.

.

. Linda Bilmes and Joseph E. Stiglitz, The Three Trillion Dollar War: The True Cost of the Iraq Conflict (New York: W. W. Norton, 2008).

.

. A private letter ruling is a written determination issued to a taxpayer by an IRS office in response to a written inquiry from an individual or an organization about its status for tax purposes or the tax effects of its acts or transactions. A letter ruling interprets and applies the tax laws to the taxpayers specific set of facts. (A letter ruling may be revoked or modified at a later date.)

. Federal Insurance Contributors Act.

. Federal Unemployment Tax.

. Private Letter Ruling 2003 05013 (October 18, 2002).

. This material is pulled from official IRS tax regulations, which are in the public domain.

).

. This and the following section have been printed with permission from Easter Seals.

Allan Checkoways career includes more than 30 years in the health care insurance field, and a specialty in the brokerage placement of disability and long-term care insurance coverage. His goal in this publication has been to share those decades of experience with readers.

Allan is the author of Disability Income: A How To Guide, published by R & R Newkirk, and Disability Income Insurance, published by Kaplan. His articles have been featured in the Wall Street Journal, Legal Economics, Lawyers Weekly, Journal of Financial Planning, Stanger Investment Digest, CFO, Medical Economics, National Underwriter, Business Insurance Magazine, Insurance Times, CLU Journal, Health Insurance Underwriter, Life Association News, Advisor Today, ProducersWEB, and other professional trade journals.

Allan received the National Association of Health Underwriters Norma Medill Award for Journalism. He served as president of the Disability Insurance Training Council and as regional vice president of the National Association of Health Underwriters. He has been a frequent speaker at the Million Dollar Round Table, Life and Health Underwriter, Financial Planning, and other professional association meetings nationally.

Allan is the publisher of ElderCare Survival Kit, an all-inclusive resource manual on long-term care planning, and Disability & Long Term Care Advisory, a newsletter on disability and long-term care benefit planning. He is also the principal of the Disability Services Group, Employee Benefit Advisors. Write to Allan at 181 Wells Ave., Newton, MA 02459-3344, or send an e-mail to .

