Copyright 2021 Steve Leeds

Published by Hopecast Publishing, a subsidiary of Hopecast LLC

All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the publisher, except in the case of brief quotations embodied in critical reviews and certain other noncommercial uses permitted by copyright law. For permission requests, write to the publisher, addressed Attention: Permissions Coordinator, at the address below.

http://www.hopecastpublishing.com

ISBN: 978-1-7373081-0-2 (print)

ISBN: 978-1-7373081-1-9 (ebook)

Ordering Information:

Special discounts are available on quantity purchases by corporations, associations, and others. Please go to http://www.hopecastpublishing.com for more details.

A sk anyone who loves analytics and theyll tell you that theres something very exciting about finding some pattern in data that no one has really noticed before and can actually be used to have a positive impact on the business. While marketing and sales teams are trying to figure out where they should put their effort and investment to keep the business growing, analytic groups are trying to find useful patterns buried in the different available company databases, and find a way to clearly summarize those findings. When theyre all on the same page, speaking the same language, and the results are not only insightful, but actionable, youll have a great experience on both sides. Moments like these are where analytics meets the business.

While all of this sounds like a great recipe for success, there is an all too common disconnect that occurs and creates frustration from those receiving the results of an analytic effort. Whether its spoken aloud or just barely whispered under their breath in frustration, its not unusual for them to say or think, What should I do with all these reports, spreadsheets, and dashboards? What are the key findings? What do I really need to know? Weve got a business to run!

It seems like a year doesnt go by where there isnt some survey that points out that companies are investing more in analytics or Big Data, but are still finding a big gap. Some point to the organizations lack of resource and/or know-how for data management, lack of focus, not hiring the proper analytical talent, or organizational structure as common roadblocks.

Whats also common in these reports is that, for the companies that are seeing progress, theres always that prediction that the major gaps will be closing in two to five years. When I see that same type of survey the following year, the results seem to be mostly the same, but once again, it will say things will improve over the next two to five years.

While some of the proposed solutions make a lot of sense in terms of how to fix the structure or improve the culture at a high-level, there is very little an analyst in the trenches can grab onto to help with their day-to-day struggles in supporting their internal clients with the key information they really need. There also seems to be a lot of focus on the latest analytic hot areas, from big data to machine learning to artificial intelligence.

While technological developments continue to improve, and understanding both analytic and data extraction techniques are important, what seems to be missing is how to navigate the interaction and communication between the analysts and the clients they support. If both parties are disconnected or not talking the same language, or both, no amount of structural planning or cool software can bridge that gap.

This book is focused on cleaning up that link that many times goes broken between analyst and client. It offers a way of working that will help the analyst focus more on being a successful analytical communicator, data translator, and ultimately the detective that gets the call when theres an important analytical case to solve.

CHAPTER 1

T he latest data just came in, and the company Not Enough Inc. (NEI) is seeing a slowdown in sales volume for its top product. Folks are concerned and want answers. As the companys marketing team, sales head, and product analyst file into the conference room, theres that general sinking feeling this is going to be an intense start to the week.

As they get started, the team leader opens by saying, Hope everyone had a good weekend. We just received another data point this morning and we continue to see a slowdown in sales. As we go through some of the slides with the updated information, Im asking for some real answers about the key drivers of this downward trend, and suggestions for actions we can take to move things back in the right direction.

The marketing department steps up to present their slides.

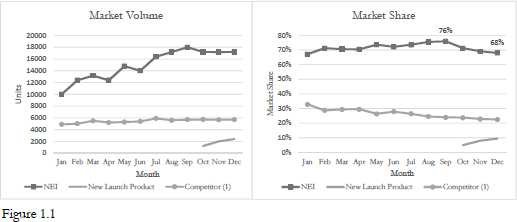

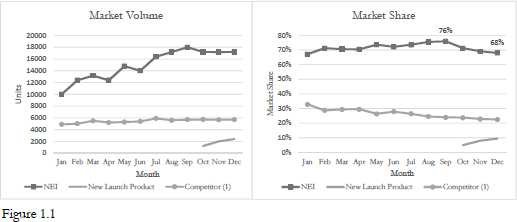

As you can see, our sales volume continues to remain flat this month, and our new competitor is having a pretty decent launch of their new product, the head of marketing says.

The team leader looks around and takes note of the mixed concentration. Looking a little annoyed he points out, I understand that when a competitors new product launches they are going to get some of our business, and its not uncommon for our share to slow up a bit, but the drop is more than I expected. Why do you think thats happening?

At this point the team leader looks around the room making eye contact quickly with each person in the room.

We heard our competitor has put a fair amount of resourcing against this launch, as well as providing a large number of free samples to our top customers across the country, the marketing head says.

Thats standard practice for new product launches, so Im still not understanding the drop, the team leader says.

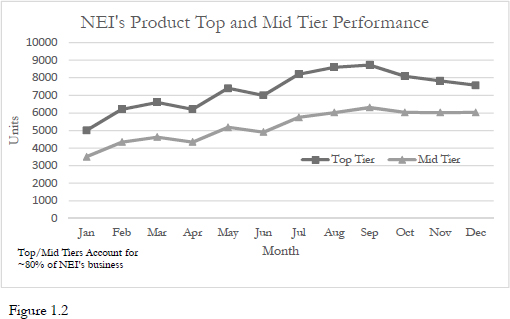

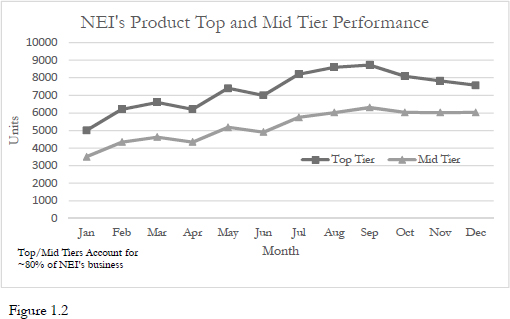

Agreed, the marketing head says. We are going through the different usual suspects to see if any patterns arise. We first looked at our top-tier customers as well as our mid-tier customers to see if anything dramatic was happening there. When we look at those two groups nationally, we see similar patterns of slowdown, however, that slowdown is a little stronger among our top-tier customers.

A slide goes up that shows the top and mid-tier customer lines, with the top-tier line slowing down more than the mid-tier line.

Why do you think this might be happening? the team leader asks.

Usually, when new products launch, the early adopters of those products are in the top-tier.

Okay. Can you pull together a list of those customers, so we can take a look at them?

The marketing lead looks over at the analytics person to get quick visual confirmation that theyre not going to promise something that cant be delivered. Head is nodding.

Sure. We can pull that list together after the meeting.

And what about patterns? Are we seeing any patterns across our SKUs?

Next page

![EMC Education Services [EMC Education Services] - Data Science and Big Data Analytics: Discovering, Analyzing, Visualizing and Presenting Data](/uploads/posts/book/119625/thumbs/emc-education-services-emc-education-services.jpg)