Contents

Guide

Page List

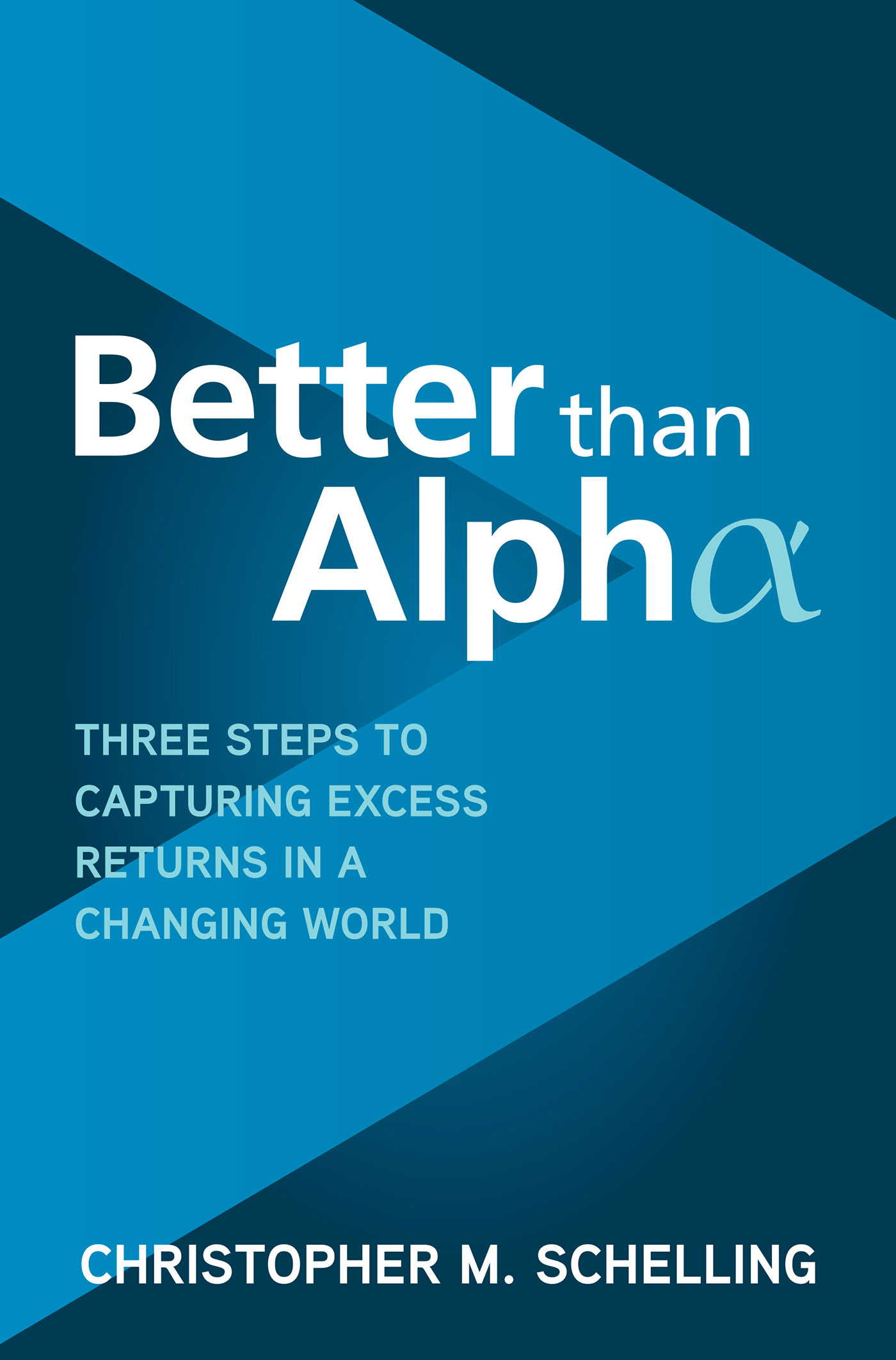

Copyright 2021 by Christopher M. Schelling. All rights reserved. Except as permitted under the United States Copyright Act of 1976, no part of this publication may be reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of the publisher.

ISBN: 978-1-26-425766-9

MHID: 1-26-425766-X

The material in this eBook also appears in the print version of this title: ISBN: 978-1-26-425765-2, MHID: 1-26-425765-1.

eBook conversion by codeMantra

Version 1.0

All trademarks are trademarks of their respective owners. Rather than put a trademark symbol after every occurrence of a trademarked name, we use names in an editorial fashion only, and to the benefit of the trademark owner, with no intention of infringement of the trademark. Where such designations appear in this book, they have been printed with initial caps.

McGraw-Hill Education eBooks are available at special quantity discounts to use as premiums and sales promotions or for use in corporate training programs. To contact a representative, please visit the Contact Us page at www.mhprofessional.com.

