Contents

List of Illustrations

List of Tables

Pages

Guide

The 52-Week Low Formula

A CONTRARIAN STRATEGY THAT LOWERS RISK, BEATS THE MARKET, AND OVERCOMES HUMAN EMOTION

Luke L. Wiley, CFP

Cover design: Wiley

Copyright 2014 by Luke L. Wiley. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at www.wiley.com/go/permissions.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993, or fax (317) 572-4002.

Wiley publishes in a variety of print and electronic formats and by print-on-demand. Some material included with standard print versions of this book may not be included in e-books or in print-on-demand. If this book refers to media such as a CD or DVD that is not included in the version you purchased, you may download this material at http://booksupport.wiley.com. For more information about Wiley products, visit www.wiley.com.

Library of Congress Cataloging-in-Publication Data:

Wiley, Luke L., 1975

The 52-week low formula : a contrarian strategy that lowers risk, beats the market, and overcomes human emotion/Luke L. Wiley.

pages cm

Includes index.

ISBN 978-1-118-85347-4 (cloth); ISBN 978-1-118-85353-5 (ePDF); ISBN 978-1-118-85357-3 (ePub)

1. Investments. 2. Success in business. 3. Competition. I. Title. II. Title: Fifty-two week low formula.

HG4521.W4764 2014

332.6dc23

2013051133

To the five most candid and loving board of advisors who help me become the person they know I am capable of becoming:

my wife, Melissa (Grounded)

daughter, Madyson (Justice)

son, Jake (Humility)

daughter, Leah (Strength)

daughter, Morgan (Joy)

There is one side to the stock market; and it is not the bull side or bear side, but the right side.

Reminiscences of a Stock Operator by Edwin LeFevre, 1923

The conventional view serves to protect us from the painful job of thinking.

John Kenneth Galbraith

There is nothing like losing all you have in the world for teaching you what not to do. And when you know what not to do in order to lose money, you begin to learn what to do in order to win. Did you get that? You begin to learn!

Reminiscences of a Stock Operator by Edwin LeFevre, 1923

The only function of economic forecasting is to make astrology look respectable.

John Kenneth Galbraith

The simpleton believes everything, but the shrewd man measures his steps.

Proverbs 14:15

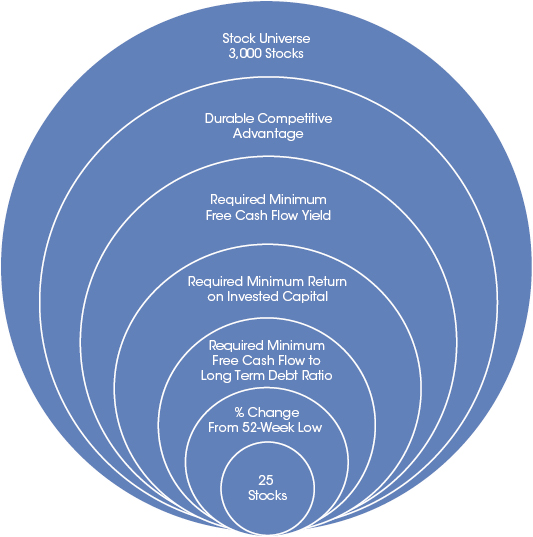

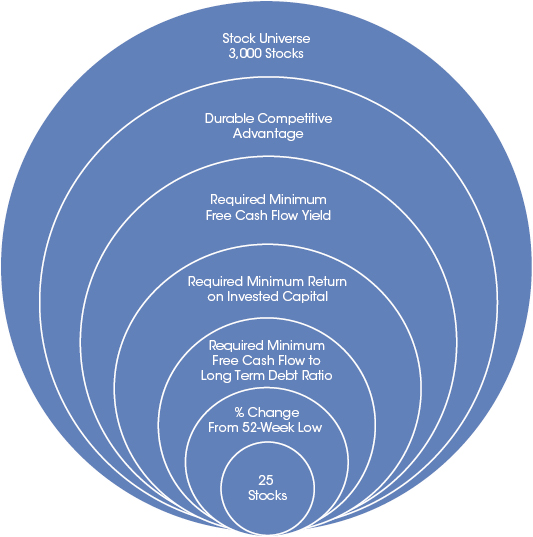

The 52-Week Low Five Filter Formula

Introduction

Would you like to become a mediocre investor? Do you have an interest in buying high and selling low? Do you seek out information that only confirms your beliefs and emotions? Do you believe the stock market is merely a crapshoot and only the ultra-wealthy make money in it?

If you are answering no to all or most of the preceding questions or would like to answer no to them, then I believe my book will help you achieve the opposite of those questionsinstead of mediocrity, you can achieve far better. My strategy, if properly followed, can insulate you from mediocre investment results. This book explains how to more effectively buy low and sell high on an ongoing basis. It is also a book about how to be a better thinker in many areas of your life.

I am the last person I ever thought would write a book. In fact, in my senior year of high school I took calculus twice, not because I failed the first semester but because I actually had a knack for math, and it was the highest level of math offered. I actually thought I would be a math teacher. In fact, it is sad to say that I read only one book in high school, and that was reflected in my substandard scores on the high school aptitude tests due to my below-average English skills. I was the guy who scored substandard on my ACTs, the guy sweating up a storm on the soccer field, the kid who shopped at the Salvation Army while my classmates went to the Gap. In my young life, it would have been hard to imagine reading a book, let alone having enough to say to write one.

Then again, maybe it wasnt so surprising because Ive never been one to conform to conventional wisdom and, despite my standardized test scores, I have had one big advantage over a lot of other people: a willingness to learn and an internal fire to disprove some of the widely held beliefs of society that kept me working long after most other people would have given up.

I grew up in a military family. My dad was in the Air Force and we moved around quite a lot when I was young, eventually settling in Florida. I was the oldest of the three brothers, the one who went first in everything. In those important developmental years, I was always the new kid in class. To many, this would have been a disadvantage, but without the influence of an older sibling and constantly having to make new friends, I was given a gifta blank slate on which to form my own opinions and approaches. I think it was a blessing that my parents had me at age 18 and that we shopped at the Salvation Army until I was 12, when my father received his bachelors degree in mechanical engineering. My parents showed me through their actions the value of doing things that go against the status quoyoung parents, young marriage, college degree midway through career, the value of a dollar, delayed gratification, and many other actions that challenged the norm.

It would be years before I would read a book by Berkshire Hathaway cofounder Charlie Munger and learn about the seventeenth-century German mathematician Carl Gustav Jacob Jacobi and his cardinal rule: invert, always invert. That cardinal rule would become my mantra, the way I thought, the way I solved problems in later years, but I think I innately understood what Jacobi was talking about early on in my life, that many of the hardest problems in life are best solved in reverse. It had been the way I lived my life.

Next page