Table of Contents

Legal Disclaimer and Copyright

Written by: Patrick Mikula CTA

Mikula Forecasting Company

P.O. Box 152672

Austin, TX 78715-2672

USA

http://www.mikulaforecasting.com/

Gann's Scientific Methods Unveiled: Volume 1

Copyright:

eBook Revised Version:

Copyright 2012 by Patrick Mikula All Rights Reserved

ISBN 978-0-9650518-8-0

eBook Version:

Copyright 2010 by Patrick Mikula All Rights Reserved

Original Hardcover version

Copyright 1995 by Patrick Mikula All Rights Reserved

First Edition:

ISBN 0-9650518-0-3

Copyright Notice:

No part of this book may be reproduced without written permission from the publisher. No part of this book may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, photocopying, electronic, mechanical, or otherwise, without the prior written permission of the publisher.

Legal Disclaimer:

Important Notice:

No claim is made that the trading methods or ideas in this book will result in profits and will not result in losses. The contents of this book are not guaranteed to produce profits. Commodity futures or stock trading is a risky business and may not be suitable for all recipients of this book. Although the financial correlations contained in this book have been reliable in the past there is no guarantee by the book's author or distributors that they will work in the future. Each trader is responsible for his/her own actions in the markets, if any. The contents of this book are not, and should not be considered as an offer to buy or sell any commodity or futures contract or stock. Purchase of this book constitutes your agreement to this disclaimer and exempts its author and distributors from any liability or litigation.

End

Introduction

1. Introduction

As a commodity futures trader I know that when traders purchase a new trading system or method they do not abandon everything they have used up to that time. Commodity traders usually integrate the new information with their other trading material. This means every trader's background and influences are a little different, and so it is a fact that no two traders trade exactly alike. The vast majority of traders who read this book will weave together their current trading ideas with the methods in this book, which is normal. As you start to practice the methods in this book and the integration of old and new ideas occurs, you should consider adopting the charting format and style which William Gann used. I am mentioning this in the introduction because Gann style charts are not necessary to apply the astrological methods in this book, but in my opinion are the best charts for technical analysis.

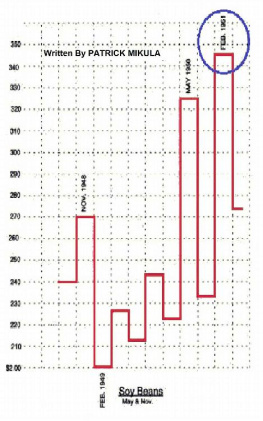

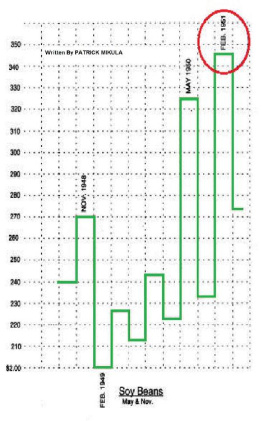

First lets look at the chart paper itself. William Gann used chart paper with eight squares to the inch (8X8) with every fourth line highlighted. This can be seen in Figure I-1.

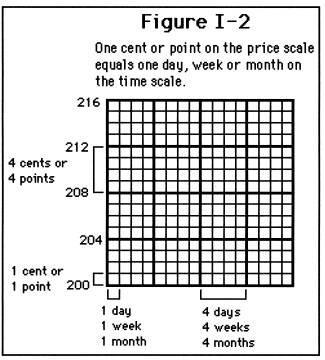

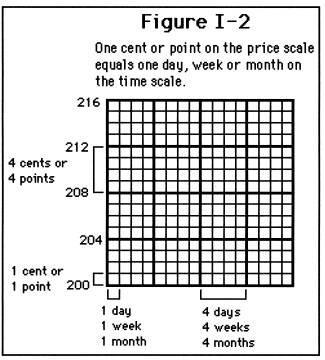

The next important point is the scale which Gann used on his charts. William Gann always kept the price and time scale in proportion to each other. For example in Figure I-2 the price to time relationship is 1 to 1. This means that one square on the chart paper represents the price move one cent or point on the vertical scale and one day, one week or one month on the horizontal scale. This creates a scale of one price unit to one time unit (1X1). When adjusting this scale you must keep a proportional relationship between price and time such as two price units to one time unit (2X1) or four price units to one time units (4X1) or eight to one (8X1) and so on.

