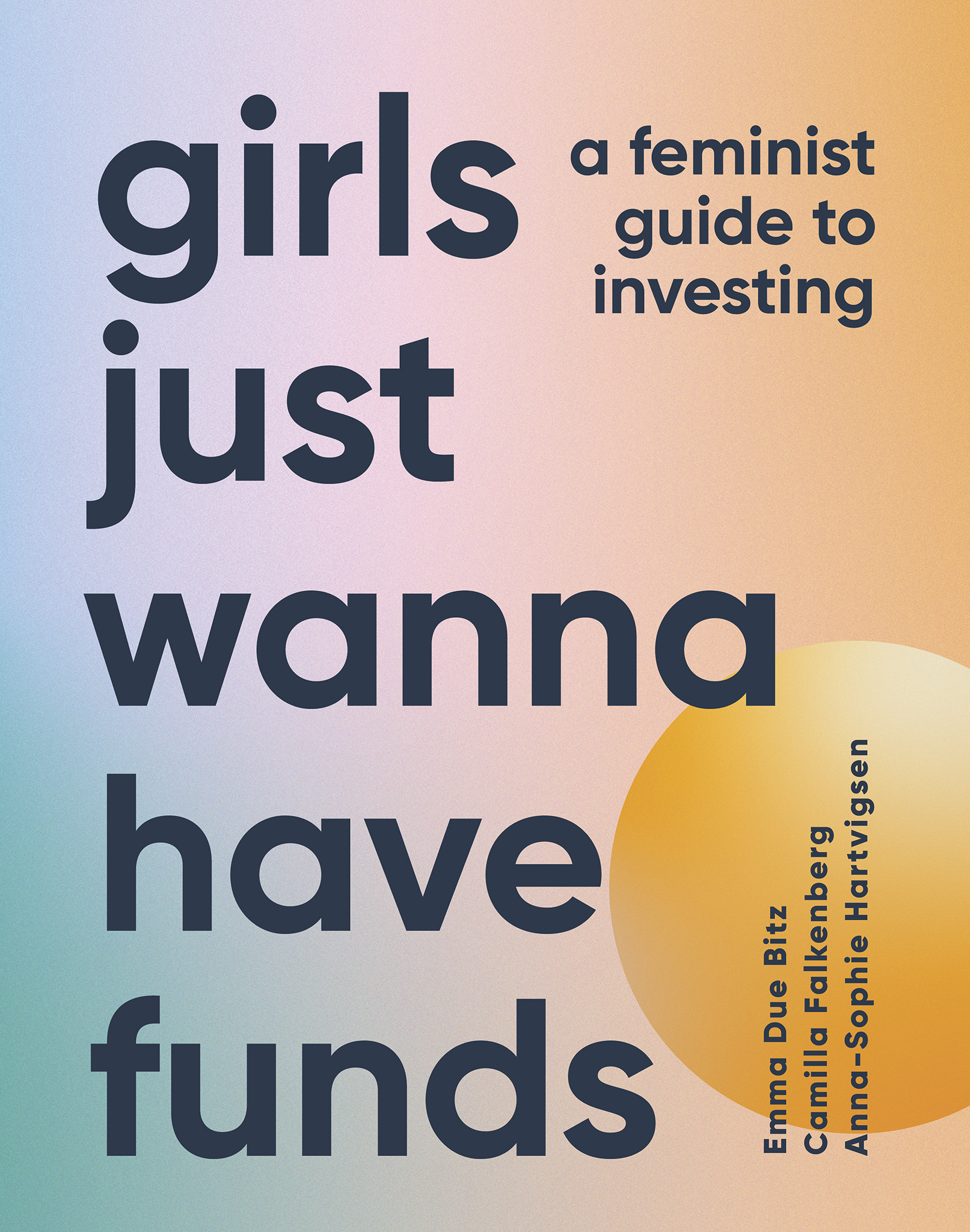

This book is written primarily with women and nonbinary people in mind, but we invite anyone who supports the mission of closing the financial gender gap to read it and learn from it...

