CHAPTER ONE:

why financial planning is so important

Having a plan

You get far more done if you have a plan. Whether its a project at work, renovating your house or going on holiday, it helps you know what youre supposed to do and by when. However, theres one area of our lives that many of us dont get round to planning and thats our finances. Even a simple budget can help to relieve money worries and stress within relationships and between loved ones.

Easy ways to improve your finances

The good news is that whether or not you think youre a natural money manager, there are always ways you can improve your own finances. It doesnt have to mean that you spend hours filling out spreadsheets and you dont have to be wealthy to have a financial plan. In fact, having a plan is as important, if not more so, when you dont have a lot of money.

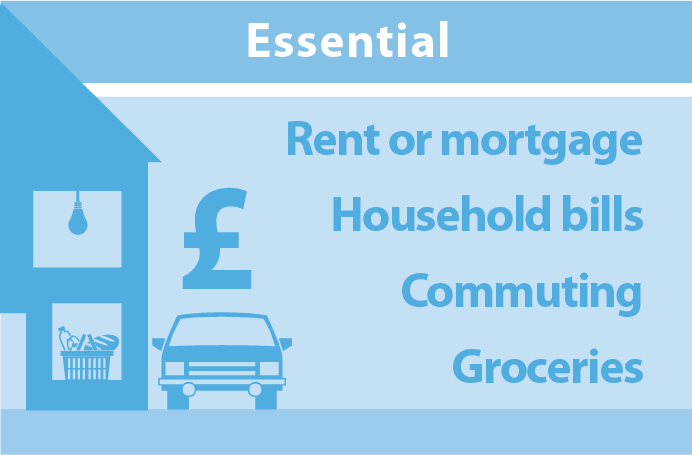

Draw up a budget : A budget is simply a record of how much money you have coming in and how much you spend. If you have a budget, you can see what you need to spend on the essentials and whats left over. The Citizens Advice budget tool is a good place to start.

Plan how to pay off your debts : If you owe money, its easier to pay off your debts after youve prioritized them and worked out how much you can afford to pay each month.

Set a savings goal : If you are saving for the first time, having a goal is likely to make you more disciplined in your approach to saving and so help you save more. If its for something specific, such as a holiday or a deposit for a house, planning how much and how long you will need to save will help you stick with it when money is tight.

Work out how and when you would like to retire : The earlier you start planning when you would like to stop work and how much money you would like to retire on, the more time you have to achieve your retirement goal.

TOP TIP Draw up a simple plan listing the money coming in and the essential spending going out each month. Then you know how much you have left.

Starting young

If you find it hard to manage your money, you could always blame your parents! Research shows that money habits are set at quite a young age. A study by the Money Advice Service , a free-to-use money information service, showed that some basic financial behaviour is set as young as the age of seven. Therefore, its really important to talk about your finances openly with your family, even its youngest members.

Your spending and budgeting

If you are drawing up a budget for the first time, its important to include all your spending. So start by getting out your bank statements and credit card statements or going online to check them. Get at least three months statements so you have a fuller picture of your spending and dont miss anything out. Once you can see what you regularly spend, you can review where cuts can be made. There are likely to be some non-essential items that you can do without or cut back on.

