Table of Contents

Guide

Pages

T HE N EW Y ELLOW B OOK : G OVERNMENT A UDITING S TANDARDS , 2018 V ERSION

B Y R EBECCA A. M EYER , CPA, CGMA

Notice to readers

The New Yellow Book: Government Auditing Standards, 2018 Version is intended solely for use in continuing professional education and not as a reference. It does not represent an official position of the Association of International Certified Professional Accountants, and it is distributed with the understanding that the author and publisher are not rendering legal, accounting, or other professional services in the publication. This course is intended to be an overview of the topics discussed within, and the author has made every attempt to verify the completeness and accuracy of the information herein. However, neither the author nor publisher can guarantee the applicability of the information found herein. If legal advice or other expert assistance is required, the services of a competent professional should be sought.

Special note: COVID-19 resources

The Association, the global voice of the American Institute of CPAs and the Chartered Institute of Management Accountants, is taking the Coronavirus (COVID-19) very seriously.

We are continually monitoring the virus impact on our members and the profession. For the most up-to-date information on this topic, please visit the AICPAs Coronavirus Resource Center at www.aicpa.org/news/aicpa-coronavirus-resource-center.html .

For topic-specific updates, please visit the following resource centers.

| COVID-19 Resource Center | Website |

| Audit and accounting | www.aicpa.org/interestareas/frc/covid19.html |

| Forensic and valuation services | www.aicpa.org/interestareas/forensicandvaluation/covid-19.html |

| Management accounting | www.aicpa.org/interestareas/businessindustryandgovernment/management-accounting-covid-19.html |

| Personal financial planning | www.aicpa.org/interestareas/personalfinancialplanning/covid19.html |

| Small firm | www.aicpa.org/membership/small-firms.html |

| Tax | www.aicpa.org/interestareas/tax/covid19.html |

2020 Association of International Certified Professional Accountants, Inc. All rights reserved.

For information about the procedure for requesting permission to make copies of any part of this work, please email with your request. Otherwise, requests should be written and mailed to Permissions Department, 220 Leigh Farm Road, Durham, NC 27707-8110 USA.

ISBN 978-1-11978-463-0 (Paper)

ISBN 978-1-11978-471-5 (ePDF)

ISBN 978-1-11978-470-8 (ePub)

ISBN 978-1-11978-472-2 (oBook)

Course Code: 746631

YBRV GS-0420-0C

Revised: May 2020

Chapter 1

Foundation and Principles for the Use and Application of Government Auditing Standards

Learning objectives

- Recognize why engagements are conducted in accordance with generally accepted government auditing standards (GAGAS or Yellow Book).

- Recall revisions brought about by the 2018 revision to GAGAS.

- Identify the types of engagements that may be conducted under GAGAS.

What is GAGAS?

Generally accepted government auditing standards (GAGAS), issued by the U.S. Government Accountability Office (GAO), provide a framework of audit and attest standards for use by auditors of government entities, functions, activities, and programs, as well as for government assistance administered by nonfederal entities. GAGAS provides the foundation for auditors to lead by example in areas of independence, transparency, accountability, and quality through the audit process. The standards provide a framework for performing high-quality audit work with competence, integrity, objectivity, and independence with the overall objective of providing accountability and helping improve government operations and services.

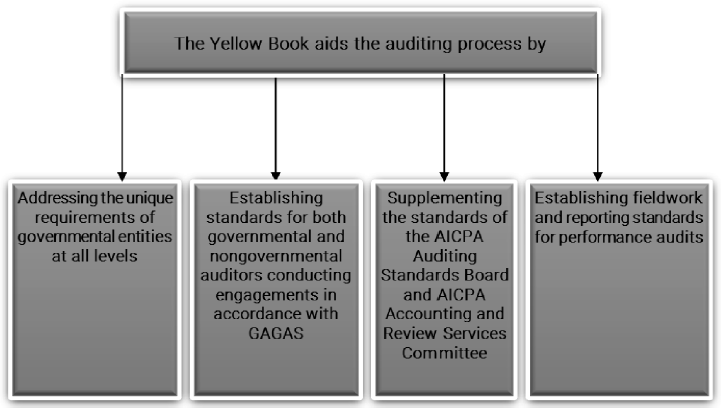

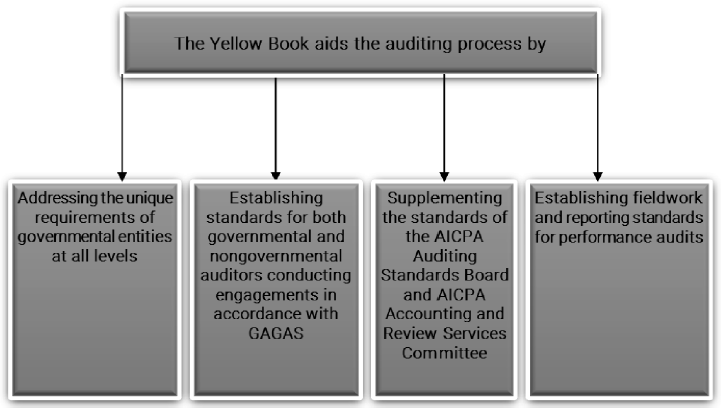

Known widely as the Yellow Book, GAGAS aids the auditing process in four ways.

In this course, the terms GAS, GAGAS, and Yellow Book are used interchangeably.

Brief history of Government Auditing Standards

Beginning in the mid-1960s, both the number and the dollar amount of federal government programs and services increased substantially. This increase brought with it a demand for full accountability from those entrusted with public funds and the responsibility for managing government programs and services properly.

Origin of the standards

In 1969, the Comptroller General of the United States held a series of meetings with a group of state auditors and federal officials. These meetings identified a need to improve government auditing. One of the areas identified was the absence of formal GAS. In July 1969, the GAO initiated plans for an audit standards work group charged with the objective of developing GAS.

In 1970, the audit standards work group started the survey and research work on which the original 1972 standards were based. The work group included representatives from the GAO, federal departments and agencies, state and local government auditors, and professional organizations including the AICPA. Assistance was also provided by academics and public interest groups. In June 1972, the Comptroller General issued the original version of the Yellow Book, Standards for Audits of Governmental Organizations, Programs, Activities & Functions.

Yellow Book revisions

In 1979, the GAO started a project to revise the standards. Based on comments and suggestions the GAO had received since the standards were originally issued, a draft of proposed revised standards was prepared and released for comment in August 1980. Comments received were analyzed and evaluated for appropriate consideration in arriving at the final draft standards. The 1981 revision of GAGAS was signed by the Comptroller General on February 27, 1981.

In November 1985, the GAO started a project to clarify, update, and revise the 1981 revision of the Yellow Book. In December 1985, the Comptroller General appointed an Auditing Standards Advisory Council (ASAC) to advise him and the GAO on revising the standards. The council was composed of individuals from federal, state, and local governments; public accounting; academia; and other special interest groups. On March 16, 1987, an exposure draft was released for comment and was sent to audit officials at all levels of government and members of the public accounting profession, academia, professional organizations, and public interest groups. Comments received were analyzed and evaluated, and appropriate changes were made in the final draft. The final revised standards were released in August 1988, superseding the 1981 revision.

In July 1993, an exposure draft was released proposing changes to the 1988 Yellow Book revision. A revision, Government Auditing Standards: 1994 Revision, was released on June 6, 1994. Its provisions were effective for financial audits of periods ending on or after January 1, 1995, and performance audits beginning on or after January 1, 1995.

After the issuance of the 1994 revision of the Yellow Book, three amendments were issued as follows: