Paolo Anders - The Strange Secret of William Delbert Gann: An Account of a Stock Market Scam

Here you can read online Paolo Anders - The Strange Secret of William Delbert Gann: An Account of a Stock Market Scam full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2018, genre: Art. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:The Strange Secret of William Delbert Gann: An Account of a Stock Market Scam

- Author:

- Genre:

- Year:2018

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

The Strange Secret of William Delbert Gann: An Account of a Stock Market Scam: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "The Strange Secret of William Delbert Gann: An Account of a Stock Market Scam" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

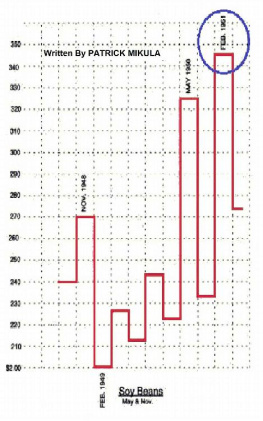

William Delbert Gann was a stockbroker who died in Brooklyn in 1955. He was a confidence trickster and a scam-artist. Think of the internet scams which exist today and you will understand him.

I have not been able to find any evidence that William Gann ever traded for his own profit. In 1920 he had some business interests other than looking after the subscribers to his private services. On March 16, 1920 the New York Times published a notice that

W. D. Gann, formerly associated with Moore, Leonard & Lynch has become a special partner with

C. J. Kelley and Co.

C. J. Kelley were brokers on the New York Curb Market. The Curb Exchange was a place where some insalubrious scoundrels were operating and where stocks were traded which did not meet the listing requirements of Wall Street.

You will soon see that William Gann had an extraordinarily convoluted style of writing, He was always pulling ones leg and tweaking ones nose. All readers of his books and MFCs: Beware!

He was highly intelligent and when his book The Tunnel Thru The Air was published in 1927, he had, as you will see, some knowledge about the Phoenicians and the Greeks and about the technique of building wooden ships. He was also well established in his own business in Wall Street. All these things are relevant. To understand the works of this man one must get behind his eyes and see into his soul.

Although he claimed to be a scientist and mathematician, his intelligence was for business and for literature. He had an astonishing ability to invent new metaphors for commonplace things. Figures of speech such as metaphors, similes and synonyms are the essence of poetry, and Mr. Gann seemed to have a liking for poetry, as was shown by many excerpts in The Tunnel Thru The Air from the works of American poets. It was not an uncommon liking in the days before radio and television. However, the poems in the book also contained coded references to the time at which the price of a security can alter and they are not primarily for tops and bottoms in price. Because these time cycles are not exclusively for strictly alternating tops and bottoms they cannot be identified by conventional cycle discovery methods.

Part of the task of this book is to unravel these literary devices and show what he did mean. His skill at obfuscation was very great, yet within his writing he did reveal one method of value - nothing that will make you one thousand per cent profit in one month, as a well known magazine article dishonestly claimed for him, but just one method of utility.

I promise you that you will puzzle over his books and courses and will struggle to see anything of value. It is because all his works used metaphors which cannot be taken literally. He did not use the motion of the planets and neither did he plot one-by-one charts for himself. These last were much touted methods of his. He claimed that other people had said of him that This man can make a fortune from reading the ticker tape alone. However, I have not been able to find any proof that he ever indulged in proprietary trading.

If there is one outstanding feature about this mans works it is the extraordinary way in which he disguised the real nature of his alleged trading methods. No writer that I know of comes close in that respect except perhaps in some of the convolutions in the writings of James Joyce. The full story of this very imaginative man will be given away.

Paolo Anders: author's other books

Who wrote The Strange Secret of William Delbert Gann: An Account of a Stock Market Scam? Find out the surname, the name of the author of the book and a list of all author's works by series.