This eBook is licensed to Alex Toh, alextoh69@gmail.com on 09/22/2020

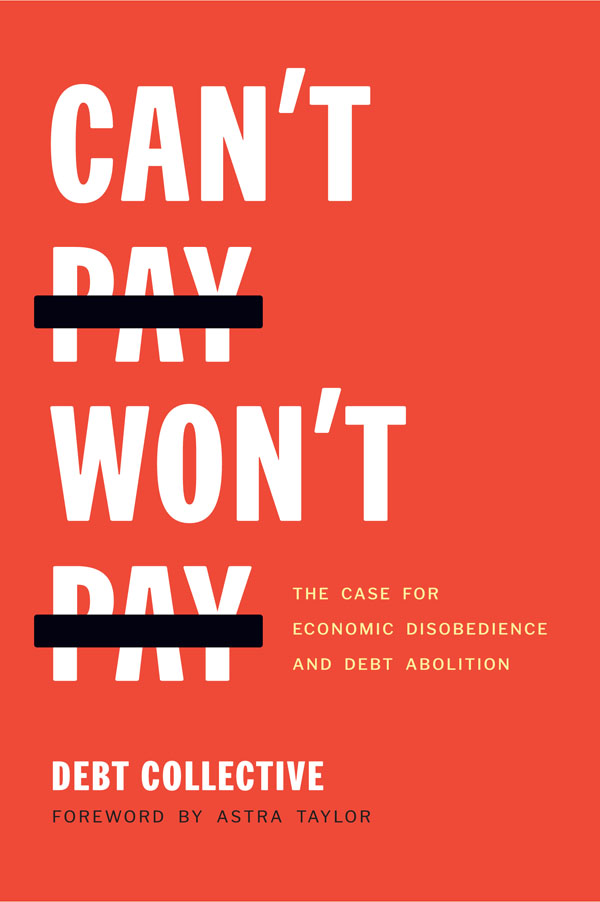

The Debt Collective has given us a visionary roadmap for forming an army of debtors that is powerful enough to make capital scream.

Naomi Klein

The Debt Collective turns a sense of entrapment into a collective call for liberation.

Stephanie Kelton

By prioritizing redress and repair, we can win free and universal education, housing, and health care. No one should have to go into debt to meet their basic needs, Debt Collective declares in this urgent book, which lays out concrete strategies and a powerful vision for radical change.

Keeanga-Yamahtta Taylor

The Debt Collectives Student Debt Strike is an important campaign to help build the mass movement we need to resist and abolish student debt.

Rep. Rashida Tlaib

Defusing explosive debts and undermining the legitimacy of the punitive, profitable debt system of the current United States is insurrectionary work, and uniting debtors in common cause is solidarity and justice work. This anticapitalist manual is a beautiful guide to how and why to do all those things.

Rebecca Solnit

This timely and outstanding book demonstrates the many predatory ways that debt stifles mobility for the most economically vulnerable. Fortunately it does not conclude there but presents a political pathway. Through solidarity and collective action, debtors unions can forge a new economy that prioritizes finance working for all people, rather than our most vulnerable working for finance.

Darrick Hamilton

This book explains why we are overdue for a debt revolution and, more importantly, how to do it. To abolish debt is to begin to rebuild society. We need to start doing so now.

David Graeber

Cant Pay, Wont Pay is a clear, readable, and hugely powerful account of debt resistance in the age of financialized capitalism. Debt Collective brilliantly summarizes the contradictions of debt-fueled growth, and demonstrates how ordinary people can work together to resist it. Cant Pay, Wont Pay is the bible of debt resistancea must-read for activists and academics alike.

Grace Blakeley

This eBook is licensed to Alex Toh, alextoh69@gmail.com on 09/22/2020

This eBook is licensed to Alex Toh, alextoh69@gmail.com on 09/22/2020

2020 The Debt Collective

Published in 2020 by

Haymarket Books

P.O. Box 180165

Chicago, IL 60618

773-583-7884

www.haymarketbooks.org

ISBN: 978-1-64259-382-2

Distributed to the trade in the US through Consortium Book Sales and Distribution (www.cbsd.com) and internationally through Ingram Publisher Services International (www.ingramcontent.com).

