Table of Contents

To my wife, Mary, the person with whom

I hope to spend a long and happy retirement,

and to my son, Henry, who,

if all my planning pans out, wont have to

support his parents in their dotage

INTRODUCTION

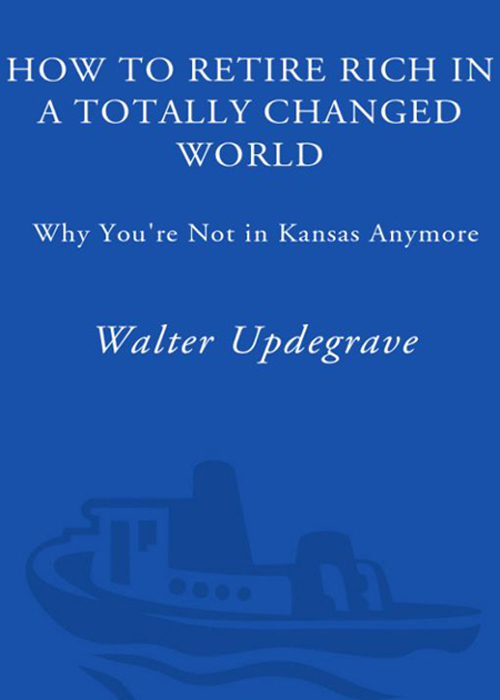

A TWIST IN THE YELLOW BRICK ROAD

It wasnt too long ago that retirement planning was a pretty straightforward affair. You went to work, you paid your Social Security taxes, and you went about your career, knowing that, without much effort on your part, you were building up retirement benefits you could count on when you left the workaday world. Then, sometime in your early to mid-sixtiesor even earlier in many casesyou called it a career, collected a tidy company pension, signed up for your Social Security benefits, and retired to the back porch or the front nine to quietly enjoy the rest of your life.

My, how things have changed. What was once a simple, well-marked, and relatively predictable road to retirement suddenly has some hazardous twists and turns in it. Its almost as if, like Dorothy in The Wizard of Oz, weve been transported to a dramatically different landscape where the rules of retirement planning have radically changed.

Where once we could count on paternalistic corporations and the government for a secure retirement, now weve got to fashion our own retirement security by contributing money to 401(k)s, IRAs, and the like.

Where once we could let corporate pension managers worry about such matters as how much we should put in stocks or bonds or mutual funds, now weve got to decide how to invest our retirement stash.

In short, the days of relying on corporate benevolence and government largesse to support us in our golden years are pretty much gone. Today the responsibility for accumulating a nest egg for retirement has been placed squarely on our shoulders.

More Responsibility... but More Opportunity, Too

Clearly, retirement planning in this new reality demands more responsibility on our part, which, understandably, can be somewhat daunting. Many people are uncomfortable choosing investments. They feel overwhelmed by a confusing array of choices and are concerned about the consequences of making the wrong decisions. The stock market, with its unpredictable, gut-wrenching downturns, seems a dangerous place to them. And retirement investing horror stories such as the one at Enronwhere thousands of employees whod loaded their retirement accounts with Enrons stock lost much if not all of their retirement savings when the companys stock collapsed have only heightened their fears.

But with more responsibility on our part for retirement-planning decisions also comes more opportunity to create a comfortable retirement. The tools and resources are definitely there. Youve got 401(k)s and other tax-advantaged retirement savings plans that can turbocharge your savings. Indeed, the Bush administration and Congress passed legislation in 2001 that over a period of years significantly boosts the amounts we can contribute to 401(k)s and other retirement plans and makes it easier to take our retirement funds with us as we move from job to job, thus making these savings plans even more valuable. You can choose from a broad smorgasbord of investing choices, including U.S. and international stocks, taxable and tax-free bonds, and a wide variety of mutual funds and annuities. And there are plenty of free or reasonably priced websites around that can help even the most financially challenged among us create a sophisticated road map for our retirement and then monitor our progress.

Similarly, the tax law that Congress passed and President Bush signed in 2003the Jobs and Growth Tax Relief Reconciliation Actshould also better enable us to prepare for retirement by lowering federal income tax rates as well as the amount of tax we pay on dividends and capital gains. The less of our income we must share with the government, the more were able to put toward our future financial security. And the lower the tax rate on our investment income and gains, the faster our savings will grow, allowing us to accumulate a larger nest egg for retirement.

But to succeed in this new retirement world, you must also know how to navigate around the new retirement landscape this new land of Oz, if you will. You must learn how to take advantage of the resources and tools that are out there and how to get maximum use out of the various tax benefits available.

And thats just what this book is designed to do: help you get the most out of the vast array of retirement-planning options open to you. The fact is, whether you like it or not, you are already in charge of your retirement. This book will help you take control of it.

Before we go any further, lets address the guiding principles of this book and your role in planning your retirement.

This Books Guiding Principles

1. It All Begins with Goals

Planning for retirement without having a goal in mind is like setting off on a journey without a destination. Thats fine if youre Jack Kerouac, but most of us actually want to get somewhere, not wander aimlessly on the road to who knows where. For you to be able to make sensible decisions about things like how much money to save each month in retirement accounts and how that money ought to be invested, you have to set goals, such as the age at which youd like to retire, how much money you will need to accumulate by that age, and how long you want that money to last. Otherwise, theres no way youll know what kind of chance your savings, combined with Social Security and other sources of income, have of carrying you through your life in retirement, which, given life spans these days, may be twenty, thirty, even forty years or longer.

Granted, it may be difficult to put a number on some goals. Knowing exactly how much income youre going to need when you retire, say, two decades from now, requires a degree of clairvoyance I doubt even the Amazing Kreskin possesses. But youve got to start somewhere, so it is imperative that you create a basic blueprint or retirement plan. Once youve done that, you can refine your plan as conditions change and as your retirement draws nearer.

2. Procrastination Is Your Worst Enemy

The earlier you start planning and saving for retirement, the better off youll be. This idea is so crucial to creating a successful retirement plan that its impossible to overstate its importance. Delaying your planning for just a few years can mean the difference between a cushy retirement and a comfortable one, and delaying a few more years can mean the difference between a comfortable retirement and scraping by. The earlier you begin saving and investing, the more opportunity the wonder of compound interestearning interest on interest or, in the case of stocks and mutual funds, gains on gainshas to build your retirement wealth.

Unfortunately, this essential retirement truththe importance of saving early and oftenescapes many people. Instead, they believe that savvy investing is the single most important factor in building a large retirement nest egg. Its true that investing plays a major role in providing retirement security. And its also true that regular saving and smart investing are inextricably intertwined when it comes to successful retirement planning. But saving is still the more important of the two. Without the savings, all the investment prowess in the world doesnt mean diddly-squat. Theres no way youre going to turn meager savings into a pot of retirement gold by picking stocks or mutual funds that soar to humongous gains. Lots of people thought they could do that during the tech and dot-com heyday back in the late 1990s. And a few years later many found that the tech and Net stocks that had doubled in value within a few months suddenly lost 50, 60, even 80 percent or more of their value just as quickly. Ultimately, we have a lot more control over how much we save than we do over the returns we earn on investments. And the sooner we get started saving, the better chance we have of achieving a comfortable retirement.

Next page