introduction

The tip was intriguing. It was the fall of 2007, financial markets were collapsing, and Wall Street firms were losing massive amounts of money, as if they were trying to give back a decades worth of profits in a few brutal months. But as I sat at my desk at The Wall Street Journal tallying the pain, a top hedge-fund manager called to rave about an investor named John Paulson who somehow was scoring huge profits. My contact, speaking with equal parts envy and respect, grabbed me with this: Paulsons not even a housing or mortgage guy. And until this trade, he was run-of-the-mill, nothing special.

There had been some chatter that a few little-known investors had anticipated the housing troubles and purchased obscure derivative investments that now were paying off. But few details had emerged and my sources were too busy keeping their firms afloat and their careers alive to offer very much. I began piecing together Paulsons trade, a welcome respite from the gory details of the latest banking fiasco. Cracking Paulsons moves seemed at least as instructive as the endless mistakes of the financial titans.

Riding the bus home one evening through the gritty New Jersey streets of Newark and East Orange, I did some quick math. Paulson hadnt simply met with successhe had rung up the biggest financial coup in history, the greatest trade ever recorded. All from a rank outsider in the world of real estate investingcould it be?

The more I learned about Paulson and the obstacles he overcame, the more intrigued I became, especially when I discovered he wasnt alonea group of gutsy, colorful investors, all well outside Wall Streets establishment, was close on his heels. These traders had become concerned about an era of loose money and financial chicanery, and had made billions of dollars of investments to prepare for a meltdown that they were certain was imminent.

Some made huge profits and wont have to work another day of their lives. But others squandered an early lead on Paulson and stumbled at the finish line, an historic prize just out of reach.

Paulsons winnings were so enormous they seemed unreal, even cartoonish. His firm, Paulson & Co., made $15 billion in 2007, a figure that topped the gross domestic products of Bolivia, Honduras, and Paraguay, South American nations with more than twelve million residents. Paulsons personal cut was nearly $4 billion, or more than $10 million a day. That was more than the earnings of J. K. Rowling, Oprah Winfrey, and Tiger Woods put together. At one point in late 2007, a broker called to remind Paulson of a personal account worth $5 million, an account now so insignificant it had slipped his mind. Just as impressive, Paulson managed to transform his trade in 2008 and early 2009 in dramatic form, scoring $5 billion more for his firm and clients, as well as $2 billion for himself. The moves put Paulson and his remarkable trade alongside Warren Buffett, George Soros, Bernard Baruch, and Jesse Livermore in Wall Streets pantheon of traders. They also made him one of the richest people in the world, wealthier than Steven Spielberg, Mark Zuckerberg, and David Rockefeller Sr.

Even Paulson and the other bearish investors didnt foresee the degree of pain that would result from the housing tsunami and its related global ripples. By early 2009, losses by global banks and other firms were nearing $3 trillion while stock-market investors had lost more than $30 trillion. A financial storm that began in risky home mortgages left the worst global economic crisis since the Great Depression in its wake. Over a stunning two-week period in September 2008, the U.S. government was forced to take over mortgage-lending giants Fannie Mae and Freddie Mac, along with huge insurer American International Group. Investors watched helplessly as onetime Wall Street power Lehman Brothers filed for bankruptcy, wounded brokerage giant Merrill Lynch rushed into the arms of Bank of America, and federal regulators seized Washington Mutual in the largest bank failure in the nations history. At one point in the crisis, panicked investors offered to buy U.S. Treasury bills without asking for any return on their investment, hoping to find somewhere safe to hide their money.

By the middle of 2009, a record one in ten Americans was delinquent or in foreclosure on their mortgages; even celebrities such as Ed McMahon and Evander Holyfield fought to keep their homes during the heart of the crisis. U.S. housing prices fell more than 30 percent from their 2006 peak. In cities such as Miami, Phoenix, and Las Vegas, real-estate values dropped more than 40 percent. Several million people lost their homes. And more than 30 percent of U.S. home owners held mortgages that were underwater, or greater than the value of their houses, the highest level in seventy-five years.

Amid the financial destruction, John Paulson and a small group of underdog investors were among the few who triumphed over the hubris and failures of Wall Street and the financial sector.

But how did a group of unsung investors predict a meltdown that blindsided the experts? Why was it John Paulson, a relative amateur in real estate, and not a celebrated mortgage, bond, or housing specialist like Bill Gross or Mike Vranos who pulled off the greatest trade in history? How did Paulson anticipate Wall Streets troubles, even as Hank Paulson, the former Goldman Sachs chief who ran the Treasury Department and shared his surname, missed them? Even Warren Buffett overlooked the trade, and George Soros phoned Paulson for a tutorial.

Did the investment banks and financial pros truly believe that housing was in an inexorable climb, or were there other reasons they ignored or continued to inflate the bubble? And why did the very bankers who created the toxic mortgages that undermined the financial system get hurt most by them?

This book, based on more than two hundred hours of interviews with key participants in the daring trade, aims to answer some of these questions, and perhaps provide lessons and insights for future financial manias.

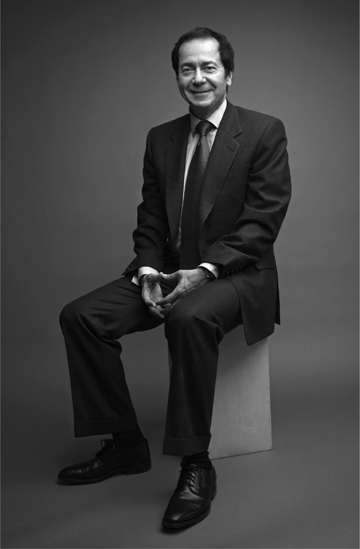

prologue

John Paulson seemed to live an ambitious mans dream. At the age of forty-nine, Paulson managed more than $2 billion for his investors, as well as $100 million of his own wealth. The office of his Midtown Manhattan hedge fund, located in a trendy building on 57th and Madison, was decorated with dozens of Alexander Calder watercolors. Paulson and his wife, Jenny, a pretty brunette, split their time between an upscale town house on New Yorks fashionable Upper East Side and a multimillion-dollar seaside home in the Hamptons, a playground of the affluent where Paulson was active on the social circuit. Trim and fit, with close-cropped dark hair that was beginning to thin at the top, Paulson didnt enjoy exceptional looks. But his warm brown eyes and impish smile made him seem approachable, even friendly, and Paulsons unlined face suggested someone several years younger.

The window of Paulsons corner office offered a dazzling view of Central Park and the Wollman skating rink. This morning, however, he had little interest in grand views. Paulson sat at his desk staring at an array of numbers flashing on computer screens before him, grimacing.