Kevin Bailey - Candlestick Trading: A Comprehensive Beginners Guide to Learn the Realms of Candlestick Trading from A-Z

Here you can read online Kevin Bailey - Candlestick Trading: A Comprehensive Beginners Guide to Learn the Realms of Candlestick Trading from A-Z full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. genre: Business. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Candlestick Trading: A Comprehensive Beginners Guide to Learn the Realms of Candlestick Trading from A-Z

- Author:

- Genre:

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

Candlestick Trading: A Comprehensive Beginners Guide to Learn the Realms of Candlestick Trading from A-Z: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Candlestick Trading: A Comprehensive Beginners Guide to Learn the Realms of Candlestick Trading from A-Z" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

If this sounds like you, keep reading!

Its hard to know where to start, as a retail investor. Theres plenty of terms, and words, out there for what youre looking for, but its a slog to have to sift through and figure out what you need to know.

One thing that circles around is the concept of candlestick trading in the forex market. But what does it mean?

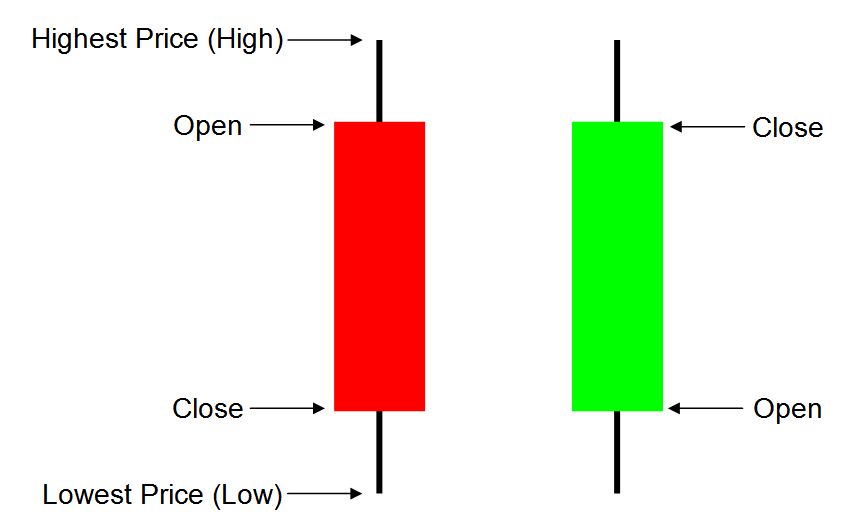

In the forex market, candlestick trading is a prominent method of technical analysis. Forex candlestick trading is used by both experienced and novice traders. This trading approach can be quite profitable if you can recognize market price trends and position your transactions correctly. Candlesticks are used to chart price movement by presenting the high, low, open, and close prices for the selected time period. Depending on whether the candlestick ends higher or lower than the initial price, it will be colored differently, commonly red or green, with red denoting a down candle and green denoting a higher candle.

The following are some of the things youll learn in this book:

- What exactly is Candlestick Trading;

- What are the common patterns to follow in Candlestick Trading;

- A Beginners guide to bullish and bearish patterns;

- How do you know when to buy and when to sell, and following trends;

- Two-pattern candles, three-pattern candles, and other patterns you should keep an eye on;

- What it means to trade binary patterns in candlestick, and other technical terms youll need to know;

- Mistakes beginners always make, and how to avoid them;

AND SO MUCH MORE!

It doesnt matter if this is your first foray into the trading world, or if youre venturing into new means of passive income in the market; Candlestick is regarded as one of the most effective and successful trading methods, but only when done correctly.

But thats the question, right? How to do it correctly, how you can start making real money with candlestick trading? If this is on your mind, if you have questions and dont know where to start then this book was made for you! Full of common mistakes, advise, and best practices look no further, help is here and ready for you.

So dont waste another minute! Scroll up, hit BUY NOW - learn today so you can earn tomorrow!

Kevin Bailey: author's other books

Who wrote Candlestick Trading: A Comprehensive Beginners Guide to Learn the Realms of Candlestick Trading from A-Z? Find out the surname, the name of the author of the book and a list of all author's works by series.