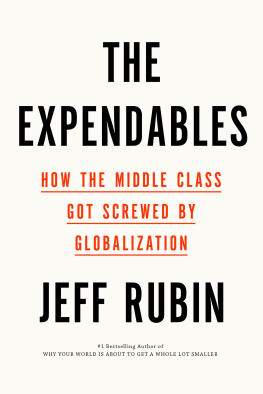

ALSO BY JEFF RUBIN

Why Your World Is About to Get a Whole Lot Smaller

The End of Growth

PUBLISHED BY RANDOM HOUSE CANADA

Copyright 2015 Jeff Rubin

All rights reserved under International and Pan-American Copyright Conventions.

No part of this book may be reproduced in any form or by any electronic or mechanical means, including information storage and retrieval systems, without permission in writing from the publisher, except by a reviewer, who may quote brief passages in a review.

Published in 2015 by Random House Canada, a division of Random House of Canada Limited, a Penguin Random House Company. Distributed in Canada by Random House of Canada Limited, Toronto.

www.penguinrandomhouse.ca

Random House Canada and colophon are registered trademarks.

Library and Archives Canada Cataloguing in Publication

Rubin, Jeff, 1954, author

The carbon bubble : what happens to us when it bursts / Jeff Rubin.

Includes bibliographical references.

ISBN 978-0-345-81469-2

eBook ISBN 978-0-345-81471-5

1. CanadaEconomic policy21st century. 2. Energy policyCanada. 3. Climatic changesEconomic aspectsCanada. 4. Industrial prioritiesCanada. 5. Petroleum industry and tradeCanada. 6. CanadaEconomic conditions21st century.

I. Title.

HC115.R76 2015 338.971 C2014-906397-0

Cover image: Level1studio / The Image Bank / Getty Images

v3.1

To Jack and Margotmy guiding lights

[CONTENTS]

[INTRODUCTION]

POP GOES THE BUBBLE

IF YOU WANT TO KNOW a thing or two about bubbles, just ask a kid. At some point or other, many of them have mixed dishwashing liquid with water and hit the backyard running, with a small plastic wand. The result can seem a little like magic: weightless, ephemeral balls floating on the breeze.

What any kid will tell you, though, is that bubbles arent built to last. As they float ever higher in the sunlight, they inevitably pop. In a flashpoof!they are gone.

Canadas carbon bubble, like its backyard cousin, is popping. For nearly a decade, the country has been chasing Prime Minister Stephen Harpers dream of becoming an energy superpower. Its a dream the Conservative leader laid out shortly after assuming office in 2006. At the time, it seemed a solid-enough plan: the world needed oil to power economic growth, and Canada had oil, in spades. And for a while at least, it seemed to work. The oil sandsthe Harper governments anointed engine for the countrys economic growthramped up production. Oil prices rose to unprecedented triple-digit highs and took the Canadian dollar along for the ride. Investment dollars poured into the oil sands, oil royalties poured into the Alberta Treasury, and Fort McMurray became a 21st-century boomtown. On the surface, everything seemed to be coming up roses.

But from todays vantage pointwith world oil prices dropping to levels not seen since the Great Recession and demand for the fuel softening even in traditionally solid marketsits clear that the journey to realizing Harpers vision wasnt destined to be all smooth sailing and fair weather. The countrys master economic plan was predicated on some key assumptions: that oil prices would inexorably move higher; that our neighbour and the worlds largest oil-consuming nation, the United States, would continue to have an insatiable appetite for our high-cost fuel; that the economy of the worlds second-highest oil-consuming country, China, would grow indefinitely at double-digit rates, single-handedly driving world demand for oil as it had once done for coal; and that emissions from the extraction and processing of bitumen, one of the dirtiest carbon fuels on the planet, would not count in the face of the worlds laissez-faire pursuit of growth.

Since 2006, one after the other, each of these assumptions has fallen by the wayside, and Canadas oversized oil industryand its whole oil-driven economyis paying the price. As the carbon bubble bursts, billions of dollars of investment and government royalties, not to mention thousands of jobs, are vanishing just as quickly as that iridescent sphere that once floated even higher in the sunlight. Poof!

Financial bubbles are, of course, nothing new. They have been a recurrent theme throughout modern history. While theyve taken different forms over the centuries, at their core they are essentially the same.

In the 1600s, Hollands upper classes went berserk for an unusual status symbol: tulip bulbs. By 1636, the bulbs were trading on the stock exchanges of many Dutch towns and cities, encouraging everyone to speculate. At the height of the craze, the rarest bulbs commanded as much as six times an average persons salary. Ten years later, prices dropped and a massive sell-off began, leaving many people in financial ruin.

In 1711, the South Sea Company presented the British government with an IOU for 10,000,000 in exchange for the rights to handle all trade with South America. Investors swarmed, paying as much as 1,000 per share. Nine years later, those shares were worth nothing. South America remained firmly under Spanish control and the British trade rights for the region were worthless.

More recently, the world witnessed the greatest financial meltdown of the postwar era when securities financed by subprime mortgages given to unsuitable borrowers crashed as delinquent payments triggered a collapse in US housing prices. The mortgage-backed securities, which had been assigned the highest rating by credit rating agencies, were widely held by financial institutions around the world, many of which failed or required massive, publicly funded bailouts.

All of these bubbles had something in common: like Canadas current energy superpower dream, they were built on false premises. People just werent going to continue sinking years worth of earnings into a status symbol that bloomed for two weeks and then went into hibernation. They werent going to keep pouring money into a company whose British charter to control trade was meaningless in a Spanish-ruled region of the world. And US real estate values simply werent going to climb forever, particularly when insolvent homeowners financed by subprime mortgages mailed in their keys and just walked away from their payments. In all of these cases, a correction was bound to occur, and occur it did, with horrific repercussions for those who failed to see the writing on the wall.

And now its our turn. No sooner have we turned the page on the subprime mortgage bubble than we find ourselves facing what could be an even more daunting one. While Canada escaped relatively unscathed from last decades Wall Streetcentred crisis, it wont be so lucky this time around. The countrys oil sandsleveraged economy is at the epicentre of the bursting global carbon bubble. No oil industry in the world is more vulnerable to plunging prices than the oil sands, home to one of the planets most costly and emissions-intensive oils. In todays convulsive oil market, where record-sized boom-bust price swings have become the norm, those high costs leave the oil sands future very much in doubtand the Canadian economy suddenly in need of a new engine for its growth.

This, then, is the fallout of chasing Harpers dream. How did we get here? And what does it mean for the future of the economy, not to mention your investments? Thats what were going to explore in the pages that follow. Well start, in , by taking a hard look at the pressing challenge of sustaining economic growth in the face of an ever more urgent need to halt carbon emissions and avert the worst consequences of warming global temperatures and rising sea levels. That dilemma has put the needs of the economy and those of the environment on a collision course like never before. Well see how countries around the world are coming to recognize this challenge, and how the goalposts are shifting when it comes to the use of fossil fuels. Well examine how Canadas record on this front sticks out like a sore (and definitely not green) thumb. This countrys leadershipunlike, say, the US president or even, surprisingly, the Chinese governmenthas followed the time-honoured dictum that growth and green are mutually exclusive concepts, despite mounting evidence that, quite to the contrary, perhaps the only way to grow in the future will be to grow green.