For the ones whove been left out of the narrative.

For the ones whove been told they cant or shouldnt.

For the ones whove wanted something more.

Its time to shift the tides of power and claim our rightful seat at the table. We welcome anyone and everyone to take charge of their financial future in the name of a new status quo.

This book is for you. You deserve to be heard.

Women are now entering higher education in record numbers. They are climbing the corporate ladder, running for political office, pushing against the glass ceiling, and pursuing power as never before. However, there is one area yet to be addressed: money.

Money equals power and opportunity. It brings you the essentials in lifefood, shelter, clothing and educationbut it can also do so much more than that; it can buy you the freedom to do what youve always wanted. Take that trip. Make music. Build a company. Get your kids off to a good start. Perhaps even use it to do your bit to make the world a better place.

But although money is an essential element of life, it is something that women and marginalized communities have historically been excluded from earning and managing. As a result, theres not a single country in the world where men and women are financially equal. In fact, the World Economic Forum estimates that it will take 257 years to close the financial gender gap. This effectively means that, today, no woman will live long enough to experience a world in which she has the same level of freedom and opportunity as her male peers. Lets get this straight: Nothing bad happens when women have more money. In fact, quite the oppositeit benefits individuals, companies, and society as a whole when women are able to spend and invest. A McKinsey & Company study from 2015 found that if women were to participate in the economy on equal terms to men, they could add as much as the combined size of the economies of the United States and China today to the worlds GDP. How remarkable is that?

There are 195 countries in the world. Not a single one has achieved financial gender equality.

Still, the discussion around money is sensitive, tainted with emotions, values and personal beliefs held by ourselves and instilled in us by the generations before us. In this book, well do our best to outline the current state of financial equalityand what you can do to improve it for women of our generation and for those to come.

We dont have to sit around and wait for change to happen. There are many ways by which we can take action ourselves, and our aim with this book is to offer you concrete advice on what you can do to optimize your own financial situation and to help everyone around you achieve the same success.

Because one thing is certain. Money is powerand women need more of both.

