Lowenstein - When genius failed: the rise and fall of Long-Term Capital Management

Here you can read online Lowenstein - When genius failed: the rise and fall of Long-Term Capital Management full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. City: New York;United States, year: 2011;2000, publisher: Random House Publishing Group, genre: Detective and thriller. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:When genius failed: the rise and fall of Long-Term Capital Management

- Author:

- Publisher:Random House Publishing Group

- Genre:

- Year:2011;2000

- City:New York;United States

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

- 100

- 1

- 2

- 3

- 4

- 5

When genius failed: the rise and fall of Long-Term Capital Management: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "When genius failed: the rise and fall of Long-Term Capital Management" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Lowenstein: author's other books

Who wrote When genius failed: the rise and fall of Long-Term Capital Management? Find out the surname, the name of the author of the book and a list of all author's works by series.

When genius failed: the rise and fall of Long-Term Capital Management — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "When genius failed: the rise and fall of Long-Term Capital Management" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Contents

To

Maury Lasky

and

Jane Ruth Mairs

Past may be prologue, but which past?

HENRY HU

AUTHORS NOTE AND ACKNOWLEDGMENTS

This history of Long-Term Capital Management is unauthorized. At the projects outset, I was granted several formal interviews with two of the firms partners, Eric Rosenfeld and David Mullins, but such formal cooperation quickly ceased. Subsequent attempts to resume the interviews, and to gain formal access to John W. Meriwether, the founder, and others of the partners, proved fruitless. Nonetheless, over the course of my research, I repeatedly conveyed (via e-mail and telephone) seemingly endless lists of questions to Rosenfeld, and he generously consented to answer many of my queries. In addition, various Long-Term employees at all levels of the firm privately aided me in my research, helping me to understand both the inner workings of the firm and the nuances of many of the individual partners; I am deeply grateful to them.

My other primary sources were interviews conducted at the major Wall Street investment banks, including the six banks that played a crucial role in the genesis and ultimate rescue of Long-Term. Without the cooperation of many people at Bear Stearns, Goldman Sachs, J. P. Morgan, Merrill Lynch, Salomon Smith Barney, and Union Bank of Switzerland, this book could not have been written.

I also had generous tutors in economics. There were others, but Peter Bernstein, Eugene Fama, John Gilster, Bruce Jacobs, Christopher May, and Mark Rubinstein helped me to understand the world of options, hedging, bell curves, and fat tails where Long-Term plied its trade.

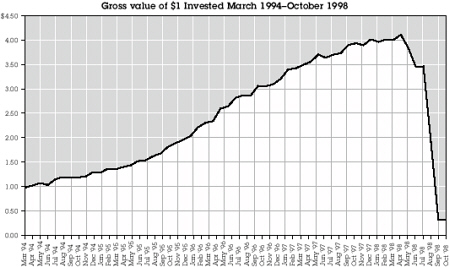

In addition, the confidential memorandum on the funds debacle prepared by Long-Terms partners in January 1999 provided facts and figures on the funds capital, asset totals, leverage, and monthly returns throughout the life of the fund, as well as information on the results of investors. It was an invaluable resource and, indeed, the source of many of the figures in this book. Finally, I am grateful to the Federal Reserve Bank of New York for its free-spirited cooperation.

Whenever possible, sources are indicated by an endnote. However, in many cases, I had to rely on sources that declined to be identified. Writing recent history is always a touchy business, and the Long-Term storyessentially, one of failure and disappointmentwas particularly delicate. Long-Terms partners are by nature private people who would have been uncomfortable with such a project during the best of times; that they were unenthusiastic about a history of such a titanic failure is only human. Therefore, I must ask the readers indulgence for the much material that is unattributed.

