Contents

Since 1996, Bloomberg Press has published books for financial professionals, as well as books of general interest in investing, economics, current affairs, and policy affecting investors and business people. Titles are written by well-known practitioners, BLOOMBERG NEWS reporters and columnists, and other leading authorities and journalists. Bloomberg Press books have been translated into more than 20 languages.

For a list of available titles, please visit our Web site at www.wiley.com/go/bloombergpress .

Copyright 2012 by Jason Kelly. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com . Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may not be available in electronic books. For more information about Wiley products, visit our web site at www.wiley.com .

Library of Congress Cataloging-in-Publication Data :

Kelly, Jason, 1973

The new tycoons : inside the trillion dollar private equity industry that owns everything/Jason Kelly.

p. cm. (Bloomberg Press series)

Includes bibliographical references and index.

ISBN 978-1-118-20546-4 (cloth); ISBN 978-1-118-22851-7(ebk); ISBN 978-1-118-24081-6 (ebk); ISBN 978-1-118-26567-3 (ebk)

1. Private equity. I. Title.

HG4751.K45 2012

332.6dc23

2012017193

For Jen, Owen, William, and Henry

We accept and welcome... as conditions to which we must accommodate ourselves, great inequality of environment; the concentration of business, industrial and commercial, in the hands of a few; and the law of competition between these, as being not only beneficial, but essential for the future progress of the race.

Andrew Carnegie

Theres a certain part of the contented majority who love anybody who is worth a billion dollars.

