Thank you for downloading this AMACOM eBook.

Sign up for our newsletter, AMACOM BookAlert, and receive special offers, access to free samples, and info on the latest new releases from AMACOM, the book publishing division of American Management Association.

To sign up, visit our website: www.amacombooks.org

Becoming

Facebook

Becoming

Facebook

The 10 Challenges That Defined

the Company Disrupting the World

Mike Hoefflinger

To makers and builders everywhere.

Everyone risking failure one more time.

And everyone tempted to.

Start today. Dont ever stop.

Contents

Preface

In 2009, Mark Zuckerberg was immortalized in Ben Mezrichs Accidental Billionairesa book that starts with the sentence, It was probably the third cocktail that did the trick and served as Aaron Sorkins source material for the movie The Social Networkas a morally dubious, socially awkward coder mostly motivated by meeting girls. Facebook, with just 150 million users at the beginning of 2009 and coming off a year with only $270 million in revenue, was considered as uncertain a business as MySpace, which was still the largest social network in the United States.

By the end of 2015, Zuckerberg was feted as one of the greatest CEOs and philanthropists ever, Sheryl Sandberg as not only a model COO but a leading light and voice in equality, and Facebook as a company as respectableand deserving of credit for changing the worldas Google and Apple. They had grown the number of people who used Facebook by 15 times, become the home to four of the worlds top six communication tools (three of which serve more than a billion users monthly), increased their market value by 30 times to over $300 billion and their revenue over 60 times to nearly $18 billion annually.

This book is the story of what happened in those seven years and what may happen in the next ten. From the inside. Facebooks coming-of-age as one of the worlds great companies.

As for me, Im a builder. Have been since 1981 when I got my first Apple ][ computer. Maybe the only thing I love more than building is to observe great builders. So its no accident Im on my second stint in Silicon Valley. The first one was back in 1978 when my dad was on a sabbatical at UC Berkeley and wed drive around the pre-PC, pre-Internet, pre-iPhone valley and visit Texas Instruments to see their brand-new SpeaknSpell toy in the lab. The second started in 1990. Twenty-five years later, Im still here.

I had the good fortune to be at Intel to work on the first microprocessor to have a name and to see the PC take the world by storm in the early 1990s. To work for Andy Grove when the Internet emerged, and we would visit Googles Larry Page and Sergey Brin and their ping-pong table boardroom in Palo Alto, Amazons Jeff Bezos in a converted hospital building in Seattle, and Loudclouds Marc Andreessen and Ben Horowitz in an industrial park in Sunnyvalea decade before they would come to be known simply as venture capital firm a16z. To work for Mark Zuckerberg and Sheryl Sandberg as they built some of the most influential services of the tectonic mobile shift.

As general manager of the Intel Inside program, I had already been a customer of Sandbergs for a year by the time the two of us sat down in a coffee shop in downtown Palo Alto in the fall of 2008 to talk about my joining her team building Facebooks fledgling advertising business. Long story short, Sandberg was very convincing, and seven years later the team had grown Facebooks advertising business by more than 60 times to $18 billion annually, and I had built the global branding, positioning, communication, consulting, and consumer insights teams, for that business who were made up ofas was every team at Facebookhundreds of the best people in the world in each of their roles looking to make their contribution to Facebooks mission of making the world more open and connected.

It was always intense and never easy, but the story of how Zuckerberg, Sandberg, and Facebooks teams built a business of real consequenceto go along with the largest mobile consumer services in the worldis one of the all-time great Silicon Valley stories. Im grateful to have been a part of it and thrilled to write it down and share it with you.

Im not a journalist like Michael Lewis (Moneyball) or a professor like Clayton Christensen (The Innovators Dilemma), but I am a builder and an observer.

I built with Sheryl and Mark and their 10,000 closest friends.

And these are my observations.

