GRAIN MARKETING

For farmers

by C. Paley

Copyright 2019, C. Paley. All rights reserved.

Contents

Chapter 1

Sometimes its Bullish; Sometimes its Bearish, The Commodities Market

Though farming is perhaps the oldest form of organized human activity in history, its not a static profession. Farming is constantly changing.

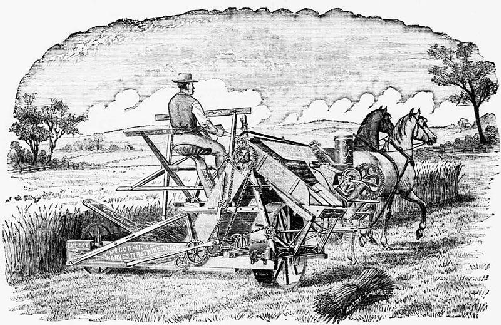

Of all the major farming innovations from the last several hundred years, few can match the revolution that came with Cyrus McCormicks reaper. The reaper is basically an automated harvesting machine that goes back to 1831. Prior to its invention grain was harvested by hand which was time-consuming and intensive. It only offered enough yield to be soaked up by the local economy, certainly not enough for exporting domestically or internationally.

1884 advertisement for an early McCormick reaper.

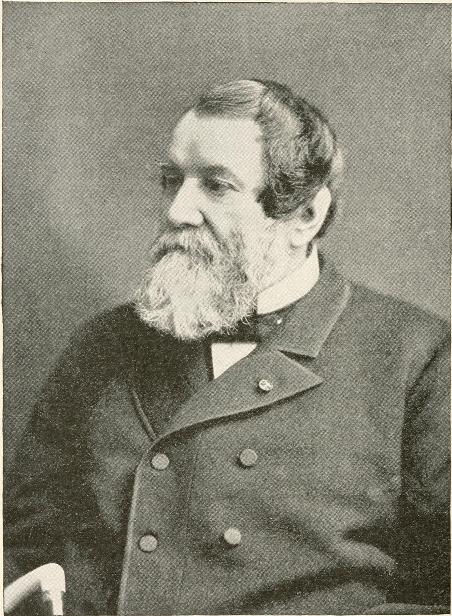

With the invention of the automatic reaper, farmers were suddenly able to harvest more grain a lot more grain. That excess grain production is what led to the grain market that we know today. Cyrus McCormick was only twenty-two when he invented the mechanical marvel that would change food production forever. With the ability to produce more grain, suddenly this staple of nutrition became more than just something to nourish the masses it was transformed into a commodity.

Cyrus McCormick. 1859.

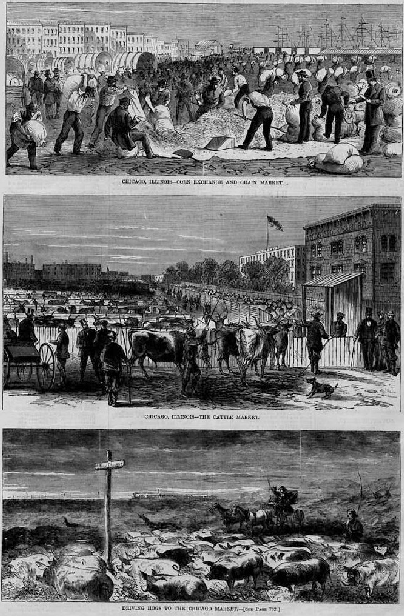

It wasnt long before farmers were bringing the extra grain to the marketplace. After all, if youve got more than you need, youre going to want to make something out of it. The income allowed farmers to expand. Grain production was seated in the Midwest, which is of course still the breadbasket of America, so farmers brought that excess grain into the largest city around (Chicago, Minneapolis, Kansas City), in order to get the best price. There wasnt a mechanism to deal with this massive influx of grain, as storage hadnt caught up with demand just yet. Farmers were literally just bringing bags of grain into the city.

Chicago Agriculture Market

This glutted the market, both in terms of price and in a physical sense. Prices plummeted, and there were mass amounts of grain that couldnt be sold just left to rot. The scene was a chaotic one in those heady, early days after the automatic reaper.

In years of plenty, prices dropped dramatically. In lean years of drought, prices skyrocketed. That completely unpredictable boom and bust cycle caused a great deal of uncertainty in the marketplace, and it created a sense of gambling in farming.

