AN EASY APPROACH TO JAPANESE CANDLESTICKS

Stefano Calicchio

published in: 2013

Disclaimer

This book does not constitute a consultation or solicitation to the public saving in any way. Dealing with Exchange is a risky activity. The reader is fully aware and responsible for his own financial decisions and the risks related to any type of activity.

By such a disclaimer, the Author declines any responsibility on possible inaccuracies of reported data, damages, economic losses, consequential direct or indirect damages by the use or popularization of the information contained within this book. Copyright: 2012 Standard license - All rights reserved.

Introduction

Would you like to discover one of the most well-known price Analysis Technique used by professional traders and companies? Would you like to learn and understand the market and its financial tools with a simple glimpse? Have you ever stopped thinking about how you could learn and immediately recognize the patterns and the predictable schemes of the market? If the answer to these questions is yes, the Japanese candlesticks are the best for you.

While financial trading was acquiring more and more importance, the Japanese candlesticks managed to be amazingly successful all around the world in the last years.

However, they owe their success to online trading, as well as to evolved graphic software and charting tools. Today all the brokers allow their own clients to visualize the market prices according to the candlesticks bar rules.

This methodology can also be learnt in a simple and efficient way even by those who are not experts on financial markets, especially from a mathematical, statistical point of view. Furthermore, the Japanese candlesticks can offer an interpretative immediateness and a trading efficiency.

The purpose of this guide is to provide you with the tools that you can apply to your daily work.

A First Look at the Japanese Candlesticks

In the next pages, you will learn the configurations of the Japanese candlesticks prices. This means that you will be offered the opportunity to study numerous price patterns or schemes, which are generally formed by two or more candlesticks. You will go into the implications of every configuration and you will be able to see them at work during a trend investment or a trend continuation.

Technical Analysis is the subject from which the statistic observations of the market come. The premise is that the facts happened in the past can cyclically repeat in the future. This way, if you can identify the candlesticks that have been able to anticipate some important graphic movements by a statistic value, you can take advantage of this knowledge in the future market.

Obviously, although there is no guarantee that the future and the past can be the same, this knowledge can help your background and turn out to be better over your competitors.

It is suitable to point out in this early phase that the Japanese candlesticks are just a simple analysis and interpretation tool, so this is how they must only be used.

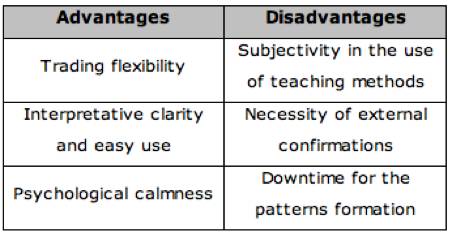

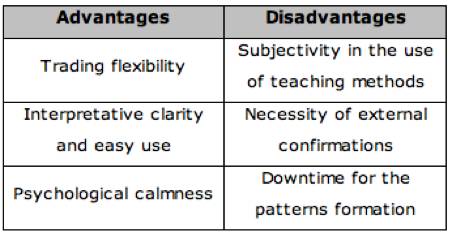

This is why we have to start up by considering some typical candlesticks advantages and disadvantages, before starting a real trading operation.

Among the numerous strong points of this technique, we can quote:

The immediateness and speed by which a skilled analyst can recognize the price schemes inside a graphic candlestick;

The extreme application flexibility, due to the fact that the Japanese candlesticks analysis can be applied to any kind of market (not only a financial one) and that a historical series of a price chart can be available;

The psychological calmness that a trader can acquire by having at disposal a tool that allow him to understand what can happen in the market.

Moreover, we have to bear in mind some limits:

The signs that can produce a mistake because of a superficial valuation or interpretation;

The occasional necessity to find a confirmation which can come from different analysis tools like indicators and oscillators, before sending a market order;

The obligation to suit this technique to the corresponding market, due to the fact that some price charts seem to work better in a strong liquidity or in a volatility context;

The necessity to wait for the chart to be closed, in order to understand its real value, that is to say, before being able to appraise positively the trading signs.

By outlining what we have just stated, you can observe that the advantages are much higher than the possible application limits:

To sum up, learning how a Japanese candlestick can work will offer you a great advantage over all the market traders that ignore its potentialities. Likewise, it is important not to apply scholastically a candlesticks technique.

Experience and constancy will also help you to study and understand which patterns will be the best and what charts will be more functional for your financial working tools.

Brief Candlesticks History

It is the name of the Japanese candlesticks itself to suggest the origin and the background of this technique. Since The Candlestick Analysis was born in Japan in 1700 in the rice markets, hundreds of years of researches and applications have been made.

At that time, rice was the principal goods of exchange in Japan. A rich merchant, Munehisa Homma, understood the cyclical repetition of the same patterns and prices on rice trading futures. This is why he decided to exploit this idea and plan his own speculative strategy.

What he understood was so extraordinary that his name became legendary throughout Japan. He was considered the best trader of that time and became a government advisor of the Imperial Japan, which awarded him with the most important honors. In the meantime, he accumulated such a real fortune that he became the richest man in the country.

Before dying, at the beginning of 1800, he left a book to the posterity about trading and psychological market rules. He entitled it The Golden Fountain, which was the first book to deal with the financial markets through an innovative approach of interpretative analysis of the price movements.

In his book, Homma Munehisa explained that the convictions and the emotions of the traders have a conclusive influence on the movement of rice prices and that it could be used to plan a successful trading strategy.

Thanks to his extraordinary activity, today we have the possibility to study and apply the Japanese candlesticks technique.

Basic information

The first thing to learn is to understand how a Japanese candlestick can take shape.

The most evident difference between a traditional financial chart and a Japanese candlestick is about how they can be observed by traders. A candlestick is a price line divided into many single bars, which are similar to a candle.

Each of them takes shape and develops according to two factors:

The temporal sample with which the construction of a price chart is planned;

The volatility measure that the financial tool has shown while it is observed.

These points immediately highlight an interesting norm: the Japanese candlesticks can visually offer a different representation of the price volatility, which is a factor that facilitates enormously the task to understand the markets. The easiest way to notice this difference consists in comparing the same financial tool according to the graphic representation rules.