CHAPTER

WORKPLACE

NICOLA GILLEND

NICOLA GILLEND

Nicola is a Partner and Head of Total Workplace EMEA at Cushman & Wakefield. She specialises in the relationship between design, behaviour and the built environment. An architect and author, she is widely recognised as an industry leader on workplace strategies and change management. Based in London, Nicola draws from 25 years experience delivering workplace strategy and innovation across EMEA, US and APAC. She is lead author of the RIBA Publishing book Future Office, published in 2019.

Introduction

Past pandemics have accelerated social and economic change, forcing societies to adapt their present and reimagine their future. COVID-19 raises fundamental questions of how and where work should be delivered. The pandemic-driven changes in economy, workforce and organisations will shape long-term impacts on real estate. The immediate impact of COVID-19 led to most offices, retail units, leisure and sporting facilities standing empty.

More than ever, the current crisis is forcing various

J. Elias, Google CEO Tells Employees Return to Office Wont Happen Until At Least June, CNBC website, 28 April 2020, https://www.cnbc.com/2020/04/28/google-ceo-says-return-to-office-wont-happen-until-at-least-june-1.html.

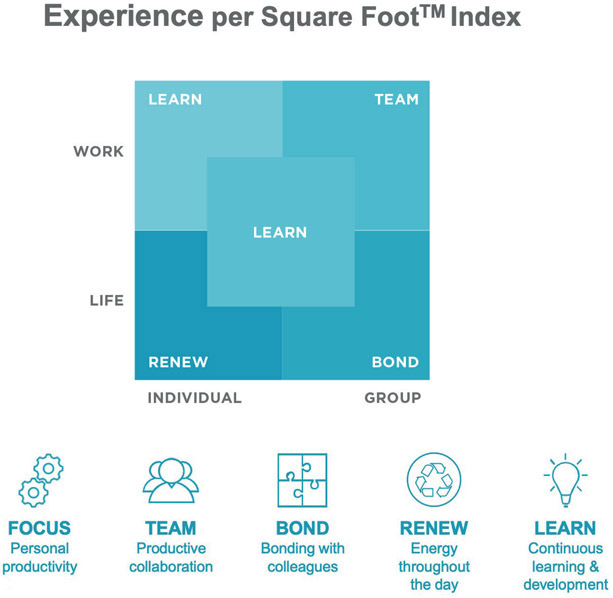

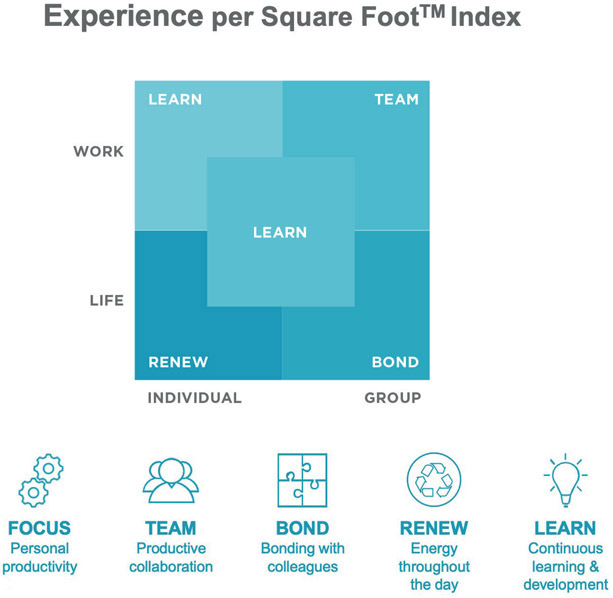

The opportunity to reimagine the workplace is reinforced in the Experience per Square Foot (XSF) research conducted during the pandemic by Cushman & Wakefield. XSF is a proprietary tool that statistically uncovers real-estate and workplace metrics relating to employee engagement and experience.

At the outset of the pandemic, Cushman & Wakefield expanded its XSF survey with an XSF@Home tool to gauge how new working conditions were affecting employees. The surveys indices look at five main areas driving employee productivity: the ability to focus; collaboration in a team; bonding with colleagues; renewal of energy throughout the day; and continuous learning (see ).

Experience per Square Foot Index, Cushman & Wakefield.