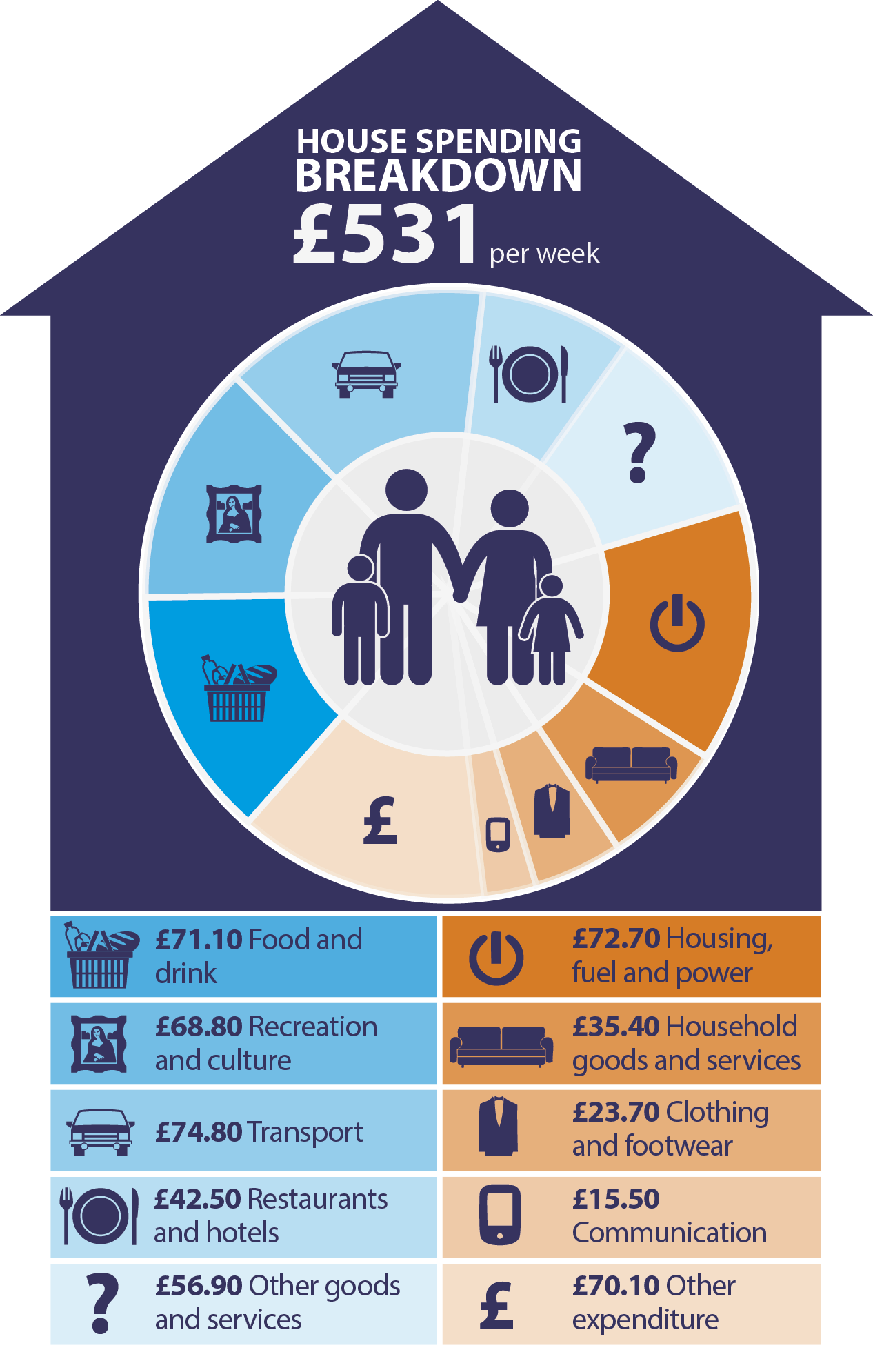

This exercise is not only useful to see how much you spend on each aspect of your life, its also interesting to compare your spending with the average British household: see the chart opposite. You might find that your spending is more modest than you thought, or vice versa.

Source: Office for National Statistics: Family Spending, 2015 Edition

Getting the most for your money

There are lots of useful online tools to help you create a budget that suits you (see the box below for suggestions). Alternatively, you can simply use pen and paper it doesnt really matter how you create a budget; the important thing for your finances is that you have one.

Once youve set up your budget, you can see where your money goes. An easy way to make sure your income goes a little further is to shop around before you buy anything and that rule applies whether youre doing your regular grocery shopping, taking out an insurance policy, signing up with an energy supplier or buying a holiday.

Online budgeting tools

Budget Planners

These let you fill in your own details about how much you spend on everything, from household bills to going out. Some budgeting tools allow you to print out or download the results. Try the simple and detailed budget planners on the Money Advice Service website. Citizens Advice also has a detailed budget tool.

Money Manager apps

Your bank may offer a budgeting tool or app that lets you put in details of all your accounts and get an overview of your spending. Money managers can be useful because they often come with user-friendly charts that show (all too clearly) where your money goes. These are not to be confused with online money management apps that let you see what you have in all your bank and savings accounts across different banks and building societies.

Dont confuse getting the cheapest with buying something thats the best value. So, for example, you could find that the cheapest travel insurance policy costs 10 for a two-week break in Europe, but it will only cover the contents of your luggage for up to 500. If what youre taking is of greater value than 500, this could be a false economy.

Similarly, if you want to buy a new washing machine, the cheapest model may not be very reliable. In every decision you make about your spending, its important to weigh up how you get the best value.

Research, compare

Its now easier than ever before to compare prices online before you buy. There are a range of different tools that include:

Price comparison sites : These can help you compare the prices of anything from energy to insurance.

Shopbots : A shopbot (short for shopping robot) is an online search tool that trawls the internet to find the cheapest prices.

Review sites : Useful for checking out a retailer before you buy from them.

Voucher code sites : You can get good discounts on many online shopping sites by using a promotional code obtained from a voucher code site. Simply enter the code when making a purchase and your bill is reduced.

Cashback sites : These sites reward you for shopping with them.

TOP TIP Dont assume the cheapest deal will give you the best value for money. When making a purchase online, always check the detail: what is included, how long it is guaranteed for and look at online reviews of the product or company.

CHAPTER TWO:

your income

Managing your income

At its most basic, income is money you receive. Not all money is income, however. For example, if you sell your own car, the money you get from selling it isnt classed as income, but if you have a business selling a car a week, you generate an income from that business. Most income above the income tax threshold is taxable. The threshold rose from 10,600 to 11,000 in April 2016, so if your income is less than 11,000 in the financial year 201617, you wont have to pay any tax.

Here are the most common types of income:

Wages from your employer : Paid with income tax already taken off.