CHAPTER ONE:

How retirement is changing

A brave new pensions world

Whats the first thing that springs to mind when you think about your retirement? The holiday of a lifetime, a chance to pursue your hobbies, more time to see your grandchildren or panic that you may not be able to afford toretire at all?

Retirement has changed beyond recognition in recent years. The good news is that we are generally living longer and healthier lives, so we should be able to enjoy a more active retirement; the bad news is that we need more substantial savings to fund retirement. Pensions are evolving to reflect these changes. Recent rules have transformed the way you can access your private pension savings, allowing you far greater control of your funds, and in April 2016 a new State Pension was introduced.

TOP TIP When you are young, its easy to think that planning for the future is something you can put off until youre much older. But the sooner you start, the more money you are likely to finish up with when you retire. So its well worth saving as soon as you get a regular income, ideally when you are still in your 20s.

Living longer

If you need evidence of how were living longer, consider the number of cards the Queen now sends to those celebrating their 100th birthday. In 2014, a total of 7517 centenarians received a congratulatory card, compared with around 3000 in 1980. Of course, not everyone will live to celebrate their 100th birthday. But, on average, you are likely to live far longer than your parents or grandparents.

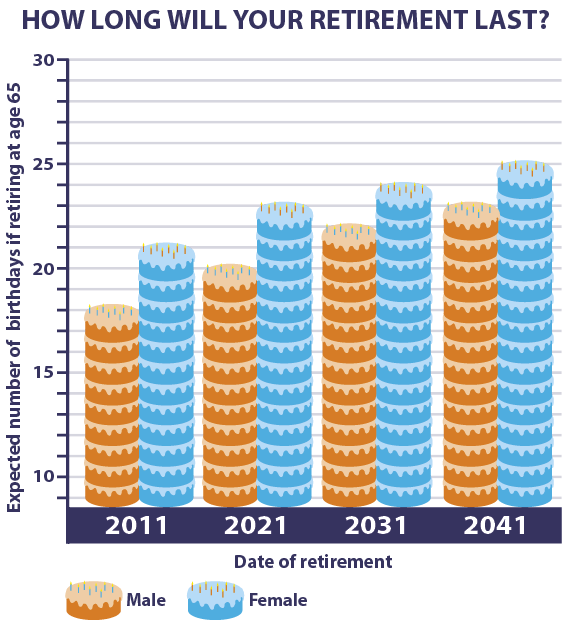

Many people still underestimate how long they are likely to live. The chart gives a clearer picture, and shows how many years you may expect to live beyond retirement. This should be a key part of your retirement plans.

TOP TIP Office for National Statistics (ONS) projections suggest that life expectancy will continue to rise, so if youre still many years away from retirement, you will need to take this into account. Not only will it affect how much money you will need for your retirement, but it may affect the age at which you are able to retire and receive your State Pension.

Source: ONS

Your income in retirement

Gone are the days when people could simply rely on the state to provide for them in retirement. The State Pension is still a valuable benefit, and for many it will be the bedrock of their finances in retirement, but its important to recognize that this is a basic safety net. To maintain a similar lifestyle to the one you have now, youre going to have to supplement the State Pension with your own savings. This can be done via company pensions, private pensions, and other savings and ).

Before you start looking at other ways of making up the shortfall, its worth knowing exactly what you will get from the state it may well be more than you think.

How the State Pension works

The State Pension is a key part of the UKs cradle to grave welfare system. But most people have absolutely no idea what it will be worth, or when they will get it. This is probably due to the fact that the State Pension is one of the most complicated parts of the pension system.

Those who retired before April 2016 received the old State Pension. This was made up of three different payments: the graphic) for anyone retiring after April 2016.

State Pension changes who benefits?

Higher earners may have got more under the old system, as they may have been entitled to a larger record, should get more under the new system.

What will your State Pension be worth?