Less than twenty years after the introduction of the automated reaper in 1848, the Chicago Board of Trade was formed. This revolutionary Midwestern financial institution debuted the grain futures market in America, and were still trading in it today. It changed the way that grain farmers did business. The purpose of this futures market was to allow farmers to fix the price of their crop in the future rather than just accept whatever the market was offering during harvest. That grain futures market, combined with grain storage, is what gives farmers control over their sales process. Futures trading allowed them to contract for harvests that hadnt even been planted yet, and to effectively plan for the future. This seems like just the way that things are done today, but its important to keep history in our rearview mirror so that we can understand how things can change. Even in an ancient profession like grain farming.

Understanding grain markets is a key to farming success. Its a skill thats as important as knowing to work the land, though its one that farmers often neglect to learn with the same zeal. Your livelihood as a farmer is dependent on your ability to understand the grain marketing. Through this book, were going to walk you through a reliable structure that you can build up your selling process making it both reliable and successful.

In a bear market, the economy has a poor outlook and things arent going well. The bull, is when things are going well and theres money to be made. Everyone would love to see more of the bull, but farmers who plan smartly and understand the market can continue to be profitable even in times when the bear is dominant.

Todays farmers have to understand the behavior of bulls and bears in the marketplace as well as how seeds grow out of the ground.

Supply, demand, and technical stuff

Within grain markets, its all about supply, demand, and technical stuff. These are the big factors that farmers need to comprehend. Supply and demand set the general direction in which the market is going. Technical stuff show when a market rally is getting overheated or a bottom is starting to form. The combination of these factors determines the price.

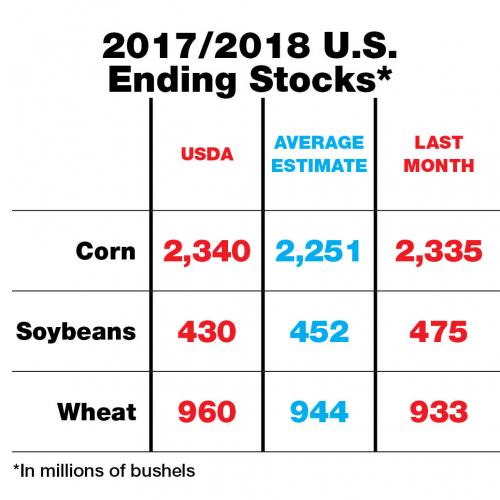

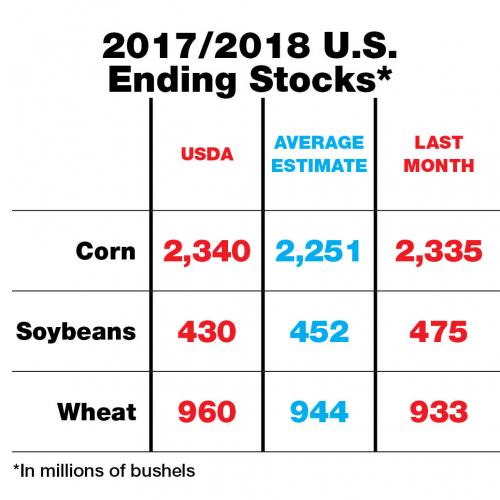

Image credit: Agriculture.com, Dec. 2018

The price and the general direction of the market is decided by whats going on in the supply and demand. In farming, supply is determined by farming issues like the weather. If its a tough planting season, crop yields are going to be lower as well as the planted acres. Theres going to be a higher price because theres a lower supply of grains. Supply is something that farmers can feel in an intimate way. Demand can be a bit more slippery and less intuitive. One key thing about international demand is that as the U.S. Dollar becomes stronger, other countries have an advantage in the market due to exchange rates. Commodities that compete with the US like Brazilian soybeans become cheaper relative to exchange rates.

Technical analysis is the place where farmers can take actions to improve profitability. There are many resources to help you learn about technical analysis, but one book every farmer should read is Market Wizards by Jack Schwager. Its a series of interviews with some top traders. Its a solid general resource on technical analysis.

Image credit: Jack Schwager

Technical analysis is basically looking at price, volume, and momentum indicators, then understanding how they change. Its charting short-term and long-term pricing. Theres usually a trading range established by the supply and demand fundamentals, and that trading range is almost always dictated by technical analysis. Lets walk through an example to dig deeper. Say corn has been trading between $4 and $5. Suddenly, it drops below $4. Now theres a new technical range for that corn. That $4 has become a resistance point, but now its trading between $3.50 and $4, the new range bound area. Until the supply and demand numbers give the market enough strength to move above the trading range, its going to stay in that range. Technical analysis is based on historical price data. People can develop a hypothesis for whats going to happen in the future based on whats happened in the past. Nicolas Darvas, author of How I made $2,000,000 in the Stock Market, was one of the first technical traders and his book is required reading for traders.

Next page