Published in 2013 by Britannica Educational Publishing

(a trademark of Encyclopdia Britannica, Inc.)

in association with Rosen Educational Services, LLC

29 East 21st Street, New York, NY 10010.

Copyright 2013 Encyclopdia Britannica, Inc. Britannica, Encyclopdia Britannica, and the Thistle logo are registered trademarks of Encyclopdia Britannica, Inc. All rights reserved.

Rosen Educational Services materials copyright 2013 Rosen Educational Services, LLC. All rights reserved.

Distributed exclusively by Rosen Educational Services.

For a listing of additional Britannica Educational Publishing titles, call toll free (800) 237-9932.

First Edition

Britannica Educational Publishing

J.E. Luebering: Senior Manager

Adam Augustyn: Assistant Manager

Marilyn L. Barton: Senior Coordinator, Production Control

Steven Bosco: Director, Editorial Technologies

Lisa S. Braucher: Senior Producer and Data Editor

Yvette Charboneau: Senior Copy Editor

Kathy Nakamura: Manager, Media Acquisition

Brian Duignan, Senior Editor, Religion and Philosophy

Rosen Educational Services

Nicholas Croce: Editor

Nelson S: Art Director

Cindy Reiman: Photography Manager

Marty Levick: Photo Researcher

Brian Garvey: Designer, Cover Design

Introduction by Richard Barrington

Library of Congress Cataloging-in-Publication Data

Banking and finance/edited by Brian Duignan.1st ed.

p. cm.(Economics: taking the mystery out of money)

In association with Britannica Educational Publishing, Rosen Educational Services

Includes bibliographical references and index.

ISBN 978-1-61530-895-8 (eBook)

1. Banks and banking. 2. Finance. I. Duignan, Brian.

HG1601.B1727 2013

332.1dc23

2012032631

Cover Multi-bits/The Image Bank/Getty Images; cover (background), pp. i, iii, 1, 11, 20, 33, 45, 63, 74, 89, 100 zphoto/Shutterstock.com

B anking and finance are typically thought of in numerical terms, such as dollars, interest rates, and loan amounts. This way of looking at these subjects may make them seem coldly mathematical. However, todays world of banking and finance includes so many varied elements, with such an intricate network of interdependence, that perhaps it can best be thought of as an ecosystem. Like an ecosystem, the environment of banking and finance can thrive on the interaction of different elements, but also like an ecosystem, there is always the danger that a problem in one area can quickly spread to other parts of the system.

This book will take you through the fundamental components of banking and finance to help you understand their components individually and see how they work together as part of a global financial system. That understanding will give you a better appreciation for the factors that often shape the economic headlines and the economys future.

A good place to start in the study of banking and finance is with the definition of a bank. A bank is often described as a financial intermediary, which essentially means it is a form of middleman between people who have money to deposit and those who want to borrow money. This central principleacting as an intermediary between depositors and borrowersmeans that banks can lend and invest a far greater volume of money than their own capital because they have customer deposits available for those purposes.

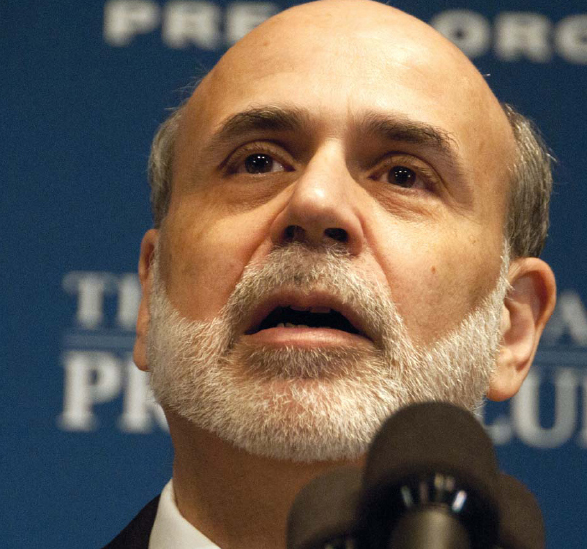

There are various types of banks, but the two major categories are commercial banks and central banks. Commercial banks are privately owned, for-profit enterprises that do business with individuals and other businesses. Central banks are sponsored by national governments and conduct transactions primarily with commercial banks and other central banks. Central banks may also have responsibilities for controling a nations flow of money and for regulating the banking system.