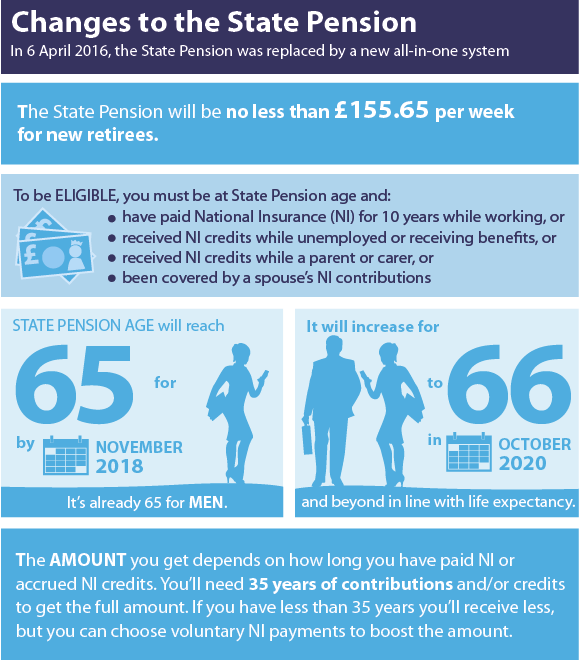

As the graphic shows, how much your pension will be worth depends on the following:

Whether you retire under the old or new system

What contributions you have made during your working life

Whether you are entitled to any means-tested top-up benefits

You may also get a higher State Pension if you opt to defer claiming until after your normal retirement age; for more on this, see . At a flat rate of 155.65 a week, the new State Pension is likely to be worth almost 8094 a year.

Qualifying for the full State Pension

To receive the full basic State Pension under the old system, you had to have paid .

TOP TIP If you dont qualify for the full State Pension, you may be able to make additional voluntary payments. Most advisers recommend making these contributions.

When do you get your State Pension?

It used to be simple: women got their State Pension at the age of 60, men at 65. But the age for women is now gradually rising, so that by 2018 both men and women will receive their State Pension on their 65th birthday. After this, the retirement age for both men and women will rise to 66 by 2020, and to 67 by 2026.

There are proposals to link the to longevity, so if we continue to live longer, the pension age will continue to rise. This means people now in their 20s may not get their State Pension until their 70s.

To find out exactly when youll be able to receive your State Pension, use the governments online calculator at GOV.UK .

Source: Legal & General

The new pension rules

It isnt just the State Pension that is changing. In April 2014 there were wide-ranging changes to company and private pensions too.

These new pension freedom rules give most people the keys to unlock their pension pots earlier and spend the money as they wish. However, these new rules dont apply to those employees with defined benefit pensions, including many working in the public sector. (If you are unsure what type of pension you have, see .)

There are also changes to the way pensions are taxed when you die that, in some circumstances, will enable you to pass on your savings tax free. The government hopes that this additional flexibility will make pensions more attractive and encourage more people to save for their retirement.

Of course, just because you can now spend your pension, doesnt mean you should. Cashing in your pension could land you with an unexpected tax bill and leave you far worse off in retirement (see , for more information on accessing pension funds).

TOP TIP On reaching .

New pension rules the main changes

Access You now have unrestricted access to your pension pot from the age of 55. Previously you could only cash in your pension pot in limited circumstances. However, pension schemes are not obliged to offer these new pension freedoms, so you may need to transfer funds to take advantage.

Retirement options You dont have to use your pension pot to secure a retirement income. Instead you can opt to keep it invested, and withdraw capital when you need it.

Inheritance If you die before the age of 75, you can leave your pension to your dependents or beneficiaries tax-free. If you die after 75, they pay income tax on funds withdrawn from the pension, rather than a 55% death tax.

CHAPTER TWO:

saving for retirement

Starting to save

There may be any number of reasons why you may not have started saving yet. You might have more immediate demands on your money, such as saving for a house or paying off a , or you might think you cant save enough to make much of a difference. It could be that you find pensions confusing and a little bit boring! Besides, retirement may be years away whats the rush? These are common misconceptions, but the fact is delaying starting your pension could affect your potential income at retirement.