g

Gender stereotypes kill dreams

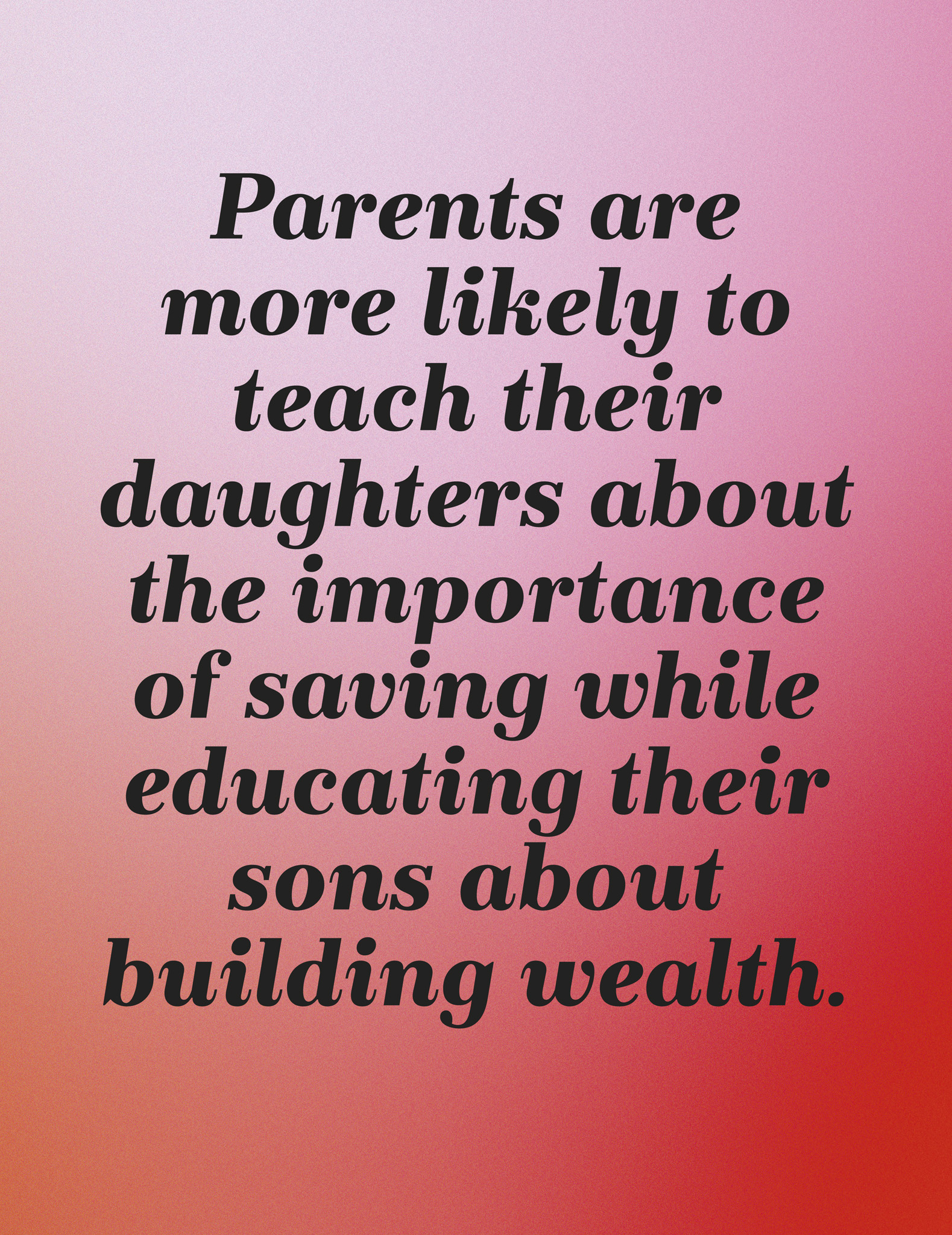

Gender stereotyping is still alive and well in the twenty-first century. From the moment babies are born, their assigned sex immediately begins to shape how they will be treated, what opportunities they will receive, and how they will behave according to dominant gender stereotypes in their society. The most significant influence on gender role development occurs within the family setting, with parents modelling and passing on to their children their own beliefs about gender. You may recognize this trend from your own childhood. For example, did your parents teach you how to manage money? Did they participate equally in all of your familys financial decision-making? In the UK today, 68% of girls feel held back by harmful gender stereotypes.

g

Is financial inequality just a gender issue?

It would be easy to make a case about men versus women, but when talking about financial gender inequality we need to consider factors beyond gender, too. Women are not a homogenous group, and different categories of people have different experiences. As formulated by Kimberl Crenshaw, an American law professor and the woman who coined the term intersectional feminism : All inequality is not created equal.

Simply put, this means that different types of discrimination, such as gender, race, class, and sexuality, overlap, creating compounding experiences of discrimination. We cant talk about one without recognizing the existence and impact of others. For example, Black, Asian, and minority ethnic women experience sexism differently from white women in a society that affords privilege to whiteness. Trans women dont have the privilege of cisgender women; people with disabilities are not enabled to participate in work to the same extent as able-bodied citizens; migrants are often excluded from the very financial systems that we want to help you understand.

Therefore, looking at the current state of financial inequality isnt enough to change attitudes; we also need to recognize the historical context of the issue. Decades of systemic discrimination have created deep inequities that disadvantage some people in society from the very beginning, and this extends across generations. This is especially important when we are talking about money, as we know that women have historically been excluded from earning, saving, and managing itespecially women and girls of color.

Another factor that significantly impacts your relationship with money is your current life situation. Do you have a job? Are you in a relationship? How is your health? How is your financial health? We all have different starting points when it comes to investing, which is why we encourage everyone to read this book with their own experience in mind.

Its not just about money. Its about freedom, independence, and the ability to live life on your own terms.