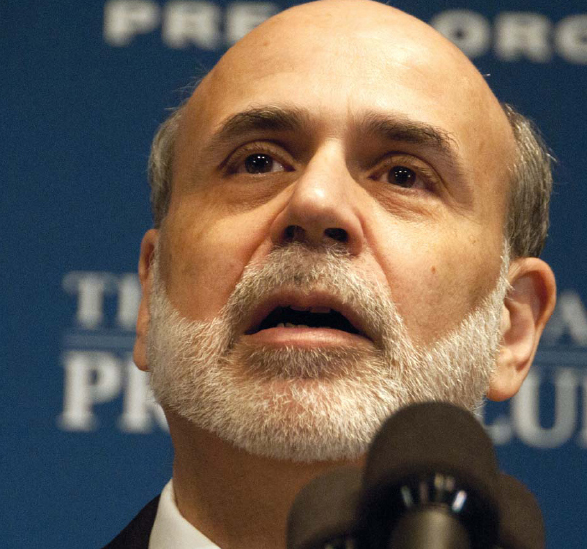

Federal Reserve Chairman Ben Bernanke. Albert H. Teich/Shutterstock.com

One of the major roles that banks play in the economic system is to provide a substitute for hard currency. When someone writes a check or uses a debit card, balances are transferred electronically, which is much more convenient than if money had to physically change hands. Providing bank money as a substitute for hard currency greatly facilitates commerce, but it also introduces an element of risk to the system, since at any given time banks hold only a small fraction of the total amount that has been deposited with them.

The reason that banks keep only a portion of their deposits on hand is that much of this money is being lent out to businesses and individuals. Providing credit in this way is another critical role that banks play in helping a modern economy operate and grow.

As traditional as these roles of banks are, they have evolved over time and continue to change. To provide some added perspective to modern banking and finance, this book will also cover some historical highlights. The history of banking can be traced back as far as ancient Mesopotamia. Much later, as trade and commerce grew substantially during the European Middle Ages, the role of banks grew as well, as banks provided loans, facilitated foreign exchange, and provided safekeeping of gold and silver.

Beginning in the 1500s, European banks evolved into two specialized types: exchange banks and deposit banks. While exchange banks, with their primary focus on facilitating foreign exchange, eventually faded in prominence compared to deposit banks, they were instrumental in establishing the concept of bank money, allowing for notional rather than physical transfers of money to facilitate trade. Another key part of this history is the introduction of banknotes, which evolved into the modern system of paper currency. Through these expanding roles, banks not only helped finance the spread of trade on a global scale but later also helped promote industrialization.

From these beginnings, banks evolved into their modern form. Though innovation continually adds new twists, the basic business model of a commercial bank is to pay customers interest for making deposits and charge them interest for taking out loans; much of the banks profit comes from the difference between those interest rates. Those deposits are considered liabilities of the bank because they are amounts that must be paid to customers on demand; the loans are considered assets of the bank because they produce revenue. Managing the balance between assets and liabilities is the essence of bank risk management.

Banks use various techniques to manage this balance. They keep cash reserves on hand to repay a certain portion of deposits; they manage their assets by structuring a mix of short-term and long-term loans to provide a steady stream of liquidity; in most developed economies, banks also have access to a central bank, which can lend them money to cover temporary imbalances in their cash flows. In addition to managing assets, banks manage their liabilities with products such as certificates of deposit, which help them control the timing of customers demands for their money.

Along with the challenge of coordinating the timing of assets and liabilities, banks also face credit and interest rate risk. As the risk environment has become more complex, banks have increasingly turned to sophisticated financial instruments, such as derivatives, to manage their risks. However, at times these instruments themselves have introduced a new element of risk to bank management. Because risk management is not perfect, bank capital serves as a cushion against asset losses and the demands of depositors. Bank capital is money put up by investors, who share in the profits earned by a bank but who are also the first to suffer losses when risk management fails.