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that neither the author nor the publisher is engaged in rendering legal, accounting, securities trading, or other professional services. If legal advice or other expert assistance is required, the services of a competent professional person should be sought.

From a Declaration of Principles Jointly Adopted by a Committee of the

American Bar Association and a Committee of Publishers and Associations

TERMS OF USE

This is a copyrighted work and McGraw-Hill Education and its licensors reserve all rights in and to the work. Use of this work is subject to these terms. Except as permitted under the Copyright Act of 1976 and the right to store and retrieve one copy of the work, you may not decompile, disassemble, reverse engineer, reproduce, modify, create derivative works based upon, transmit, distribute, disseminate, sell, publish or sublicense the work or any part of it without McGraw-Hill Educations prior consent. You may use the work for your own noncommercial and personal use; any other use of the work is strictly prohibited. Your right to use the work may be terminated if you fail to comply with these terms.

THE WORK IS PROVIDED AS IS. McGRAW-HILL EDUCATION AND ITS LICENSORS MAKE NO GUARANTEES OR WARRANTIES AS TO THE ACCURACY, ADEQUACY OR COMPLETENESS OF OR RESULTS TO BE OBTAINED FROM USING THE WORK, INCLUDING ANY INFORMATION THAT CAN BE ACCESSED THROUGH THE WORK VIA HYPERLINK OR OTHERWISE, AND EXPRESSLY DISCLAIM ANY WARRANTY, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. McGraw-Hill Education and its licensors do not warrant or guarantee that the functions contained in the work will meet your requirements or that its operation will be uninterrupted or error free. Neither McGraw-Hill Education nor its licensors shall be liable to you or anyone else for any inaccuracy, error or omission, regardless of cause, in the work or for any damages resulting therefrom. McGraw-Hill Education has no responsibility for the content of any information accessed through the work. Under no circumstances shall McGraw-Hill Education and/or its licensors be liable for any indirect, incidental, special, punitive, consequential or similar damages that result from the use of or inability to use the work, even if any of them has been advised of the possibility of such damages. This limitation of liability shall apply to any claim or cause whatsoever whether such claim or cause arises in contract, tort or otherwise.

Contents

Acknowledgments

During my career, I have worked with some fantastic investors, mentors, and colleagues, all of whom together are too numerous to list. But I would be remiss if I didnt explicitly thank Keith Black and TJ Carlson. No one has been more instrumental in my approach to research and investing than Keith, nor anyone so influential to my thoughts on management and governance as TJ. I am indebted to both.

Of course, I must thank my editor Stephen Isaacs and the rest of the team at McGraw Hill for shepherding an entirely unprepared new author through the publishing process. His patience and counsel have been much appreciated. I have also been fortunate enough to profit from the confidence placed in me as a writer and the generous benefit of helpful edits over the years by my colleagues at Institutional Investor, namely Mimi Chiahemen for her tireless support, Amanda Cantrell for her unerring improvements to my work, and of course Leanna Orr and Kip McDaniel for their leadership. I would not be an author without them.

This book was also immeasurably improved by the input of several friends who generously gave of their time to read drafts of the manuscript and make helpful suggestions along the way, including Brian Portnoy, Gailen Krug, Bruce Cundick, Ben Happ, and last but most emphatically not least Tom Masthay. I greatly appreciate their insights.

Lastly, to my readers: Writing a book on investments is an act of hubris, insanity, or most likely some combination of the two. Ill leave it to you to decide which relative proportions apply in this case, but Im incredibly grateful for your attention nonetheless. I can say with absolute certainty I have learned far more from writing this than you will from reading it, so thank you for indulging me.

1

What Is Alpha?

Tactics without strategy is the noise before defeat.

SUN TZU

Introduction

Whether you are a young employee entering the workforce and beginning to save for retirement, a middle-aged executive putting money aside for college tuition for your kids, or a pension plan manager investing billions to generate the income that retired pensioners will use to pay for their groceries and mortgages, we all need to invest. But figuring out how isnt so easy.

One of the challenges consumers of financial products face, individuals and institutions alike, is deciphering the seemingly unending stream of acronyms, buzzwords, and professional jargon created by this increasingly specialized and technical industry. Too often, the point is not to move toward clarity for clients, but rather to create confusion and opacity by drowning them in interminable verbosity.

After all, an uninformed and confused client makes for a more profitable counterparty, just like the easy mark at the poker table. If people dont fully understand what they are buying, and cant assess the relevant risk and potential conflicts of interest, they certainly wont be able to appropriately price the asset or service.

Complexity is beguiling. It could be the synthetic collateralized debt obligations that were marketed and sold by investment banks during the global financial crisis as high-quality bonds despite being made up of credit default swaps, which themselves were derivatives of other underlying shaky loans. Or it might be a relative-value hedge fund with thousands of line items across dozens of strategies and little transparency other than the impressive math credentials of the founders and some aggregated risk statistics. But as a result of this complexity, the Street usually gets the investor to overpay.