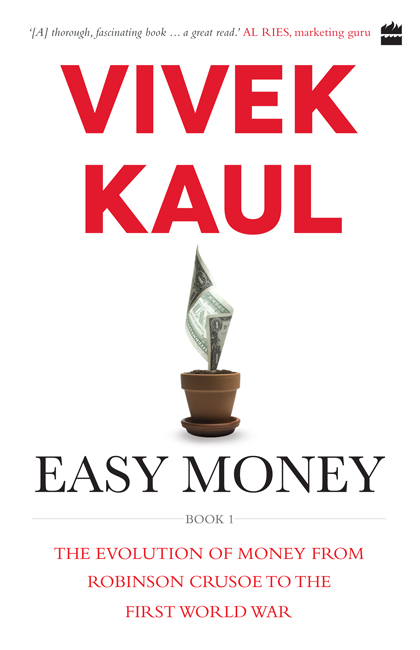

vivek Kaul - Easy Money

Here you can read online vivek Kaul - Easy Money full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2018, publisher: HarperCollins Publishers India, genre: Science. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Easy Money

- Author:

- Publisher:HarperCollins Publishers India

- Genre:

- Year:2018

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

- 60

- 1

- 2

- 3

- 4

- 5

Easy Money: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Easy Money" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

vivek Kaul: author's other books

Who wrote Easy Money? Find out the surname, the name of the author of the book and a list of all author's works by series.

Easy Money — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Easy Money" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

To Ma and Papa, for letting me be!

Contents

W e shape our buildings, Winston Churchill observed, thereafter they shape us. The same principle applies to most human creations.

Money and credit, one of mankinds most important and imaginative fictions, fundamentally altered the nature of trade and economic activity, making possible economic development and increased prosperity on an unparalleled scale. But like all human inventions, it has a dark side a latent destructive power.

In the late twentieth century, there was a fundamental change in the zeitgeist we came to live in a time of easy money. Financial engineering replaced real engineering. Fortunes were more likely to be made in trading claim on real assets rather than creating, making and selling goods and services. Strong economic growth and improving living standards meant that no one questioned the source of this wealth.

The prosperity was the result of an excessive build-up of debt, imbalances in trade and capital flows, and the financialization of the economy, which underpinned a social and political structure reliant on debt-driven consumption and increasing levels of borrowing to fund social entitlements.

Around 2007-08, the process stopped and began to reverse. Since the problems became obvious, policymakers have struggled to stabilize the economy and financial system.

The real solution was to reduce debt, reverse the imbalances, decrease the financialization of the economy, and bring about major behavioural changes. However, unwilling to deal with the fundamental issues, policymakers substituted public spending, financed by government debt or central banks, and expanded the supply of money to boost demand. Utopian policymakers and professors hoped that strong growth and increased inflation would correct the problems. Despite a conspicuous lack of success, policymakers persist with the same policies even now.

Today, the level of debt in major economies has increased to levels higher than that which prevailed at the onset of the problems. Global imbalances have decreased, but primarily as a result of slower economic growth. Countries such as China and Germany are reluctant to inflate their domestic economies and move away from their export-driven growth model. Major borrowers, such as the United States, refuse to reduce spending and bring their public finances into order. Enthusiasm for fundamental regulatory changes to reduce the role of financial institutions has dissipated, in part driven by a concern that lower credit growth will decrease economic growth.

Policymakers continue to believe that their cocktail of measures can work. Nevertheless, it is not clear how increasing levels of government borrowing and printing money (referred to as Quantitative Easing for political correctness) can restore the health of economies. Underlying the crisis are profound questions about the nature of money and debt and also the basic functioning of modern economies. In Easy Money, Vivek Kaul undertakes a thorough and exhaustive analysis of the history of money and the changes which inexorably and subtly led us to this inflexion point in economic and social history.

Financial history may not only help to understand the present crisis but also to identify its potential evolution. But as poet T.S. Eliot wrote in Gerontion, history has many cunning passages and her lessons deceive with whispering ambitions and vanities.

Politicians and policymakers are reluctant to acknowledge how misunderstanding of money, debt and financial history led to the present state of affairs. In the aftermath of the greatest financial and economic crisis since the Great Depression, the wrong lessons are being learnt and the errors perpetuated.

Perhaps Easy Money can set the record straight. However, as Winston Churchill wisely knew: Men occasionally stumble over the truth, but most of them pick themselves up and hurry off as if nothing ever happened.

Satyajit Das

Global finance expert and

author of international best-sellers Traders, Guns and

Money and Extreme Money.

O n Monday, 29 September 2008, I walked into the Mumbai office of the Daily News and Analysis (DNA), the newspaper that I used to work for, wondering what to write for the day. As the personal finance editor, it was my job to fill up (for the lack of a better expression) the personal finance page every day. But it was one of those Monday mornings (actually afternoon!) when one really did not feel like working. And furthermore, for once, I hadnt a clue of what I wanted to write. I had also run out of expert columns that I used to save precisely for such dry days.

Two weeks earlier, at 1.45 a.m. on 15 September 2008, Lehman Brothers, the smallest of the big investment banks on Wall Street, had gone bust and had filed for bankruptcy. Since then, business journalists in India had turned into jargon-spewing monsters. Any random write-up on the financial crisis that was unfurling in the United States would have words such as sub-prime, securitization, collateralized debt obligations (CDOs), alternative A-paper (Alt-A), slice and dice and what not.

Going through one such article on that day, I wondered whether people writing this stuff actually understood the terms they were using so liberally. But more than that, I found it rather embarrassing that I did not understand most of these terms except securitization, on which I had written now and then, from the time I started writing full time in late 2004.

That gave me my idea for the day. I thought, Let me write a piece which tries to explain some of these terms that were being used. It was an act of pure self-indulgence. By then, I had realized that if one really wanted to understand something complicated, the best way to do it was to write about it.

And so I did. But as soon as I had started writing I realized that there were chances that the article would turn out to be one of the most boring ones that I had written. All I was trying to do was explain a series of terms to myself and hopefully the reader. The trouble was that there was no integrating theme or even a context for that matter. And all said and done, I was writing for a newspaper and not compiling a dictionary.

Just as I was about to give up, another brainwave saved the day. I wove a fictional story around the financial terms I was trying to understand, to build some overall context and at the same time to be able to explain all the terms that I wanted to. And that is how I came up with two unnamed characters, a man and a woman, in conversation.

The article was headlined Why Is the Wall St Resting in Peace? and was scheduled to appear the next day, on 30 September 2008. It started with a woman calling a man to ask, Why is the Wall Street going bust? And during the course of the flirtatious duologue that takes place at an ungodly hour, 2.30 a.m., the man explains the trouble erupting at Wall Street and elucidates the meaning of several esoteric terms that had been troubling me, the writer of this piece.

I was very happy at the end of the day to have been able to write something different and more importantly, to have been able to fill up the space. Thankfully, I worked with editors who did not have fixed notions about what a newspaper should carry. Therefore, they let it go.

When I came to office the next day I was in for a surprise. My mailbox had some twenty-five emails from readers saying that they had loved the piece. This had never happened before; even what I thought were my best pieces would get no more than five to ten reader emails, spaced over a couple of days. But more importantly, what I understood from the response was that I was not the only one who had not been able to comprehend the pecuniary parlance. There were others like me out there. What the feedback also told me was that this whole concept of readers being more interested in what was happening in their own city and country was not always entirely true.

Font size:

Interval:

Bookmark:

Similar books «Easy Money»

Look at similar books to Easy Money. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Easy Money and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.