I am deeply grateful to Viken Berberian, a research aide who proved to be not only an intrepid gatherer of facts but a resourceful and insightful assistant. Neil Barsky, Jeffrey Tannenbaum, and Louis Lowensteintwo dear friends and a nonpareil dadtirelessly read this manuscript in crude form and provided me with invaluable and much-needed suggestions; their inspired handiwork graces every page. Melanie Jackson, my agent, and Ann Godoff, my editor, as unerring a team as Montana-to-Rice, skillfully shepherded this project from conception to finish. Their repeated shows of confidence lightened many otherwise solitary hours. And my three children, Matt, Zack, and Alli, were a continuing inspiration. Many others helped the author, both professionally and personally, during the course of writing this book, and my gratitude to them knows no bounds.

INTRODUCTION

The Federal Reserve Bank of New York is perched in a gray sandstone slab in the heart of Wall Street. Though a city landmark building constructed in 1924, the bank is a muted, almost unseen presence among its lively, entrepreneurial neighbors. The area is dotted with discount stores and luncheonettesand, almost everywhere, brokerage firms and banks. The Feds immediate neighbors include a shoe repair stand and a teriyaki house, and also Chase Manhattan Bank; J. P. Morgan is a few blocks away. A bit farther to the west, Merrill Lynch, the peoples brokerage, gazes at the Hudson River, across which lie the rest of America and most of Merrills customers. The bank skyscrapers project an open, accommodative air, but the Fed building, a Florentine Renaissance showpiece, is distinctly forbidding. Its arched windows are encased in metal grille, and its main entrance, on Liberty Street, is guarded by a row of black cast-iron sentries.

The New York Fed is only a spoke, though the most important spoke, in the U.S. Federal Reserve System, Americas central bank. Because of the New York Feds proximity to Wall Street, it acts as the eyes and ears into markets for the banks governing board, in Washington, which is run by the oracular Alan Greenspan. William J. McDonough, the beefy president of the New York Fed, talks to bankers and traders often. McDonough wants to be kept abreast of the gossip that traders share with one another. He especially wants to hear about anything that might upset markets or, in the extreme, the financial system. But McDonough tries to stay in the background. The Fed has always been a controversial regulatora servant of the people that is elbow to elbow with Wall Street, a cloistered agency amid the democratic chaos of markets. For McDonough to intervene, even in a small way, would take a crisis, perhaps a war. And in the first days of the autumn of 1998, McDonough did interveneand not in a small way.

The source of the trouble seemed so small, so laughably remote, as to be insignificant. But isnt it always that way? A load of tea is dumped into a harbor, an archduke is shot, and suddenly a tinderbox is lit, a crisis erupts, and the world is different. In this case, the shot was Long-Term Capital Management, a private investment partnership with its headquarters in Greenwich, Connecticut, a posh suburb some forty miles from Wall Street. LTCM managed money for only one hundred investors; it employed not quite two hundred people, and surely not one American in a hundred had ever heard of it. Indeed, five years earlier, LTCM had not even existed.

But on the Wednesday afternoon of September 23, 1998, Long-Term did not seem small. On account of a crisis at LTCM, McDonough had summonedinvited, in the Feds restrained idiomthe heads of every major Wall Street bank. For the first time, the chiefs of Bankers Trust, Bear Stearns, Chase Manhattan, Goldman Sachs, J. P. Morgan, Lehman Brothers, Merrill Lynch, Morgan Stanley Dean Witter, and Salomon Smith Barney gathered under the oil portraits in the Feds tenth-floor boardroomnot to bail out a Latin American nation but to consider a rescue of one of their own. The chairman of the New York Stock Exchange joined them, as did representatives from major European banks. Unaccustomed to hosting such a large gathering, the Fed did not have enough leather-backed chairs to go around, so the chief executives had to squeeze into folding metal seats.

Although McDonough was a public official, the meeting was secret. As far as the public knew, America was in the salad days of one of historys great bull markets, although recently, as in many previous autumns, it had seen some backsliding. Since mid-August, when Russia had defaulted on its ruble debt, the global bond markets in particular had been highly unsettled. But that wasnt why McDonough had called the bankers.

Next pageFont size:

Interval:

Bookmark:

Similar books «When genius failed: the rise and fall of Long-Term Capital Management»

Look at similar books to When genius failed: the rise and fall of Long-Term Capital Management. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book When genius failed: the rise and fall of Long-Term Capital Management and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.