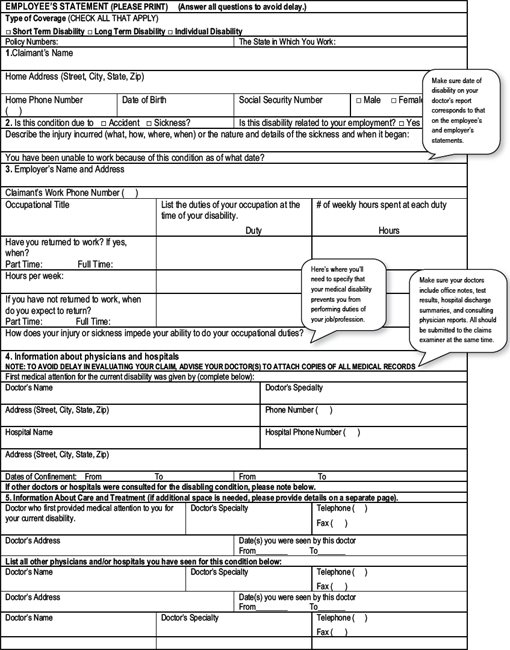

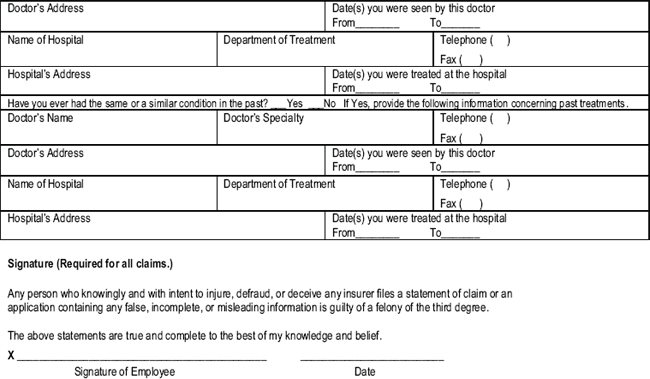

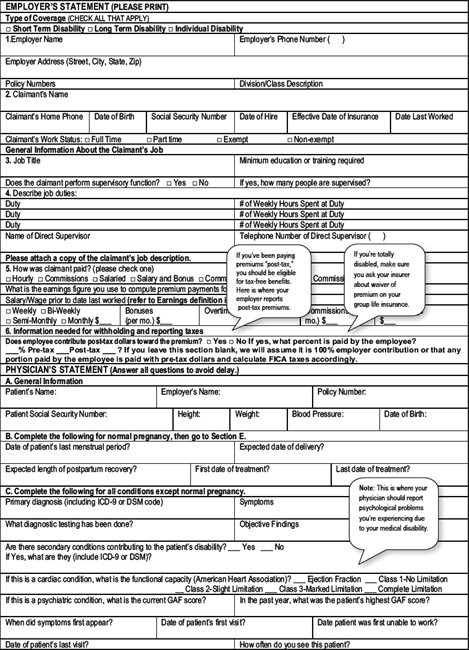

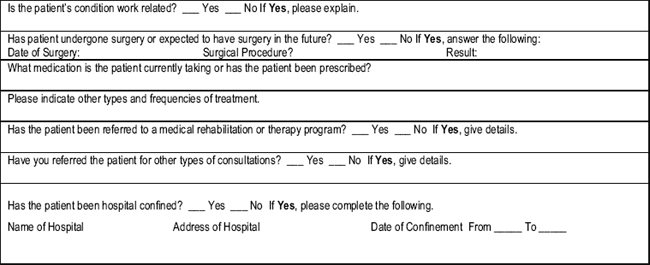

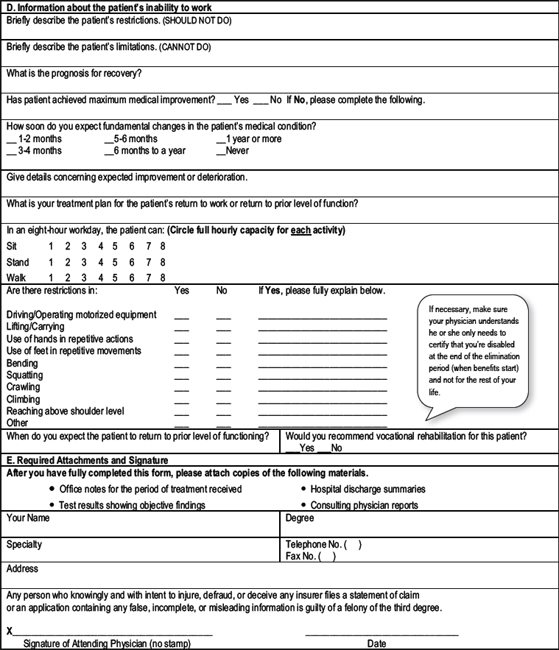

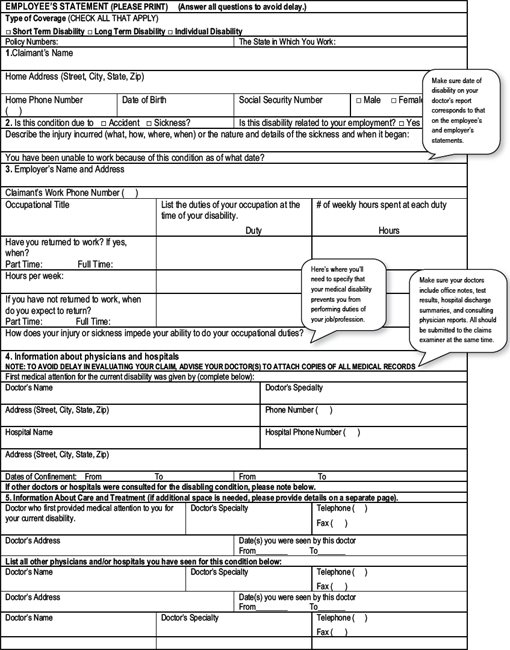

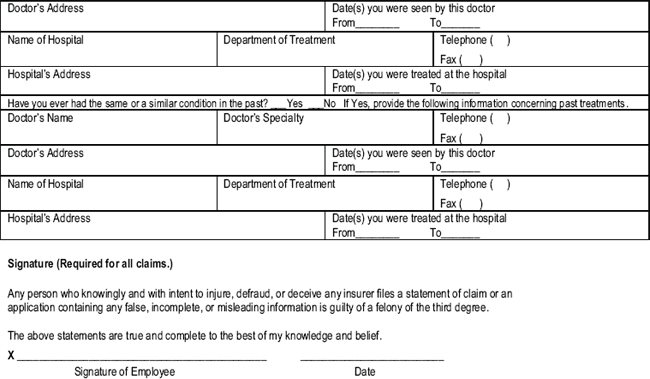

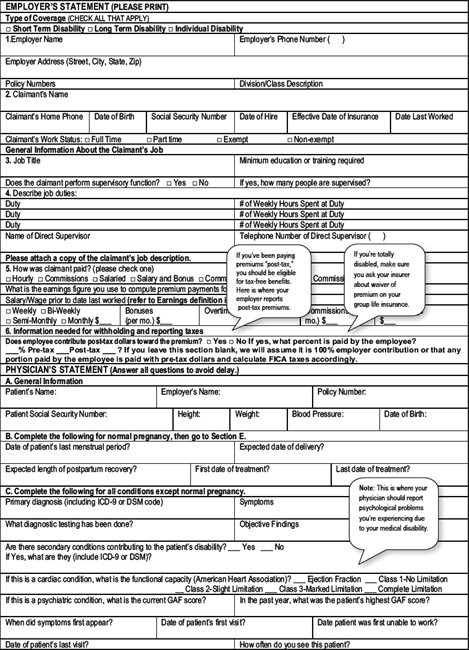

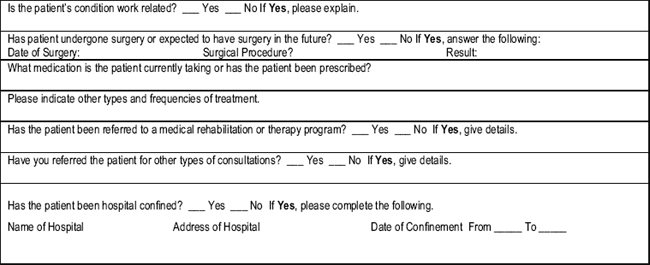

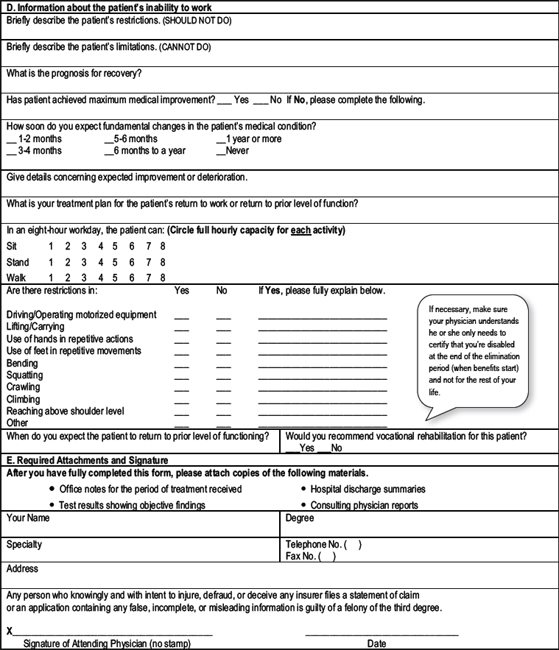

As you fill out the form sampled on the previous pages, be sure to keep in mind these key factors:

Most Important:

- Successfully collecting benefits will not depend on your medical condition but on how your medical condition prevents you from performing the duties of your occupation.

- With group life insurance, youll have a conversion privilege you need to make a decision on before the conversion period (usually 30 days) expires.

- Make absolutely sure your physician is verifying how your medical condition affects your ability to do the duties of your job/profession before the claim is submitted.

- Your physician should be reporting any psychological (secondary) problems youre experiencing due to your medical (primary) disability.

- Physical aspects of your job: your physician will indicate that youre unable to perform the most important duties of your job and the percentage of time that you perform those duties.

- Make sure your employer reports your last day of work, consistent with the date your doctor says you were disabled and your first day of treatment.

- Make sure your doctors include office notes, test results, hospital discharge summaries, and consulting physician reports; submit all medical documentation to the insurer at the same time.

- If youre totally disabled, make sure you ask your insurer about applying for disability waiver of premium on your group life insurance so that your life insurance continues.

- If youve been paying premiums post-tax to be eligible for tax-free benefits, your employer reports post-tax premiums to allow for tax-free benefits.

Vitally Important:

If youre totally disabled, you may well be uninsurable and not be able to qualify medically for new life insurance. Dont neglect your guaranteed group life conversion option.

See the employers form (with further advice) on the pages that follow.

Proper Presentation of a Long-Term Disability Claim

Most of you would not ordinarily think of filing a long-term disability (LTD) claim as requiring a presentation. But a presentation is just what is neededand a carefully thought-out presentation.

