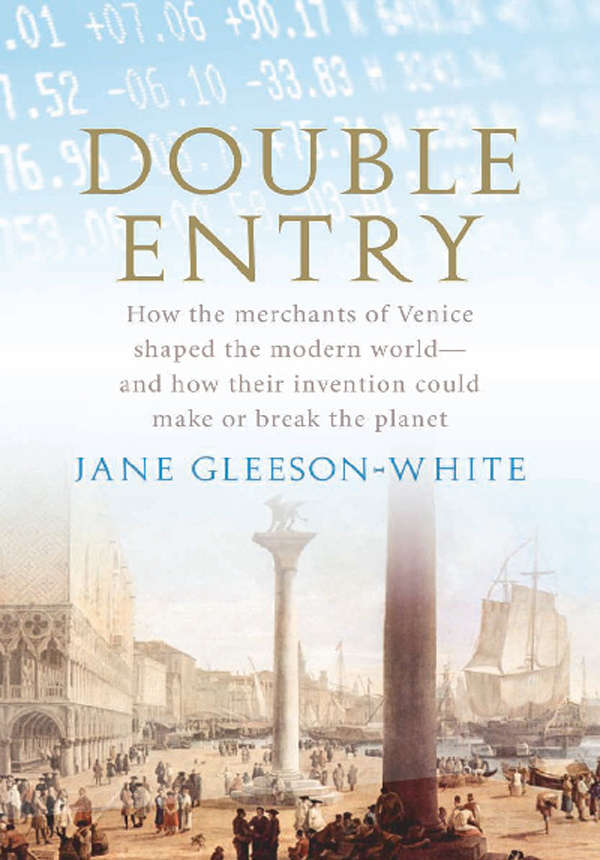

Jane Gleeson-White - Double Entry

Here you can read online Jane Gleeson-White - Double Entry full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. publisher: Allen & Unwin, genre: Religion. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Double Entry

- Author:

- Publisher:Allen & Unwin

- Genre:

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

- 80

- 1

- 2

- 3

- 4

- 5

Double Entry: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Double Entry" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Double Entry — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Double Entry" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

First published in 2011

Copyright Jane Gleeson-White 2011

All rights reserved. No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording or by any information storage and retrieval system, without prior permission in writing from the publisher. The Australian Copyright Act 1968 (the Act) allows a maximum of one chapter or 10 per cent of this book, whichever is the greater, to be photocopied by any educational institution for its educational purposes provided that the educational institution (or body that administers it) has given a remuneration notice to Copyright Agency Limited (CAL) under the Act.

This project has been assisted by the Australian Government through the Australia Council for the Arts, its arts funding and advisory body.

This project has been assisted by the Australian Government through the Australia Council for the Arts, its arts funding and advisory body.

Allen & Unwin

Sydney, Melbourne, Auckland, London

83 Alexander Street

Crows Nest NSW 2065

Australia

Phone: (61 2) 8425 0100

Fax: (61 2) 9906 2218

Email: info@allenandunwin.com

Web: www.allenandunwin.com

Cataloguing-in-Publication details are available

from the National Library of Australia

www.trove.nla.gov.au

ISBN 978 1 74175 755 2

Index by Jo Rudd

Text design by Peter Long

Set in 11.5/16 pt Minion by Post Pre-press Group, Australia

eBook production by Midland Typesetters, Australia

Also by Jane Gleeson-White

Classics

Australian Classics

For my father Michael Gleeson-White,

who told me tales of art and finance

And for Michael Hill, always

What advantages does the merchant derive from Book-keeping by double-entry? It is amongst the finest inventions of the human mind.

Johann Wolfgang von Goethe, 1795

More than four hundred years ago, in the very first book published on the subject, bookkeeping was outlined in a form which still prevails around the entire world.

A.C. Littleton, 1933

Historians often forget. Even the most mundane professions have their history, and those mundane professions increasingly run the capitalist world.

