss occasioned to any person acting or refraining from action as a result of any material in this book. (OMG, Author, do people actually act or refrain from acting, this is miles too heavy Ed) The information and examples contained in this book may not be appropriate in every situation and, if professional assistance is required, the services of a competent professional person should be sought. (Author, youre fired but the disclaimer stands. Ed)

Part One

Introduction

It is truth universally acknowledged that finance professionals have at their disposal a mass of jargon which can take trainee accountants, new managers and new business owners some time to learn. Managers who are promoted and facing new challenges are trained for the physical task they have been assigned, but may have no experience of the bunch of financial hurdles and measures that come with the job. Trainee accountants have to get the basics absolutely right if they are to become dependable sources of the financial assistance that it is their role to supply. And someone who has just started running a business needs to understand whats going on. Knowledge of the applications of the inevitable jargon is an essential tool.

Everyone feels they ought to know some of this financial information, especially since we probably learned some of the basics at school or college. This book will help you to recall those basics and then build on them in order to be as financially literate as you can possibly be. If youre totally new to the subject then this is a great introduction. You may, of course, be an aspiring accountant in which case a solid understanding of bookkeeping is not just nice to have, its a must. Bookkeeping is to accountancy what arithmetic is to mathematics.

In the bookkeeping section I cover everything from trial balances to journals, from bank reconciliation to depreciation. Then, to make quite sure youve really got it, there are exercises at the end of the book that you can use to test your knowledge.

If youre a line manager you ought to have a reasonable knowledge of the bookkeeping section certainly enough to approach the second part of the book which covers income statements, balance sheets and cash flow statements. From these statements you can derive the ratios you need to take the financial pulse of a business. After all, your bosses are going to measure your performance by a subsection of these ratios, so you had better understand them.

In short, in this book lie the universal truths of bookkeeping and financial statements

The business model

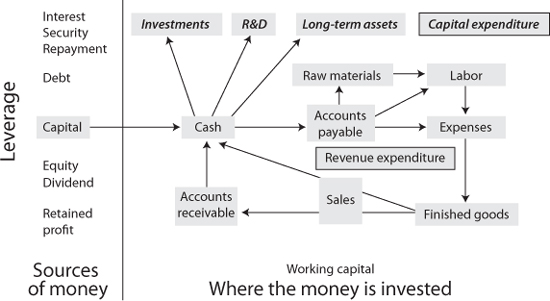

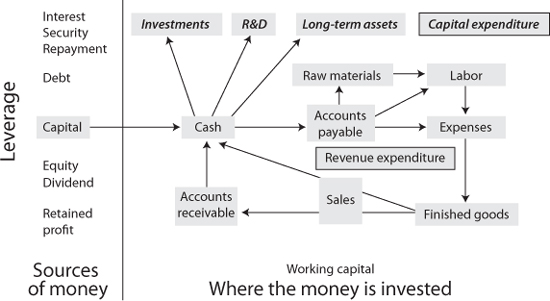

To understand business finance it is useful to have a diagram of how money flows round a business. Here is the business model:

Sources of money

The money used (or capital) in the business comes from stockholders (the owners) and lenders. Initially, the owners will pay for shares of stock and this money is invested in the business. As profits are earned, some of these profits are returned to the stockholders by way of dividends. If a company wishes to grow, it will retain profits within the business. These retained profits still belong to the stockholders but are being used to finance growth.

In the past, the term stockholders funds was used to describe the amount of stockholders money invested in the business. The modern term is equity. Equity is therefore made up of the stockholders initial investment plus retained profits. The company owes this money to the stockholders but has no obligation to pay it back.

A company can borrow cash from a variety of sources. In a small business, the owners will often provide loans to the company sometimes at a low rate of interest. The line of credit from the companys bank is a popular form of financing since the company can access cash according to the needs of the business. However, lines of credit will usually carry a higher rate of interest than a long-term loan.

There is a wide range of other financial institutions seeking to lend to businesses. For the purposes of this book about basic finance, we will consider only the straightforward case where the loan is for a fixed term.

The implications of these two sources of money are different. In one sense, money from stockholders is cheaper. Return on the stockholders investment comes in the shape of dividends that are normally paid twice a year. In the early stages of a business the owners may very well drop the requirement for dividends and allow the managers to retain all the profits to allow them to grow the business. At that stage the money could be said to be free.

There is also no need for the managers to plan to have the cash to buy back the stock; in practical terms the money is in the company forever. The only downside in using stockholders funds to get a major business going is the cost of raising money in this way, since lawyers and accountants dont come cheap. Another problem is that the business has to find someone willing to take the risk of putting money into an enterprise which, who knows, may fail. If the business does fail the owners lose all the money they have invested. It is this risk of failure which makes stockholders demand, in the long term, that their overall returns should be higher than the providers of loans. They get this return through the growth of dividends that the company pays out. In the long term, of course, if the companys stock is traded on a stock market exchange the stockholders are hoping that the price of the shares will go up.

Loan finance (usually referred to as debt) is cheaper to arrange. Banks and financial institutions assess the risk of the company, make loans and charge an interest rate to reflect the perceived risk. It seems reasonable that they should tailor their interest charges to protect themselves against the risk of default; the problem is that a business in dire straits and in desperate need of cash has to pay more to get it adding to the downward spiral.