Harry Browne - How You Can Profit From The Coming Devaluation

Here you can read online Harry Browne - How You Can Profit From The Coming Devaluation full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2012, publisher: Lipton Financial Services, Inc., genre: Romance novel. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:How You Can Profit From The Coming Devaluation

- Author:

- Publisher:Lipton Financial Services, Inc.

- Genre:

- Year:2012

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

- 100

- 1

- 2

- 3

- 4

- 5

How You Can Profit From The Coming Devaluation: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "How You Can Profit From The Coming Devaluation" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

How You Can Profit From The Coming Devaluation — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "How You Can Profit From The Coming Devaluation" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

How You Can

Profit from the

Coming Devaluation

By Harry Browne

First published in 1970

Reprinted many times since

Copyright 1970 by Arlington House

Copyright 1971 by Harry Browne

Copyright 2012 (including Introduction and Foreword)

by Lipton Financial Services, Inc.

and Pamela Browne

All rights reserved according to International Law. No part of

this book may be reproduced for public or private use

without the written permission of the publisher.

Introduction by Publisher - Roger Lipton

Harry Browne's economic wisdom substantially helped this then young Wall Street analyst survive the financially turbulent 1970s. His predictions proved correct and timely for all the right reasons, rare among financial commentators. His views of forty two years ago are even more relevant today, as we contend with international financial strains that are an order of magnitude larger. His timeless wisdom should be incorporated into financial discussions among policy makers and their constituencies worldwide. We are fortunate to have the internationally respected monetary scholar, James Grant, provide his foreword which follows. In 1974 I presented Harry Browne to my clients (at Carnegie Hall in NYC), and I am privileged in 2012 to present him once again.

Roger Lipton - April 2012

Roger Lipton is founder of Lipton Financial Services, Inc., a money management firm based in New York City.

2012 Foreword by James Grant, editor of

Grant's Interest Rate Observer

In 1970, between these very covers, Harry Browne predicted the signal monetary event of the late 20 century. But it was no mere prediction he served up to what would prove to be a vast and grateful readership. How You can Profit from the Coming Devaluation was both title and subject.

Nowadays, with the clarity of hindsight, anyone can see that the days of the gold-backed dollar were numbered. Pure and simple, the Treasury was running out of gold. It was not so clear when Browne wrote, however. The financial and economic establishment insisted that nothing was wrong, or could be wrong, with the U.S. dollar, (economic science having allegedly advanced well beyond the point at which gold had any relevance to the value of a currency, or so the argument went). Browne, however, was unswayed. Since we live in an uncertain world, he undogmatically couched his forecast, where all relevant factors can never be known, it would be foolish of me to make a prediction as to either when or if. Instead, let me say that I expect a devaluation to occur sometime between this coming Saturday and the end of 1971.

And so it came to pass. On Aug. 15, 1971, President Richard Nixon abandoned the gold dollar, or what was left of it, and redefined the greenback as a piece of paper backed by nothing but the good intentions of the government that printed it. No more could an official American creditor a central bank or a government, for instance exchange dollars for gold at the statutory, $35-per-ounce rate. In American finance, the Age of Hamilton was over, the Age of Greenspan and Bernanke (and of their assorted Federal Reserve predecessors) just beginning.

Browne's was a superb forecast, and this is a remarkable book. A two-time presidential standard-bearer for the Libertarian Party, Harry Browne wrote for everyman. A little like the author Henry Hazlitt, he had the gift of conveying complex ideas in simple language. Nobody, reading his parable of the counterfeiters in the chapter headed What is Inflation, can fail to absorb the essence of the process of currency debasement.

Governments will always try to foist unsound money in place of gold and silver, Browne observed, and once again he was as right as rain. In 1973, three years after the first edition of this volume appeared, the 20 leading nations of the world solemnly pledged that the special drawing right, or SDR, will become the principal reserve asset and the role of gold and of reserve currencies will be reduced. Needless to say, the SDR has made no such headway, certainly not against gold.

Browne, who died in 2006, did not live to see the full-blown consequences of the monetary ideas he so uncompromisingly opposed (the Great Recession and associated financial thunder and lightning were to come two years after his death). But I am quite sure that they would not have surprised him. I commend this volume to every investor and to one particular central banker: For your sake and ours, Ben Bernanke, please read every word.

James Grant - April, 2012

Original Flaps and Back Cover

How You Can Profit from the Coming Devaluation

HARRY BROWNE

Those who believe that a devaluation of the dollar in terms of gold would have little effect upon us have been seriously misled, maintains financial analyst Harry Browne. In spite of the soothing words of Keynesian economists, most people will suffer crippling losses - while others will enjoy great gains. Will you be one of those who come out smiling - or weeping?

Those who lose from devaluation will be those who accept conventional investment advice. Those few who come out ahead will be those who are nor afraid to stand apart from the crowd and. Who understand why devaluation makes investing a whole new ball game.

Starting with fundamentals that most economists ignore, Harry Browne shows the chilling similarities between the late Twenties and today. And because an investor cannot survive a period of devaluation without a solid understanding of the nature of money and how it behaves, Harry Browne spells it out in language any reasonably intelligent layman can grasp.

Although devaluation is bound to come, Browne shows that other economic events may come first. What happens in case of continued inflation at the current rate? Runaway inflation? A short-term recession? A full-scale depression? Harry Browne analyzes your investment program in light of each - but always in light of the devaluation that is now inevitable. Should you be in stocks and mutual funds? Commodities? Should you sell short? What about real estate? Home ownership? Undeveloped land? Diamonds? \Works of art? Cash? Bonds? Treasury bills? Life insurance? Swiss francs and other foreign currencies? Gold stocks? Silver stocks? Coins? Silver bullion? Other, more sophisticated investments ?

But Mr. Browne doesn't leave you hanging. In the most important section in the book, he spells out several investment Programs that cove ever economic contingency, Whether you can write a check for $1000 or $1,000,000; whether your object is capital growth, income, safety or some combination of all three, Hairy Browne shows you how to achieve them when devaluation strikes - and all the conventional rules bring you not prosperity but disaster.

It can happen here. But with this book, you're ready to profit from it.

TAX DEDUCTIBLE

If you maintain an investment portfolio, this book can qualify as a tax-deductible expense, as information you use for investment decisions.

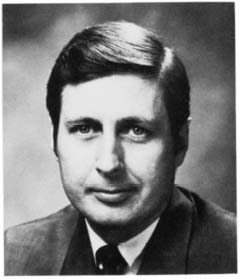

ABOUT THE AUTHOR

HARRY BROWNE is an investment counselor for the few and a lecturer who has addressed hundreds of thousands of concerned investors over the past decade. His most popular subjects include The Economics of Success, The Art of Profitable Living and The Economics of Freedom. Through most of the Sixties Mr. Browne's column on economics, The American 'Way, was syndicated in more than one hundred newspapers'

Font size:

Interval:

Bookmark:

Similar books «How You Can Profit From The Coming Devaluation»

Look at similar books to How You Can Profit From The Coming Devaluation. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book How You Can Profit From The Coming Devaluation and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.