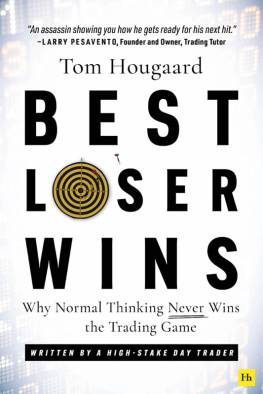

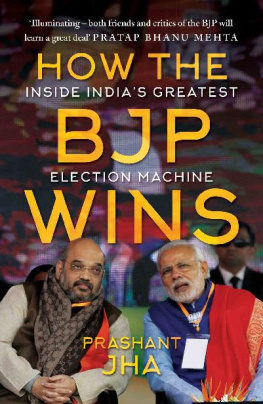

Tom Hougaard - Best Loser Wins

Here you can read online Tom Hougaard - Best Loser Wins full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2022, publisher: Harriman House Ltd, genre: Business. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Best Loser Wins

- Author:

- Publisher:Harriman House Ltd

- Genre:

- Year:2022

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

- 60

- 1

- 2

- 3

- 4

- 5

Best Loser Wins: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Best Loser Wins" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Best Loser Wins — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Best Loser Wins" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

BEST

LOSER

WINS

BEST

LOSER

WINS

Why Normal Thinking Never

Wins the Trading Game

Tom Hougaard

harriman house ltd

3 Viceroy Court

Bedford Road

Petersfield

Hampshire

GU32 3LJ

GREAT BRITAIN

Tel: +44 (0)1730 233870

Email:

Website: harriman.house

First published in 2022.

Copyright Tom Hougaard

The right of Tom Hougaard to be identified as the Author has been asserted in accordance with the Copyright, Design and Patents Act 1988.

Paperback ISBN: 978-0-85719-822-8

eBook ISBN: 978-0-85719-823-5

British Library Cataloguing in Publication Data

A CIP catalogue record for this book can be obtained from the British Library.

All rights reserved; no part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise without the prior written permission of the Publisher. This book may not be lent, resold, hired out or otherwise disposed of by way of trade in any form of binding or cover other than that in which it is published without the prior written consent of the Publisher.

Whilst every effort has been made to ensure that information in this book is accurate, no liability can be accepted for any loss incurred in any way whatsoever by any person relying solely on the information contained herein.

No responsibility for loss occasioned to any person or corporate body acting or refraining to act as a result of reading material in this book can be accepted by the Publisher, by the Author, or by the employers of the Author.

The Publisher does not have any control over or any responsibility for any Authors or third-party websites referred to in or on this book.

To the girl at the Bloomberg terminal

CONTENTS

F rom the moment I first came across you, I have been fascinated by you. I probably even fell in love with you. I was too young to know what that meant, no more than ten years old. You were featured in a national newspaper a competition of sorts.

I was too young to play with you, so I observed. Time was not on my side. I was born a few decades too soon to participate in trading like it is possible today. I had to go and live my early life and you went about yours.

When you went through the devastating bear market of 1973, I was just learning to walk. When you roared with anger during the crash of 1987, I was just finishing school. When you took the first steps towards the epic 1990s bull market I was almost ready. But not quite there yet.

So, you sent me a message that would change my life, and I took you up on the invitation, leaving everything behind me to pursue you. I studied you at university, two degrees in fact. I toiled for hours and hours, trying to understand you through the eyes of the conventional economic thinkers, through the eyes of Nobel Prize recipients, and through the eyes of well-meaning journalists and experts.

I wish you could have told me back then not to bother. You are not an equation to be solved. You are far more complex than a model could ever capture. Over and over, you prove yourself to be the elusive mistress that no one every truly understands. You are everywhere and you are nowhere. Universal laws do not apply to you.

My love for you was deep. You gave me so much joy. I gave you my all. You were there when I woke up, and you were there when I went to sleep. You have elevated me when I was fluid, rewarded me beyond my wildest dreams when I was flexible. You have punished me when I was rigid and stubborn, taking all your gifts back with interest.

And boy did I pursue you. I pursued you like a lovestruck teenager. I approached you from all angles, from Fibonacci ratios to Keltner Channels, to Bollinger Bands, to Trident strategies, as well as mythical vibrations of Gann and Murry Math.

I developed models of the tide swell in the Hudson River to see if you responded to that. I printed out thousands and thousands of charts, applying lines and circles, trying to find a way to dance with you so that my feet didnt get stamped on so much.

I had sore toes, my love. Sometimes my toes were so sore that I had to go to the beach and just throw stones in the water for hours on end, angry that you didnt want to do the tango with me.

You gave me sleepless nights. You gave me tears in my eyes, anger in my body, hurt in my soul, and yet I couldnt let you go. I knew there was more to it, and I knew I had to keep looking.

I gave you everything because you made me feel alive. You gave me a purpose. You gave me challenges so hard even a drill sergeant would have to give you a nod of respect. And I will always love you for it. You kept me on my toes, like a parent wanting only the best for their child.

But you made the lessons obscure. You designed it to look easy. But it was never easy. You made everyone believe that you could be danced with through models, through equations, through indicators, through conventional thinking and through logic. But often there is little logic to you. And I struggled to dance with you for years, until one day by chance you told me your secret. You told me to stop trying to understand you. You told me to understand myself.

I stopped trading. I took the time to understand myself, and I came back. And when I returned to the dance floor, you welcomed me with open arms, smiled, and said, Welcome back, I see you get it now. Did you bring the band-aids?

And I did. Best loser wins.

H ow you feel about failure will to a very large degree define your growth and your life trajectory, in virtually every aspect of your life.

You may want to close this book and think about that for a while. It is quite frightening how deep that sentence is.

What 99% of traders do not realise is that they are looking for answers in the wrong places. Knowledge of technicals, fundamentals, indicators, ratios, patterns and trend lines well, everyone knows about them and everyone loses, except the 1%.

What do the 1% do that the 99% is not doing?

What am I doing, enabling me to have the success in trading that I have, which the others are not doing?

The answer is as simple as it is complex. I am an outstanding loser.

The best loser wins.

I have conditioned my mind to lose without anxiety, without loss of mental equilibrium, without emotional attachment, and without fostering feelings of resentment or desire to get even .

It is because of how my mind works that I am able to trade in the way that I do. My knowledge of technical analysis is average at best. My knowledge of myself is what sets me apart.

The true measure of your growth as a human being is not what you know, but rather what you do with what you know.

I wrote this book to describe how I transformed myself into the trader I am today, and how I was able to bridge the gap between what I knew I was capable of, and what I actually achieved.

M y name is Tom Hougaard. I am 52 years old. Thirty years ago, I left my native Denmark. I wanted to trade the financial markets and I wanted to do it in London.

I had an idea of what I needed to do to become a trader. I got a BSc in Economics and MSc in Money, Banking and Finance. I thought I had everything I needed to become a trader: the right kind of education; a good work ethic; and passion for the markets.

I was wrong.

On paper, I was qualified to navigate the financial markets. In reality, educational qualifications mean little in the dog-eat-dog world of trading.

Font size:

Interval:

Bookmark:

Similar books «Best Loser Wins»

Look at similar books to Best Loser Wins. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Best Loser Wins and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.