Praise for Mastering Financial Pattern Recognition

Very well written. The book makes complicated stuff an easy read and is a must if you are passionate about trading.

Saby Upadhyay, CEO, White Swan Global Markets

An extremely useful book for those interested in technical analysis, especially candlestick analysis. Easy to read and follow. I highly recommend this book for beginners and veterans alike.

Sattam Al-Sabah, president, OneUp Trader

Provides a wealth of information on technical analysis and candlestick charting. Having the Python code as a starting point helps the reader implement and understand things that much faster.

Timothy M. Kipper, Jr., founder, JDTK Investments

A comprehensive guide for trading using candlestick pattern-based signals, with detailed illustrations of indicators, easily implementable code, and a thorough overview of building your own systematic trading strategy.

Ning Wang, quantitative investment strategies structurer, Barclays

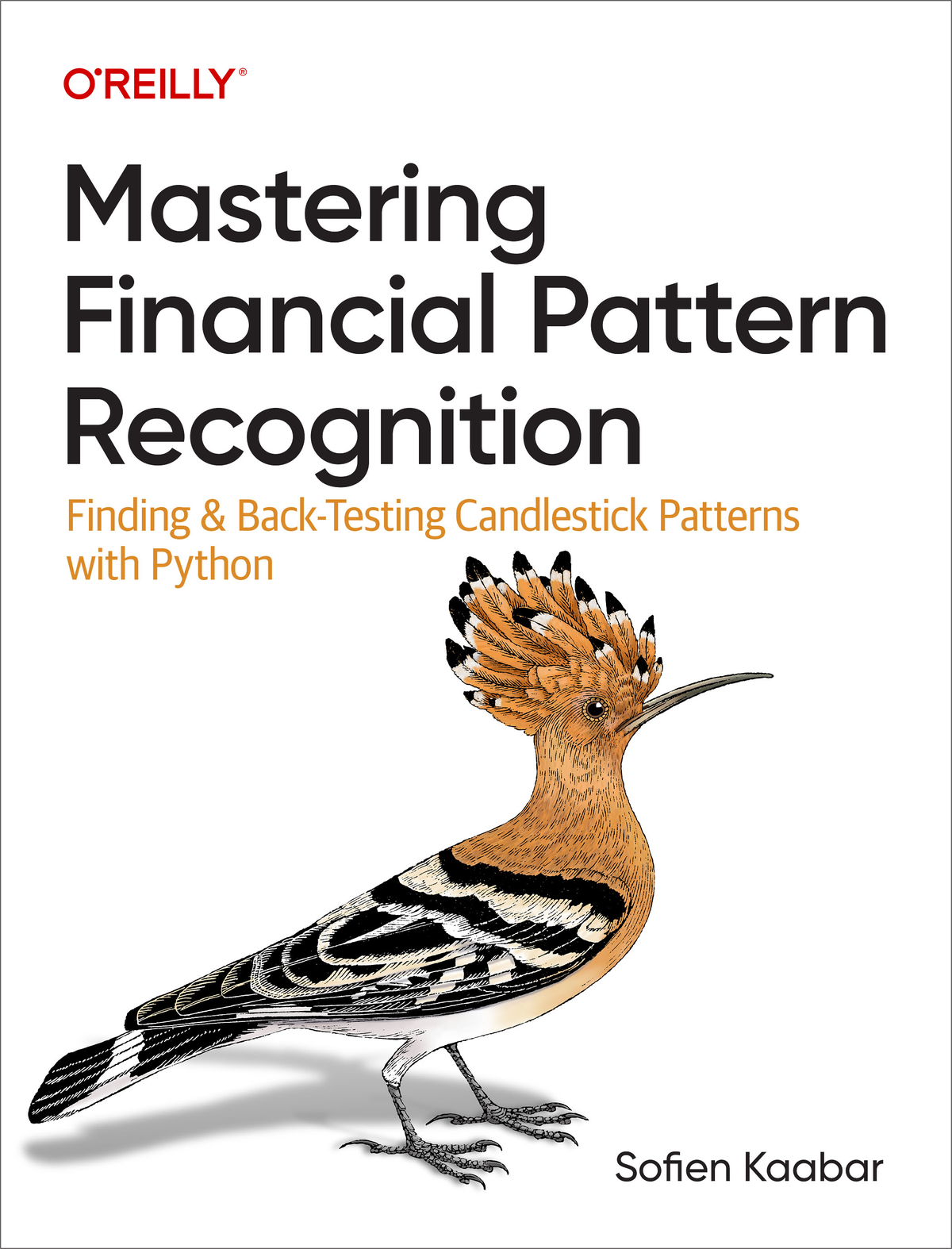

Mastering Financial Pattern Recognition

by Sofien Kaabar

Copyright 2023 Sofien Kaabar. All rights reserved.