The findings compare 2.5 million data points driving workplace experience from the pre-COVID-19 era with 2.5 million data points from more than 55,000 respondents worldwide in their work-from-home environment. The findings point to the future role of offices, with observations including:

- Collaboration increased by 10% through homeworking.

- Colleagues working from home struggle to maintain personal connections, which impacts their learning and connection to company culture.

- Younger generations, especially, are struggling with maintaining a sense of connectedness while working remotely.

- 73% want flexible working to continue.

- The new normal will be a total workplace ecosystem leveraging home, office and third places.

Office occupiers and investors alike are looking at the long-term implications of COVID-19. When and where will tenants want to occupy space? What typologies will be needed and how much of each will be required? How can people feel connected, safe and productive while working across a variety of locations? Its not just about the office, its about a wider ecosystem in which as much as half of the future workforce will likely be working across the office, home and elsewhere.

The current crisis has shown that the ability to operate virtually is not only business critical, but it also opens new channels for more equal collaboration and potentially gives access to untapped sources of talent as more employees can access work from wherever they are.

COVID-19 could also impact how we design public realm. Previous pandemics impacted public spaces like the boulevards and sewers of Paris,and Central Park in New Yorkhealth and wellbeing, with cities like London beginning to take lessons from places like Amsterdam in promoting cycling and walking. We are reclaiming the spaces between buildings and opening up ground floors to drive better experience, wellbeing and social equity.

C. Klein, How Pandemics Spurred Cities to Make More Green Space for People, HISTORY website, 27 April 2020 (updated 28 April 2020), https://www.history.com/news/cholera-pandemic-new-york-city-london-paris-green-space.

Coming out of the crisis, occupiers will rethink the role of offices: from purpose to location and how many offices there should be. Recognising that remote working works for many, there could be less need to have cohorts of employees commuting daily to underutilised offices in expensive capitals, with the associated carbon footprint.

The shift of core offices towards physical meeting and collaboration spaces could accelerate, and this would most likely continue to take place in vibrant urban centres and regional knowledge clusters. Virtual collaboration and individual work will happen from an increasing variety of locations closer to talent pools. Many organisations could therefore potentially shift from centralised models to distributed, on-demand space provision.

The idea of the distributed workplace is not new. Its intellectual history can be traced back to Frank Duffy and DEGW.

F. Duffy et al., Design for Change: The Architecture of DEGW, Haslemere/Basel: Watermark/Birkhuser, 1998.

https://collections.reading.ac.uk/special-collections/collections/degw-archive/; H. Patel and S.D. Green, Beyond the Performance Gap: Reclaiming Building Appraisal Through Archival Research, Building Research and Information, 48(5), 2020, pp 46984.

F. Duffy, About This Book, in B. Hardy et al., Working Beyond Walls, Office of Government Commerce, 2008, p 6, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/394153/Working-beyond-Walls.pdf.

Since COVID-19, rather than concentrating on standalone offices, organisations will likely operate across a workplace ecosystem including the following components:

- Core hubs smaller and higher quality: the core office function would focus on collaboration, learning and development, and client meetings, creating a sense of belonging and brand. Post social distancing, employees may still be expected to spend regular time in these key hubs to ensure informal collaboration and connection to corporate culture. Requirement for individual desking could decrease, but more companies will target central and accessible urban locations for event spaces.

- On-demand event spaces and third spaces: for companies increasing remote work or even completely shifting to virtual, there could be a new requirement for on-demand event/collaboration spaces for recurring company and team meetings. Demand for these would be in accessible and memorable locations such as city centres, main transportation hubs including airports, and out-of-town destination hotels. There will be continued demand for third spaces, i.e. people working in cafs, hotel lobbies and in transit.

- Flexible touch down space: in larger metropolitan areas with extended employment catchment areas it would make sense to provide additional space on demand, leased on flexible terms. These hubs would be smaller and in less central areas, still surrounded by amenities and public transport. They could welcome employees that want to benefit from corporate workplace infrastructure within reasonable commute distance.

- Local community hubs: to avoid longer commute times and tap into wider employment catchment areas, people could access local community workplace hubs close to where they live. These could be in regional cities, out of town or on local high streets. High-street retail units could be rejuvenated to provide innovative workspaces within walking or cycling distance. These hubs would also satisfy employee appetite for greater engagement within their own communities and increased movement.