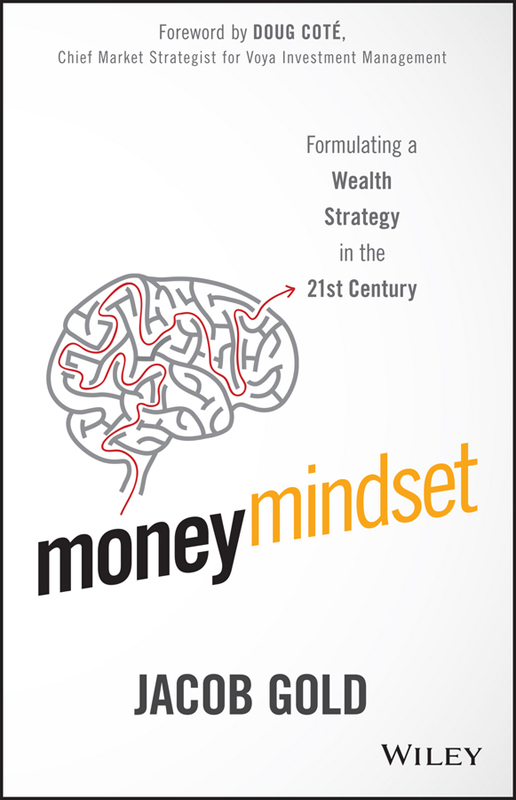

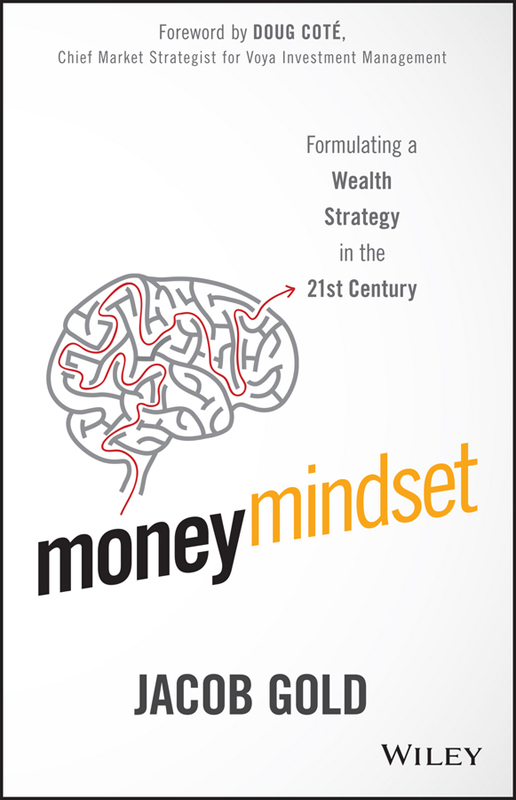

Cover image: thinking brain iStock.com / cosmin4000

Cover design: Michael J. Freeland

Copyright 2016 by Jacob Gold. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at www.wiley.com/go/permissions.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.

Wiley publishes in a variety of print and electronic formats and by print-on-demand. Some material included with standard print versions of this book may not be included in e-books or in print-on-demand. If this book refers to media such as a CD or DVD that is not included in the version you purchased, you may download this material at http://booksupport.wiley.com. For more information about Wiley products, visit www.wiley.com.

Library of Congress Cataloging-in-Publication Data:

ISBN 9781119136057 (Hardcover)

ISBN 9781119136071 (ePDF)

ISBN 9781119136064 (ePub)

I dedicate this book to my three children:

Kelvin, Savanna, and Bella.

May the wisdom in this book help fuel

your aspirations in life.

Foreword

The everyday investor was not prepared for the Great Recession that shook the world in 2008. And too many have found themselves repeatedly wrong-footed by the markets in the eventful years that have followed; the excessive risk-taking that characterized the precrisis zeitgeist gave way to the hunker-down mentality of the postcrisis period, leaving behind a wide swath of investors whose extreme risk aversion prevented them from participating in the fourth-longest bull market in history.

And while the relentless advance of markets off their 2009 troughs has made it look easy for those with the fortitude to remain fully invested, in truth the worldand the investment environmenthas grown more complex, not less. The crisis-entrenched Euro Zone, a doubling down on unconventional monetary policy by global central banks, and ever-evolving geopolitical risks are but a few of the factors giving investors inclined toward skittishness ample justification for their fears.

Fortunately, we have Jacob Gold to help make sense of it all. Ive had the pleasure of working closely with Jacob in my capacity as spokesperson for the Voya Global Perspectives program and find myself consistently impressed with his planning and investing acumen. As he did with his 2009 release Financial Intelligence: Getting Back to Basics after an Economic Meltdown, Jacob in his new book delivers practical, real-world advice for investors in search of a comprehensive plan for their assets. Money Mindset: Formulating a Wealth Strategy in the 21st Century seeks to shape the financial mindset for this young century by drawing a parallel between our nations rapid ascent toward energy independence and the individual investors quest for financial independence.

Money Mindset shows readers how to create a plan to grow wealth, protect it, and transfer it to future generations. Jacob advises thinking of the many areas that contribute to a successful retirementfrom the various funding sources like pensions, insurance, social security, and retirement savings vehicles to the shifting asset allocation over timeholistically and always in the context of an investors end game. This latter factor is key and demands of investors an honest, forthright, and realistic assessment of their wants, needs, and objectives, both now and in retirement.

Knowing the risks to accept and manage versus those to transfer can mean the difference between a successful financial plan and one that falls short. Throughout Money Mindset, Jacob offers diversification techniques that can help mitigate a portfolios vulnerability to fickle global markets, while also highlighting the disparate opportunities energy independence may present for a number of sectors, industries, and consumers that maybe dont immediately come to mind.

Jacobs insights and experience make this an important book not only for the general public but for financial professionals as well. As a third-generation wealth manager, planning and investing is, as Jacob says, somehow embedded in my DNA. A close read of Money Mindset will serve anyone without this expertise imprinted in their genetic code.

Douglas Cot, CFA

Chief Market Strategist

Voya Investment Management

New York, NY

Preface

The beginning of the 21st century in the United States has been economically volatile and quite unpredictable. Crises resulting from the dot-com boom and bust to the real estate bubble and bank crises that fueled the Great Recession to the ever-changing geopolitical environment have led people to expect the unexpected and to fear the ways it might affect their financial future.

Many hope that the dust will begin to settle and things will return to a certain level of normalcy. However, what is important to remember is that the only thing that is certain about the world in which we live is its uncertainty. The world is becoming smaller through the advancements of telecommunications, so much so that it can become confusing and convoluted. The world will only continue to become more complicated and interconnected. This may have the adverse effect of leaving people in a state of information overload and wondering where is the right path for them to become financially secure.

Given this new economic environment, the first step in knowing what to do is to understand the fundamentals of todays economy and how to invest wisely given that context.

As a third-generation financial planner and a professor of finance at W.P. Carey School of Business at Arizona State University, my understanding of financial planning and investing seems to be embedded in my DNA. I was mentored by some of the early pioneers of the financial planning industry: my grandfather and father. At the young age of 10, I began as my fathers apprentice, learning about the flow of money, the management of money, and the important psychology that goes with it.

Next page