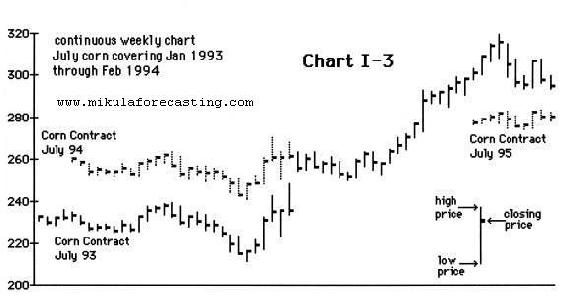

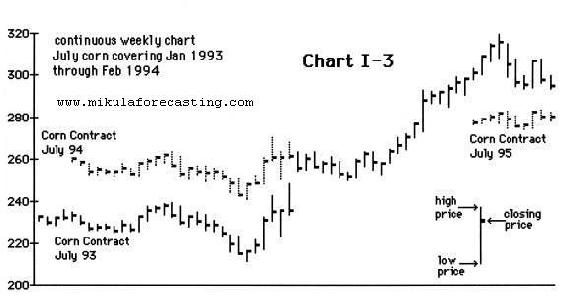

William Gann's style of charting connects the different contracts for the same month. For example you would chart and connect the July 91 contract to the July 92 to the July 93 and so on. Ideally you would make this type of chart for the contracts in which you actually trade. You should consider always keeping up monthly and weekly charts of this type, and a daily chart while you are actually trading.

When you start to make this type of chart there is one important question to address. What should be done with the portion of the distant contract which overlaps the current contract of the same month? To answer this question, we must examine how Gann dealt with this problem. Fact number one - William Gann actually graphed the overlapping portion of the distant contract, on some of his charts. Fact number two - when Gann did not graph the distant contract he still kept track of important high and low prices which occurred in the distant contract. For example, if the contract high or low occurred while it was the distant contract, Gann would write down the date and price of that high or low to use in his calculations. Given these two facts, it is my opinion that the correct way to make a Gann style chart is to graph the entire life of a contract because this is the easiest way to keep track of important highs and lows which occur in the distant contract. This will create a life of contract, single-contract-month, continuous chart. This can be seen below in Chart I-3.

You may have noticed on Chart I-3 that the price and time scale is not a correct Gann style scale. The reason is that I do not know of any software which can graph two sets of price data with a Gann style scale. It is important to say again that the astrological methods in this book can be applied to any style of bar chart. You do not need Gann style charts to use the astrological methods in this book.

2. Headings

Through out this book, except for Chapter 2, I have placed the chapter title and discussion heading at the beginning of each new discussion. In some places such as Chapter 5, you will see the chapter title and the discussion heading at the top of each page. This is because a new discussion starts on each page. In other chapters you will see the chapter title and discussion heading only once every several pages because the discussions are longer.

3. Numbering Of Figures, Tables & Charts

Figures, tables and charts are all numbered in sequence within each chapter. For example Figure 8-6, indicates that it is a "figure" in Chapter 8 and is the 6th exhibit. After Figure 8-6 comes Chart 8-7, which indicates it is a "chart" in Chapter 8 and is the 7th exhibit. All figures, tables, and charts are numbered this way in each chapter.

4. Basic Information Not Provided

In the book you are reading, I do not cover the non-astrological methods which are presented by William Gann in How To Make Profits Trading in Commodities . Gann does a good enough job of this. In Gann's book he teaches the important price patterns, how to divide the price range, how to deal with time periods, volume analysis, money management and more. In addition, Gann also gives advice on how to trade successfully. Do not skip Gann's advice, much of which is on pages 1 to 17 of Gann's book, it can provide you with valuable insight into trading profitably. Also, OBEY GANN'S "TWENTY-EIGHT VALUABLE RULES." These 28 rules can mean the difference between success and failure. Make sure you study all the non-astrological information presented by Gann in his book as I do not repeat it here.