Lets return to the hospital scenario presented in the foreword to this book. You will remember that morning of waking up in the hospital, hooked up to tubes and machines, as possibly the worst of your life. Lying there a week later, envisioning leaving the hospital in a few days, you contemplate your family, your comfortable home, and your finances. Your doctor says it will be four to six weeks before you can return to work.

Luckily, your boss has assured you that your job will still be there when you are ready to return. The company sick leave plan gives you full pay for a month. Plus, you have accumulated four weeks of vacation time. You will only be without pay for a month before your LTD benefits become available. You think to yourself that youre in good shape financially.

Hitting the Walland Bouncing Back

In a single moment, you had crossed the line from seemingly good health to living with a disability. Your peace of mind has been shaken and replaced by anxiety and fear.

It has been noted that becoming disabled is like walking into a wall. You have been healthy your whole life, except for a few sprains and cuts and bruises. You never fully realized how your good health added to your sense of well-being. You also never stopped to appreciate the value of a steady paycheck.

You have gone from being a wage earner, an employee, to applying for disability benefits. You have begun the process by filling out an application, and there is no guarantee you will be successful. You will be dealing with strangers on the phone, and you can expect paperwork followed by more paperwork.

Chances are that, if youve read this far, you or someone to whom you are close has recently become disabled. Or else, you have read through your disability insurance policy and you dont understand all the terminology. Or youre getting ready to file an LTD claim with your insurer and youre not quite sure you have done it right. You may have heard or read that it can be hard to collect LTD benefits. You may have already filed an LTD claim that has been contested or denied. You may be unsure about the next step to take.

The brightest scenario (we hope its yours) is that you are just starting the process of completing your LTD claim form and you want to make sure you have done it correctly. You want to make sure your presentation to the insurer is as effective as possible.

Next page