Penguin supports copyright. Copyright fuels creativity, encourages diverse voices, promotes free speech, and creates a vibrant culture. Thank you for buying an authorized edition of this book and for complying with copyright laws by not reproducing, scanning, or distributing any part of it in any form without permission. You are supporting writers and allowing Penguin to continue to publish books for every reader.

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional services. If you require legal advice or other expert assistance, you should seek the services of a competent professional.

INTRODUCTION

SAMS STORY

A few years ago, Sam received an inheritance after his dad died. Grief stricken and overwhelmed by the demands of work, marriage, and raising children, he placed the money in a local banks savings account. Every so often, Sam would make an effort to think about the money. He knew he should invest it in... well, something. A few times a year a very official-sounding officer from the bank, someone called a wealth officer, would contact him about it, suggesting a complimentary meeting.

So Sam would sit down at the bank, and an advisor would offer him coffee and muffins and talk to him about his children, his job, and where he next planned to go on vacation. Then he would offer a solution, the next-best thing to a guarantee, he said, as he started talking really fast about expected rates of return, risk, and the importance of the stock market.

The wealth officer, or wealth specialist, or whatever the heck he was called, wanted Sam to sign papers right there and then so the money could get to work, as he put it. But Sam held off. He knew there were unscrupulous money people out there, and he wanted to do his due diligence.

So Sam would call friends, and friends of those friends. Sometimes those friends were in finance or married to people in finance, and they would make suggestions based on what they had picked up from their jobs or their husbands or wives over the years. One offered to manage the money for him altogether but didnt say how he would be compensated for his time and effort. Another said he should call Vanguard and put the money in something called index funds. Bonds, advised another. Others talked about allocating different percentages to different investments. Still another pal suggested a financial advisor named Kelly who had done amazing things for him.

Other people told Sam horror stories. There was the friend who had been persuaded to invest in tech stocks in 1999 and lost a bundle, as he put it. A coworker told him about the friend of the family who seemed so kind but put her mom in some sort of investment that didnt do what it was supposed to and left her in a worse position than when she started out. Several people mentioned Bernie Madoff.

It was overwhelming. It seemed as if everyone contradicted one another. And they were all so sure... sure that they had the secret to how to make money grow or that it was all a rip-off. And Sam was scared. He needed that money. He wanted to send his children to college. He couldnt bring himself to risk losing it.

So Sam ended up doing... nothing.

Not only did Sams nest egg end up losing a chunk of its value to inflation, but the stock market also did well during this period. Sam didnt benefit from that run-up. He wasnt running anywhere. He was stuck doing nothing because the combination of the myriad options and uncertainties of money, the economy, and the financial services industry had all but paralyzed him.

THE POUND FOOLISH STORY

Sam is hardly alone. Statistics and studies show that many of us choose not to deal or take a hands-on approach when it comes to our finances.

- say our finances cause us stress on at least a monthly basis.

- say money is a major source of conflict with their significant other.

- with investable assets worth between $50,000 and $250,000 say they fear outliving their retirement savings.

- answered never when asked how often we balance our checking accounts.

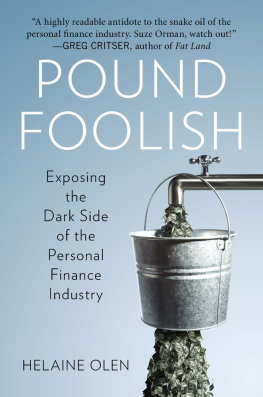

The roller coaster that is our economy only makes us even more hesitant to take control of our financial lives. In her book Pound Foolish: Exposing the Dark Side of the Personal Finance Industry, Helaine told the story of how for all too many of us wages began to stagnate and fall, even as jobs and paychecks became less secure. At the same time, almost all the income and wealth gains since the end of the Great Recession have gone to the wealthiest.

We feel as if we are falling behind because, frankly, we are, often through no fault of our own.

Were convinced any financial mistake will send us on a downward spiral we wont be able to recover from. Many of us walk around with a constant and growing sense that financial doom can arrive at any moment.

So like Sam we fret about our finances but remain frozen. Money feels complicated, boring, scary, and overwhelming all at once. Who wants to wade through competing budget apps? We want to be careful financial stewards but instead get caught up playing a losing game of financial Whac-A-Mole.

Desperate, we tell ourselves that someone out there must have the answer. All too many people working in the financial services industry market themselves as our friends who have special insights into the world of finance and future events. Even as we dont trust many of the financial types we encounter, we are secretly convinced there is one person out there, one honest man or woman, who can identify exactly that magic investment for us, and guarantee that our money will grow, and that nothing will go wrong, not ever.

But as Pound Foolish showed, many of our financial problems were not the result of our financial missteps. They were caused by economic trends and recessions and then compounded by the failure of financial regulators to crack down on bad behavior by those who claimed to be offering us help.

Many of Pound Foolishs readers contacted Helaine to thank her for not laying all the blame of their financial woes on their shoulders, and just as many had a simple follow-up question: If we all need to be wary of the financial services industry, and yet we also need to be proactive about our finances, what do we do?

For a long time, Helaine had no answer to that question.

Fortunately, Harold did.

HAROLDS STORY

Like Helaine, Harold does not work in the financial services industry. A professor at the University of Chicago and a contributor to a number of media outlets and blogs, including the Washington Posts Wonkblog, Harold came up with the concept of the index card not as some academic experiment but as a practical solution to the kinds of urgent financial problems many of us encounter at some point in our lives. As he explains,

For most of my life, I had no real savings to speak of. I didnt even own a home until I was forty years old. My wife, Veronica, and I were not poor by any means, but we were starting a family. Like many people our age, we never displayed much financial forward thinking or savvy. I was putting money in my retirement account but basically treading water otherwise. We rented (and subsequently missed out on a historic real estate run-up). I invested in dot-com stocks. You can guess how well that ended. We had child-care expenses. We let some costly debts accumulate. We overpaid for a nice new car when a nice used model would have worked fine.