Printed in the United States of America.

Published by OReilly Media, Inc. , 1005 Gravenstein Highway North, Sebastopol, CA 95472.

OReilly books may be purchased for educational, business, or sales promotional use. Online editions are also available for most titles (http://oreilly.com). For more information, contact our corporate/institutional sales department: 800-998-9938 or corporate@oreilly.com .

- Acquisitions Editor: Michelle Smith

- Development Editor: Corbin Collins

- Production Editor: Elizabeth Faerm

- Copyeditor: Kim Wimpsett

- Proofreader: Paula L. Fleming

- Indexer: Potomac Indexing, LLC

- Interior Designer: David Futato

- Cover Designer: Karen Montgomery

- Illustrator: Kate Dullea

- October 2022: First Edition

Revision History for the First Edition

- 2022-10-18: First Release

See http://oreilly.com/catalog/errata.csp?isbn=9781098120474 for release details.

The OReilly logo is a registered trademark of OReilly Media, Inc. Mastering Financial Pattern Recognition , the cover image, and related trade dress are trademarks of OReilly Media, Inc.

The views expressed in this work are those of the author and do not represent the publishers views. While the publisher and the author have used good faith efforts to ensure that the information and instructions contained in this work are accurate, the publisher and the author disclaim all responsibility for errors or omissions, including without limitation responsibility for damages resulting from the use of or reliance on this work. Use of the information and instructions contained in this work is at your own risk. If any code samples or other technology this work contains or describes is subject to open source licenses or the intellectual property rights of others, it is your responsibility to ensure that your use thereof complies with such licenses and/or rights.

978-1-098-12047-4

[LSI]

Preface

Finding patterns is the essence of wisdom.

Dennis Prager

With technological progress and the decentralization of financial information, coding and automated research have become integral parts of the trading world. Anyone who masters the art of trading and coding has a tremendous edge in the markets.

Trading techniques are numerous, and they can be based on many tools and concepts. For example, fundamental traders rely on economic and political analyses to derive a long-term view on different assets, while technical traders rely on more quantitative measures and a few psychological concepts to forecast the next likely moves of the markets.

Therefore, we can say that on a high level there exist two types of analyses, fundamental and technical. This book will present in detail a field in technical analysis called candlestick pattern recognition.

Why This Book?

I have spent my career researching trading strategies, patterns, and anything related to the financial world. I have developed a special passion for patterns, and specifically candlestick patterns, due to their widespread adoption but also their interesting performance results. Moreover, throughout the years, I have discovered a few candlestick patterns that I believe can at least rival the classical patterns. This brings us to the purpose of writing the book: I am aiming to present the totality of candlestick patterns, including my personal ones, and how to code a system that back-tests them across a wide variety of markets.

Machines can perform pattern recognition and detection better than humans because of their objectivity. Therefore, I have dedicated the first chapters of the book to creating the structure of a candlestick pattern recognition algorithm before moving on to dig deep into patterns and strategies in the later chapters. This means that the first skill you will learn is how to automate the data import process in Python.

There are many classical candlestick patterns, and it is everyones duty to test them to see whether they actually are predictive. After all, if we use these patterns to forecast the markets, we should have objective results that prove they are indeed value-adders. We will get such results and interpret them, just as I do with the candlestick patterns that I have discovered over the years. We will also see the advantages and limitations of every pattern.

When we do find the good patterns that help with the predictive task, you should insert them in the overall trading framework, which includes other tools and a risk management system. You will learn how to code technical indicators and combine them with candlestick patterns to create trading signals. Finally, you will back-test these signals, and you will be able to optimize the parameters so that you get a good full-scale pattern recognition strategy.

Hence, the utility of this book is to show you how to automate your research by letting the algorithms you create evaluate the different candlestick patterns. Finally, you will learn how to determine your strategy, which will use the patterns and combine with other technical indicators.

Target Audience

This book is suited to aspiring students, academics, curious minds, and finance practitioners who are interested in candlestick pattern recognition and its applications in finance. You will benefit from this book if you are interested not only in using Python but also in developing strategies and technical indicators.

The book assumes you have basic background knowledge in both Python programming (professional Python users will find the code very straightforward) and financial trading. I take a clear and simple approach that focuses on the key concepts so that you understand the purpose of every idea.

Conventions Used in This Book

The following typographical conventions are used in this book:

ItalicIndicates new terms, URLs, email addresses, filenames, and file extensions.

Constant widthUsed for program listings, as well as within paragraphs to refer to program elements such as variable or function names, databases, data types, environment variables, statements, and keywords.

Constant width boldShows commands or other text that should be typed literally by the user.

Constant width italic