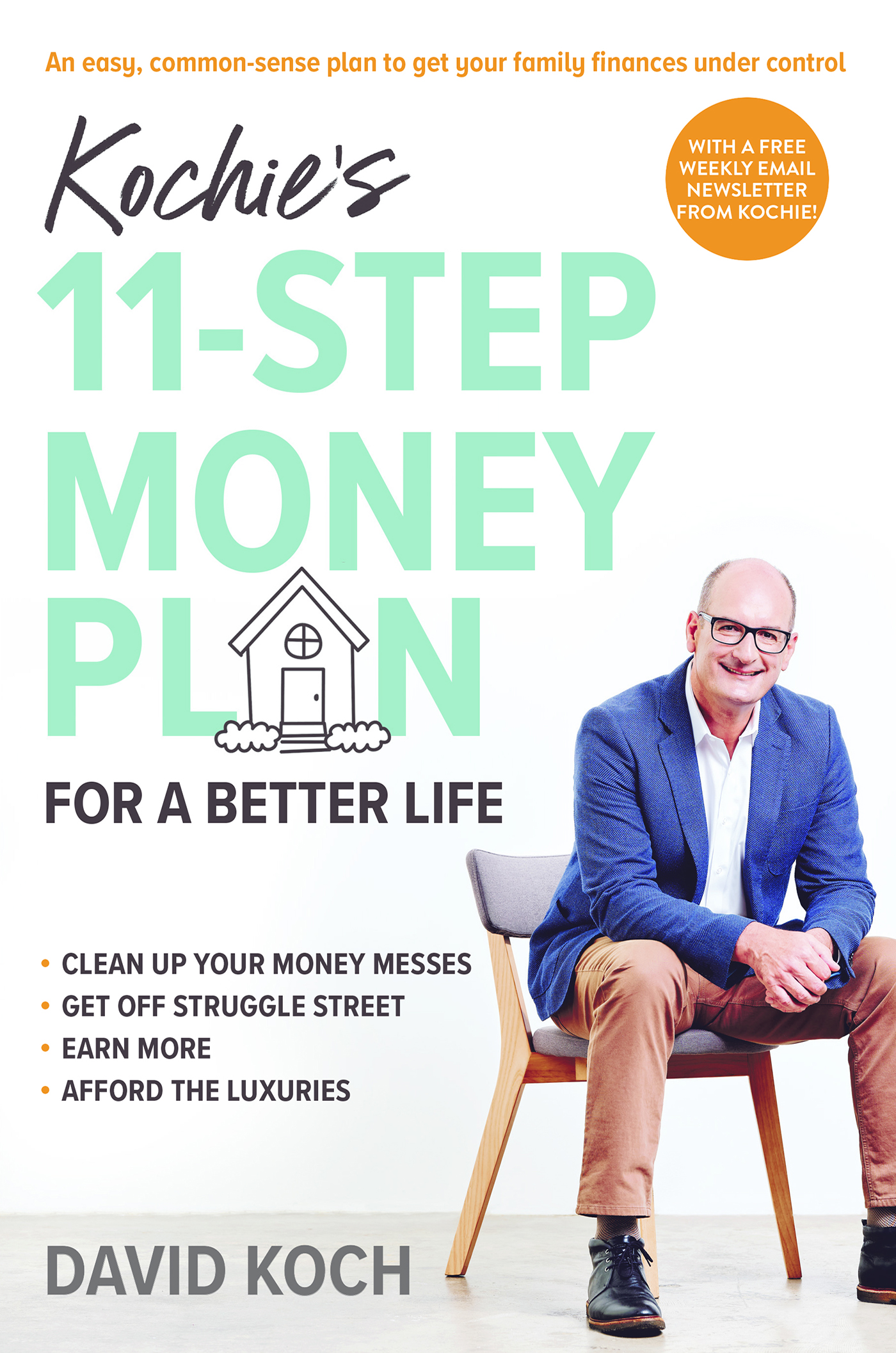

David Koch - Kochies 11-Step Money Plan For a Better Life

Here you can read online David Koch - Kochies 11-Step Money Plan For a Better Life full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2019, publisher: Pan Macmillan, genre: Home and family. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Kochies 11-Step Money Plan For a Better Life

- Author:

- Publisher:Pan Macmillan

- Genre:

- Year:2019

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

- 100

- 1

- 2

- 3

- 4

- 5

Kochies 11-Step Money Plan For a Better Life: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Kochies 11-Step Money Plan For a Better Life" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Kochies 11-Step Money Plan For a Better Life — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Kochies 11-Step Money Plan For a Better Life" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

About Kochies 11-Step Money Plan for a Better Life

David Koch, online entrepreneur, finance journalist and trusted Australian media personality knows a thing or two about the family finances.

Father of four kids, sole breadwinner, ad a man not afraid to admit to his own odd money mistake, David has also spent hour after hour in the Sunrise studio tuning in to the way the average Australian thinks about money. He knows the extent to which we all:

- spend too much on silly stuff

- avoid keeping track of our expenses

- get overwhelmed by the cost of raising a family

- settle for less in terms of salary

- do without the things that would bring a bit of pleasure to our lives

- pay the banks too much in fees and interest.