This book was published with the generous support of Lannan Foundation and Wallace Action Fund.

Cover design by Chase Whiteside. Graphics by Jared Bajkowski.

Library of Congress Cataloging-in-Publication data is available.

This eBook is licensed to Alex Toh, alextoh69@gmail.com on 09/22/2020

CONTENTS

Astra Taylor

3.Debt Strike:

Cities, Countries, Empires

4.Disrupting Dystopia:

Algorithmic Extraction and Digital Redlining

This eBook is licensed to Alex Toh, alextoh69@gmail.com on 09/22/2020

FOREWORD

In 2008, around the same time Lehman Brothers collapsed and the mortgage market began to melt down, I got a call telling me my student loans were in default. I remember trying to grasp the logic as I spoke to the collector. Because I didnt have money, they were increasing my principal by 19 percent. My balance ballooned, as did my monthly payments, which meant I was even more broke than before. My credit score tanked, further compounding my financial woes.

When I got involved in Occupy Wall Street a few years later, I realized my situation was hardly unique. Most people drawn to the encampments were also in the red. To talk to fellow protesters during the first few weeks of Occupy Wall Street was to talk about student loans that couldnt be repaid, medical bills that were piling up, houses that had been foreclosed on by bailed-out banks, and insolvent communities forced to endure austerity measures, with people of color hit hardest. Millions were homeless and jobless, delaying starting families or losing hope of ever being able to retire, while bankers got massive bonuses. Perhaps organizing around indebtedness, some of us thought, would be worthwhile.

Thats what those of us who wrote this book have been working to do ever since. What follows is a jointly authored record of insights and ideas developed over years with various collaborators too numerous to name individually. Our efforts kicked off in April 2012 when the Occupy Student Debt Campaign (OSDC) organized a protest marking 1T Daythe day outstanding student debt hit one trillion dollarsand demanding full debt cancellation and free public college. (The 1T protest was the first time I ever heard anyone make the call for student debt cancellation, and I was enrapt). Over the coming months, OSDC merged forces with Strike Debt, a decentralized initiative focused primarily on public education. Strike Debt hosted debtors assemblies, where strangers gathered and shared personal stories, and collaborated on a pamphlet called the Debt Resisters Operations Manual, which combined practical financial advice and a radical overview of our economic system. A little over a year after Occupy began, we launched the Rolling Jubilee, a crowd-funded project that erased more than $30 million of medical, tuition, payday loan, and criminal punishment debt belonging to thousands of strangers. We acted just like debt collectors, buying portfolios of debt on shadowy secondary debt markets for pennies on the dollar, but instead of collecting on them we erased them, sending people letters notifying them that their obligations were gone, no strings attached. In 2014 we formally launched the Debt Collective, a union for debtors.

Over the years we have developed a shared understanding of the central role debt plays in our economy and the way debt might be wielded as a form of power, an analysis we share in the following pages. Debt, we realized, bridges the individual and the structural, the personal and political, binding each of us to a broader set of financial and political circumstancescircumstances that have emerged over centuries of racist, colonialist, and capitalist exploitation and wealth accumulation. Our goal has been to devise new creative ways to organize. Specifically, turning our individual indebtedness into a source of collective leverage in order to transform those broader conditions. As Marx famously said, the point isnt just to interpret the world but to change it.

Taking inspiration from the labor movement, we believe debtors organized in a union can exercise material power over their common circumstances. The two modes of organizing have different targets but complementary aims. Where labor unions focus on sites of production, debtors unions focus on circulation, or how money and capital flow and to whom. Labor organizing targets the employer, demanding higher wages, benefits, and more. Debtor organizing, on the other hand, targets the creditor (which, in the era of neoliberalism is also often the state). Debtor organizing fights