John Kenneth Galbraith

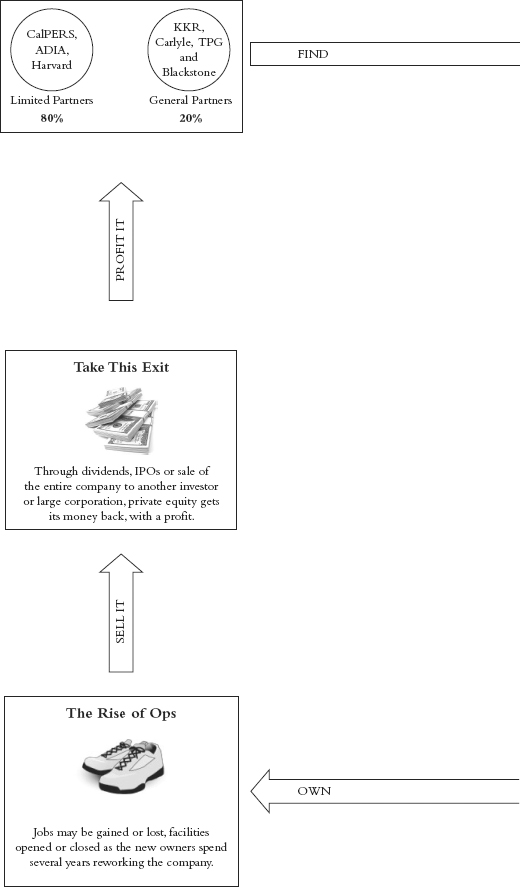

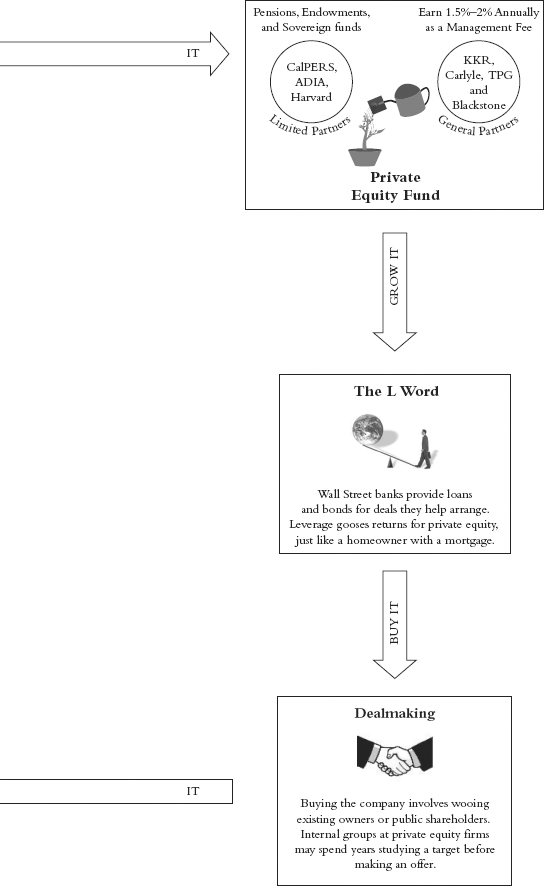

A Visual Tour of Private Equity

FOLLOWING THE MONEY

Deciphering Private Equity

You or someone you know almost certainly works for a company connected to private equity or is invested in a buyout fund through a pension or retirement account. Getting smart about the way these things work means getting comfortable with the alphabet soup of acronyms and abbreviations they use. Some are meant for pure shorthand, but others feel like theyre meant to give it a sheen of importance and others to obfuscate whats actually going on. For example: TPG and KKR arent likely to exit the TXU LBO through an IPO. There was no way they could do a recap, and the LPs will be lucky to get their money back. The GPs can probably forget about carry and its going to make a huge dent in the funds IRRs.

If youre in the business, feel free to skip ahead, but for anyone whos curious about the lingo, heres what you need to sound conversant, with explanations in plain English.

Firms and Players

Bain Capital : The private-equity firm founded by Mitt Romney. Distinct from Bain & Co., the consulting firm, where Romney and others at Bain Capital once worked, and that provided Bain Capital with its start.

Blackstone Group : Founded by Peter G. Peterson and Stephen Schwarzman in 1985 and headquartered in New York. Stock symbol: BX, on the New York Stock Exchange.

Carlyle Group : Founded by William Conway, Daniel DAniello, and David Rubenstein in 1987 and headquartered in Washington. Stock symbol: CG on the Nasdaq.

General partner : Abbreviated as GP, its another term for a private-equity manager. Blackstone, Bain, Carlyle, KKR, and TPG are GPs.

ILPA : The Institutional Limited Partners Association. A group of investors in private-equity funds who conceived a set of guidelines to encourage more transparency and lower fees. Usually pronounced as ILL-puh, it began as a supper club in the early 1990s and evolved into an influential trade association.

KKR : The firm founded by Jerome Kohlberg, Henry Kravis, and George Roberts in 1976. Headquartered in New York. Trades as KKR on the New York Stock Exchange.

Limited partner : Abbreviated as LP, these are the pensions, endowments, and sovereign wealth funds that commit the money that comprises private-equity funds. Public pensions in California and Washington are examples of LPs.

9 West : The iconic sloping building on West 57th Street in Manhattan that houses KKR, among other private-equity firms, and offers sweeping views of Central Park.

TPG : Created by David Bonderman, James Coulter, and William Price in 1992 and originally called Texas Pacific Group. Headquartered in Fort Worth, Texas, though most of its senior executives work in San Francisco. Not publicly traded.

Industry Terms

AUM : Assets under management. Refers to the value of funds overseen by a private-equity manager plus the value of the companies it owns through those funds.

Carried interest : Also known as carry, this is the portion of profits a private-equity manager keeps from a successful investment. Unlike salaries earned in other professions, carry is taxed at the lower capital gains rate instead of the tax rate for ordinary income. Some have argued that it should be treated as ordinary income, which would roughly double the taxes paid on thisincome by managers. Managers argue that carry is investment income akin to the sweat equity in an entrepreneurial venture and should be treated like a profit from selling a public stock or bond. The fight boiled over into a mainstream issue amid the Occupy Wall Street protests and the 2012 presidential election.