Mike Hoefflinger

Los Altos, California

October 2016

Setting the Scene

The Bell Tolls

Half the company it used to be

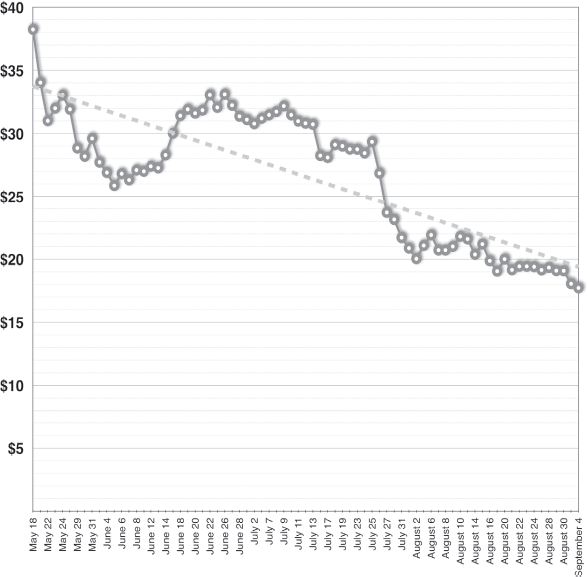

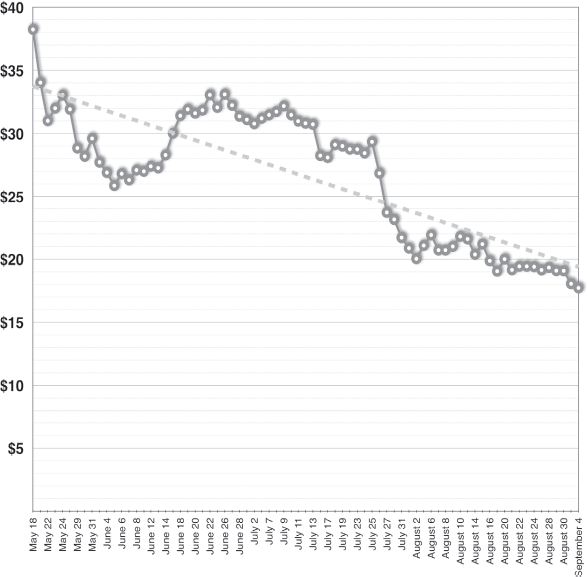

Figure 1-1. Facebooks closing stock price following its 2012 IPO

(May 18September 4)

On September 4, 2012, 109 days after standing up in front of an expectant world as the second largest stock market initial public offering (IPO) in US history, Facebooks stock closed at $17.73, 53%and more than $50 billion in valuebelow its hopeful origin as not just a public company but as a referendum on social media. (See .)

A referendum on Mark Zuckerbergthe wunderkind who had been fictionally immortalized in an Oscar-winning Aaron Sorkin screenplayfor whom a million wasnt cool.

A referendum on Zuckerbergs vital business partner, Sheryl Sandberg, and her sparkling record in government and business and passion for equality that had not yet expressed itself in a best-selling book but was on display at TED conferences.

A referendum, it seemed, on the very concept of the new Silicon Valley, which was no longer about either Silicon or its valley as networks of shuttles whisked the young software developers who had inherited this part of the earth to and from their preferred San Francisco playground.

There was no saving grace. No apparent way to talk yourself out of the surrounding facts: the overall economy was recovering, and highly regarded technology companies like Google and Applehell, even the NASDAQwere up 10% in the same time frame.

No. Facebook stood starkly alone in its decline, and $17.73 didnt look like the bottom. BMO Capital was setting their future price estimate at $15, implying Facebook was well on its way to eroding its IPO valuation by a soul-crushing three-quarters. Influential analyst eMarketer announced lower than expected revenue projections for the year. And only a month hence, October 2012 would bring the ending of the post-IPO lockup of 1.2 billion shares of Facebooks stock, introducing a frighteningly large amount of new supply to overwhelm the already flagging demand for the stock.

Facebooks new narrative hued more closely to the dismissed carcasses of once high-flying technology darlings like Groupon, Zynga, and MySpace.

Facebook was not originally created to be a company, proclaimed its own materials shared with partners to aid them in understanding the companys unique culture. Maybe, the pundits gathering in droves around the declining company suggested, not-a-company is how it would end.

Next page