Norman Davies, 1996

O n 18 March 1968, three months before an assassins bullet cut short his life, Senator Robert F. Kennedy made an impassioned speech at the University of Kansas. He spoke about the health of his nation, the economic powerhouse that is the United States of America, and the way we measure national wealth using figures such as the Gross National Product (GNP). Kennedy said:

Too much and for too long, we seemed to have surrendered personal excellence and community values in the mere accumulation of material things. Our Gross National Product, now, is over $800 billion a year, but that Gross National Productif we judge the United States of America by thatthat Gross National Product counts air pollution and cigarette advertising, and ambulances to clear our highways of carnage. It counts special locks for our doors and the jails for the people who break them. It counts the destruction of the redwood and the loss of our natural wonder in chaotic sprawl. It counts napalm and counts nuclear warheads and armored cars for the police to fight the riots in our cities. It counts Whitmans rifle and Specks knife, and the television programs which glorify violence in order to sell toys to our children. Yet the Gross National Product does not allow for the health of our children, the quality of their education or the joy of their play. It does not include the beauty of our poetry or the strength of our marriages, the intelligence of our public debate or the integrity of our public officials. It measures neither our wit nor our courage, neither our wisdom nor our learning, neither our compassion nor our devotion to our country, it measures everything, in short, except that which makes life worthwhile.

Like many before and after himincluding the GNPs creator, Simon KuznetsSenator Robert Kennedy believed there was something profoundly wrong with the way we calculate our national wealth and with the numbers we produce to do so, such as the GNP and the Gross Domestic Product (GDP). As Kennedy pointed out, these numbers generate alarming anomalies: in their parlance cigarette advertising is worth more than the health of a child. And yet today, forty years after Kennedys call for their revision, these numbers continue to rule the policy decisions of governments, financial institutions, corporations and communities. These flawed numbers rule our lives.

How could we have got things so wrong?

And it is not just in our national accounting that things have gone so awry. From the notorious implosion in 2001 of the 1990s It Company, the energy giant Enron, to the near collapse of the global financial markets in 2008, we have witnessed a wave of spectacular cases of profoundly misleading, inscrutable and flawed corporate accounting.

On 27 February 2008, the 2007 annual accounts of the Royal Bank of Scotland were signed off. By asset size, the RBS was titanic. It was the biggest company in the world. The groups assets were larger than the GDP of many nations, including the United Kingdoms (which was 1.762 trillion versus the 1.9 trillion group assets of the RBS). As befits a massive financial institution entrusted with other peoples money, the rhetoric of the companys 2007 annual report was responsible and measured: It is the Groups policy to maintain a strong capital base, to expand it as appropriate and to utilise it efficiently throughout its activities to optimise the return to shareholders while maintaining a prudent relationship between the capital base and the underlying risks of the business.

A mere two months later, in April 2008, the so-called prudent bank was sinking, torpedoed by its exposure to toxic assets which left a 12 billion gaping hole in its balance sheeta figure which soon stretched to 100 billion and counting. And yet nowhere is this multibillion-pound-sterling chasm evident in the groups accounts. Company accounts are supposed to be the tools by which corporate transparency is guaranteed for shareholders, the market and the public alike. And so shouldnt a massive shortfall of 12 billion be obvious in the RBS accounts? Or, as writer John Lanchester put it: By rights, by logic, and by everything thats holy, it should therefore be possible to see, somewhere in the accounts and the balance sheet, some clue to what went wrongespecially given that whatever went wrong must already have gone wrong, to hit the company so hard less than two months later.

It was later revealed that the group had a much greater exposure to the sub-prime mortgage market than it had publicly admitted. Despite this apparent gross misrepresentation of the companys assets in February 2008, a spokesman for the RBS said: The Board was in possession of full information and the details provided to the market in all financial reporting reflected the Groups honestly held opinion at the time.

This would become an all too familiar refrain over the coming months, as the behemoths of finance and banking toppledLehman Brothers, Lloyds-HBOS, AIG, Anglo Irish Bank, the Icelandic banks Glitnir and Landsbankiall struck down by gigantic holes that appeared, apparently out of nowhere, on the asset side of their balance sheets. And on their way down, these giants brought the international financial system to its knees. The costs of these collapses will be paid by taxpayers for decades.

Font size:

Interval:

Bookmark:

Similar books «Double Entry»

Look at similar books to Double Entry. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Double Entry and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.