David is here to help. In 11 easy steps he shows us everything we need to do to:

- pay less on the mortgage

- put up to $14,000 extra back in the average family budget

- get those finances sorted in 15 minutes a month

- develop a side hustle or get a salary increase (or why not both?)

- learn a little about investing for the future

- tackle debt once and for all.

Friendly, clear and easy to use, this is the guide you need to reset your money habits so you can learn more, worry less, breathe easier and enjoy of the fruits of your labour.

Kochies 11-Step MoneyPlan will never be out of date as it comes with aweekly email newsletter from Kochie covering the important things you need toknow. You can sign up for the newsletter here:www.ymyl.com.au/11steps

HEY YOU YEP, YOU!

Whether youre reading this in the bookstore or online and pondering whether to buy, or youve already taken the plunge and made the purchase, lets have a chat.

I know what youre going through. Yes, I have a glamorous job on TV now, but that came to me late in life. Libby and I struggled for years with four young kids, a big mortgage and trying to build our own family business. Its a tough period of your life, juggling a relationship, children and a job and dont even get me started on the nonstop bills. And all this at a time when wage rises are almost non-existent.

These financial pressures can take a toll on our emotional and mental wellbeing. We start being grumpy with our partner and family. The struggle to make ends meet seems endless, and lifes little luxuries seem constantly out of reach. Money doesnt buy happiness, the old saying goes. That may be right, but gee, having enough to relieve the financial stress and enjoy a few luxuries can make you feel so much better!

So enough with feeling sorry for ourselves. Lets do something about it.

Im here to help. But I need a commitment from you first. You have to want to change your life. I need you to commit to a step-by-step plan to get on top of your finances and possibly make some life-changing decisions for the better. If you commit, Ill commit and be there for you . Were getting into a sort of ongoing partnership here to change your life.

This book outlines the 11 steps you need to take to get your finances under control and have a bit left over to afford the good things in life. But it doesnt end there. The problem with a book is that its written at one point in time, but as we all know, when it comes to money theres constant change. Whether its the economy, shares, property, interest rates, new investments, good deals theres always something happening.

For that reason, the book also comes with a weekly email from me to keep you constantly updated on threats, opportunities, best deals and top suggestions for your money. It will basically contain the updates and information I think you need to know each week to keep your finances in shape. My promise is that the weekly email will be relevant and easy to understand, plus have a significant impact on your family finances. And it will help you sleep better at night.

This book is just the start of a unique partnership between us.

Im excited! I hope you are too.

We advise that the information contained in this book does not negate personal responsibility on the part of the reader for their own financial management, including compliance with any legal requirements. It is recommended that individually tailored advice is sought where appropriate. The publishers and their respective employees, agents and authors are not liable for injuries or damage occasioned to any person as a result of reading or following the information contained in this book.

STEP 6: FUTURE-PROOF YOUR EARNINGS AND ASSETS

Write a will, and while youre thinking long term, turbocharge your super and sort out your insurance.

DO THIS NOW |

|

YOUR MOST VALUABLE ASSET IS... ?

I know that with all the immediate issues you have to deal with relationship, kids, health, finances you dont have time to think about whats happening next week, let alone next month, year, decade or even longer. But Id be breaking the trust weve built together if I didnt gently remind you of the importance of superannuation, estate planning and proper insurance cover.

On second thoughts, bugger it, Im not going to be gentle. You must read this chapter because it may just be the most important step in your financial life. If youre not looking after your will, superannuation and insurances, youre not financially healthy. Sorry if thats too blunt, but Im passionate about this.

Your biggest assets are invariably your house, possessions, car and you. Yes, you . You help earn the income, make the decisions, care for the family. Protecting your ability to earn an income is crucial. You need to future-proof your income streams and make sure you have control of them even from beyond the grave.

Insurance is a waste of money until you need it. Superannuation feels like fake money in an invisible bank account, but it will feel very real when you retire and its your main source of income. And your will feels like something someone else needs, not you but none of us is immortal! Now I dont want to be morbid, but whenever youre reading this chapter and think, Its all too hard, or, Its so far in the future, just glance over at that will I asked you to have nearby, as a gentle reminder that nothing lasts forever.

This chapter is all about protecting you from yourself by protecting:

- your income and major assets

- your superannuation

- your right to distribute your wealth the way you want to when you fall off the proverbial twig.

INSURANCE: PROTECTING WHAT YOUVE GOT

We all hate paying insurance premiums when things are running smoothly. But when a disaster happens and we need to make a claim, those premiums become worth every dollar. The trick is balance: having the right amount of insurance cover for your circumstances not too much and not too little.

Home and car insurance

Its ludicrous to pay $600,000 for a house and then not insure it its too big a risk. If you cant afford to insure your house or car, you cant afford to own them. If you live in a bushfire- or flood-prone area, make sure youre covered for those.

To save money, contact your insurer and ask if you can reduce your house and car premiums by increasing the excess you have to pay in the event of a claim. You may also be able to cut the amount of car insurance you pay if you restrict your cover to two nominated drivers or if you ban people under 25 from driving your car.

Font size:

Interval:

Bookmark:

Similar books «Kochies 11-Step Money Plan For a Better Life»

Look at similar books to Kochies 11-Step Money Plan For a Better Life. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Kochies 11-Step Money Plan For a Better Life and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.